- Australian inflation missed forecasts, settling at a two-year low of 3.4% in January.

- There is a 60% chance that the RBA will cut rates in August.

- Data on Tuesday revealed a sharp drop in US durable goods orders.

Wednesday’s AUD/USD price analysis revealed a dip, with the Aussie witnessing a decline following the release of softer-than-expected inflation data. At the same time, the dollar was weak after poor economic data pointed to a slowdown in the US economy.

–Are you interested in learning more about automated Forex trading? Check out our detailed guide-

Australian inflation missed forecasts, settling at a two-year low of 3.4% in January. Meanwhile, economists had expected that figure to rise to 3.6%. This is good news for RBA, which is struggling to tame inflation. Moreover, it raises doubts in the market that the RBA will rise again.

Investors are now keen to see the February inflation figures which show the state of services inflation in the country. The RBA keeps a close eye on service inflation, because it was the most difficult to reduce. However, investors are more confident that the RBA rate hike cycle is over. Furthermore, there is a 60% chance that the RBA will cut rates in August.

Elsewhere, a Reuters poll found that Australian house prices will increase by 5.0 per cent in 2024.

Meanwhile, the dollar weakened after data on Tuesday revealed a sharp drop in US durable goods orders in January. In addition, a separate report showed a decline in consumer confidence. US consumers are worried as the country enters election season.

The next big report in the US is the core PCE price index. This will show the state of inflation, giving an indication of the prospects for a Fed rate cut. Economists expect an increase in this figure of 0.4%.

AUD/USD key events today

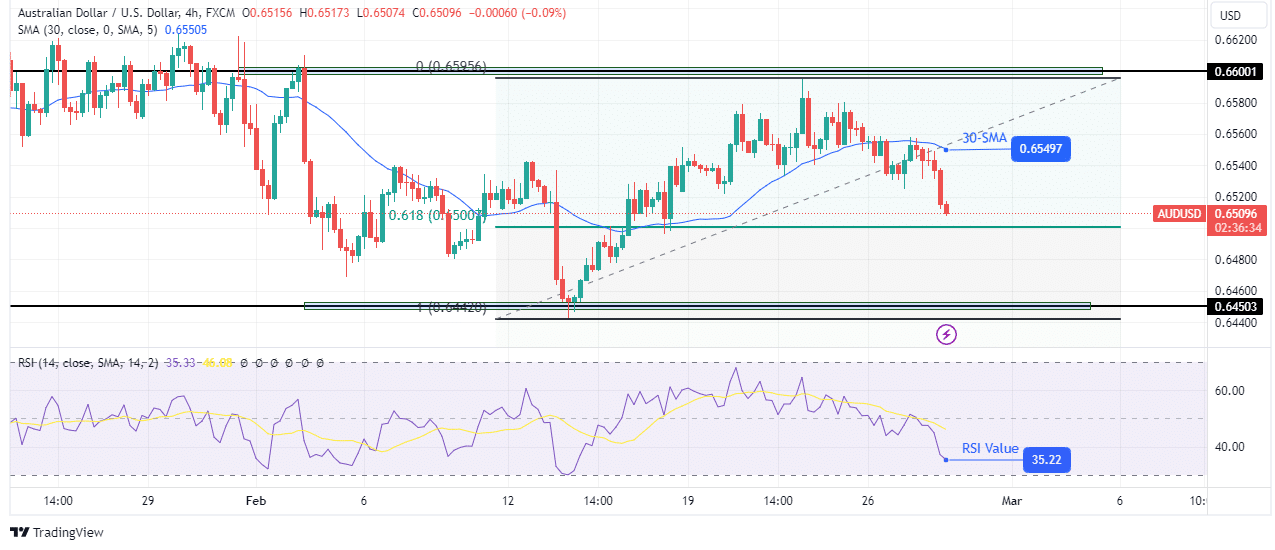

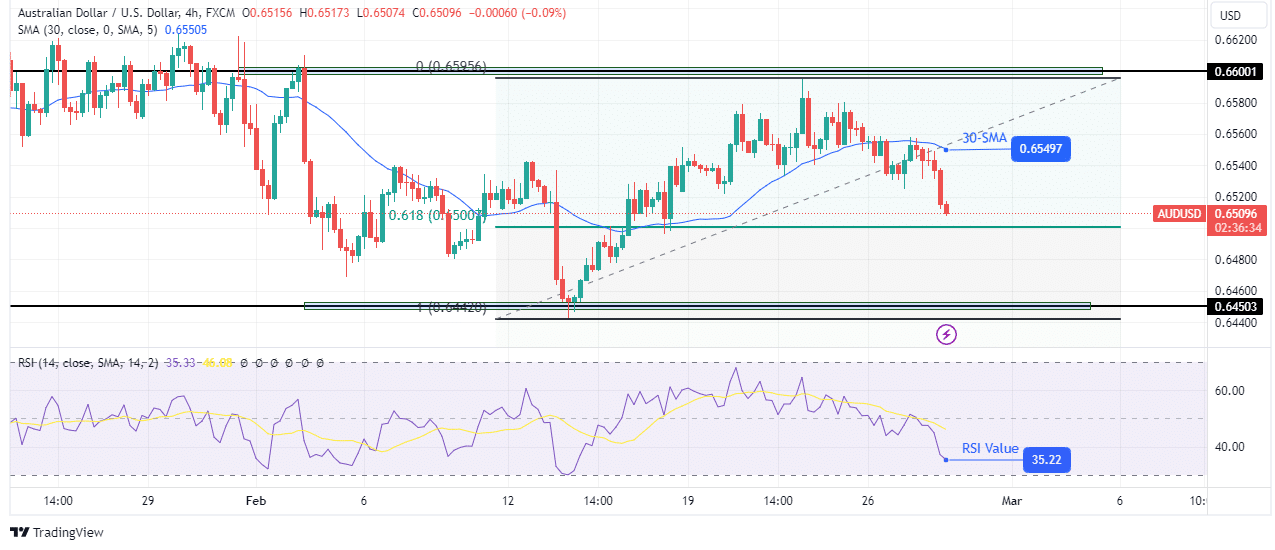

AUD/USD Price Technical Analysis: Bearish sentiment strengthens below 30-SMA

On the technical side, the bias for AUD/USD is bearish. Recently, there was a bearish sentiment shift when the price broke below the 30-SMA support. Furthermore, price confirmed this new direction when it retested the SMA as resistance and made a lower low.

–Are you interested in learning more about forex signals? Check out our detailed guide-

At the moment, the price is approaching the critical Fib level of 0.618. If this level acts as support, it could lead to a pause in the decline. However, given the solid bearish bias, the price is likely to break below to retest the 0.6450 support level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.