- Headline inflation in Australia increased by 3.4% in February.

- The odds of an RBA rate cut in August have risen to 68%.

- There is a 71 percent chance the Fed will start cutting interest rates in June.

Today’s AUD/USD price analysis shows a slight dip following the release of data showing Australian inflation has missed forecasts. The revelation sparked speculation that the Reserve Bank of Australia could be inclined to cut interest rates as early as August.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

Headline inflation in Australia rose 3.4% in February, remaining steady since January. Meanwhile, economists expected inflation to rise by 3.5%. However, core inflation remained high, indicating that inflation is still persistent. As a result, the Australian dollar fell briefly before recovering.

The Reserve Bank of Australia has recently taken a less hawkish stance on falling inflation. Moreover, the Australian economy has slowed due to high interest rates. As a result, the odds of an RBA rate cut in August rose to 68%. Still, this would put the RBA among the last major central banks to grow. So it gives the Australian dollar an edge over its peers.

Namely, there is a 71% chance that the Fed will start cutting interest rates in June. This is much earlier than RRA. However, the dollar remained strong as the data contradicted the prospect of a rate cut. Although Powell claims the Fed will cut rates three times this year, data on inflation and economic performance suggest otherwise. Accordingly, there is little uncertainty about the prospect of a rate cut.

AUD/USD key events today

Traders will continue to absorb the Australian CPI report as there are no more key events scheduled for today.

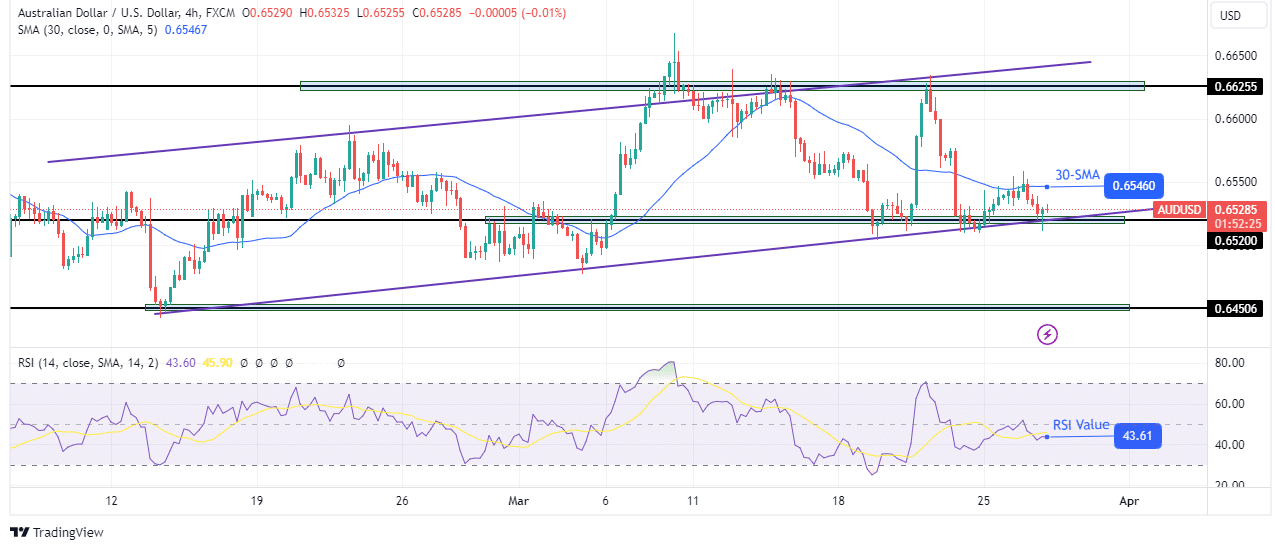

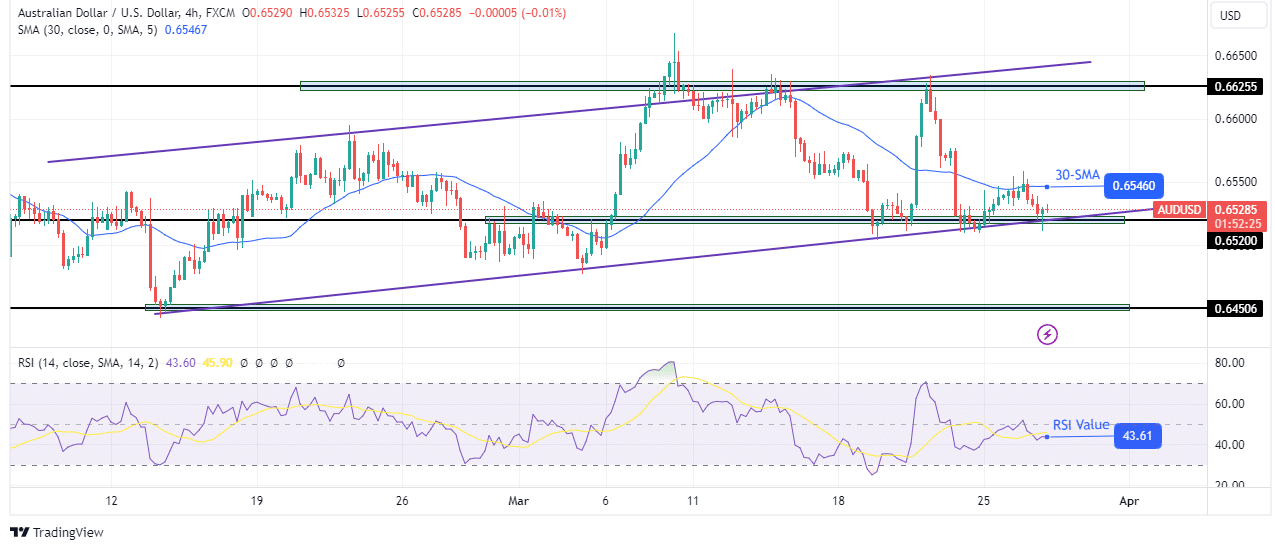

AUD/USD Price Technical Analysis: Price pulls back after failed 30-SMA breakout

On the technical side, AUD/USD edged lower after failing to break above the 30-SMA. At the same time, the RSI respected the 50 mark as resistance and bounced lower. This is a sign that the bears are not ready to give up control. However, bears have also weakened as price is now making small-bodied candles.

-Are you interested in learning more about forex indicators? Click here for details –

Moreover, the decline failed to break below the solid support zone consisting of the key level of 0.6520 and the support of its bullish channel. The price increases each time it enters this zone. Therefore, there is a good chance that the bulls will soon retest the 30-SMA with the aim of breaking above and retesting the channel resistance.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.