- China has decided to stick to its 5% economic growth target.

- In Q4, there was a significant increase in Australia’s current account surplus.

- Markets are eagerly awaiting Powell’s testimony on Wednesday.

AUD/USD price analysis revealed a bearish tone on Tuesday as the currency fell following disappointing news from China. China in particular has decided to stick to its 5% economic growth target. However, analysts believe that achieving this goal will require more stimulus than is currently in place.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

The Australian dollar is sensitive to news from China and is considered a proxy for the yuan. As a result, the poor outlook for the Chinese economy is weighing on the currency.

Meanwhile, investors dismissed data from Australia that revealed a significant increase in the country’s current account surplus in Q4. Consequently, a recession is less likely. In addition, government spending increased over the same period. These optimistic data significantly contribute to estimates of gross domestic product in the fourth quarter.

A good economy allows the RBA room to keep interest rates high for longer. Although investors do not expect more rate hikes from the RBA, the first rate cut may not come until September.

Meanwhile, the possible timing of a US interest rate cut could soon change as investors await more economic data. In addition, markets are eagerly awaiting Powell’s testimony on Wednesday. In his speech, he could give clues as to when the Fed will start cutting rates.

On the other hand, headline data from the US includes the non-farm payrolls report. Economists expect employment to slow last month. However, US employment numbers keep surprising markets. Another blockbuster report could send AUD/USD further lower as the greenback rises.

AUD/USD key events today

AUD/USD Price Technical Analysis: Previous low broken, new bottom expected

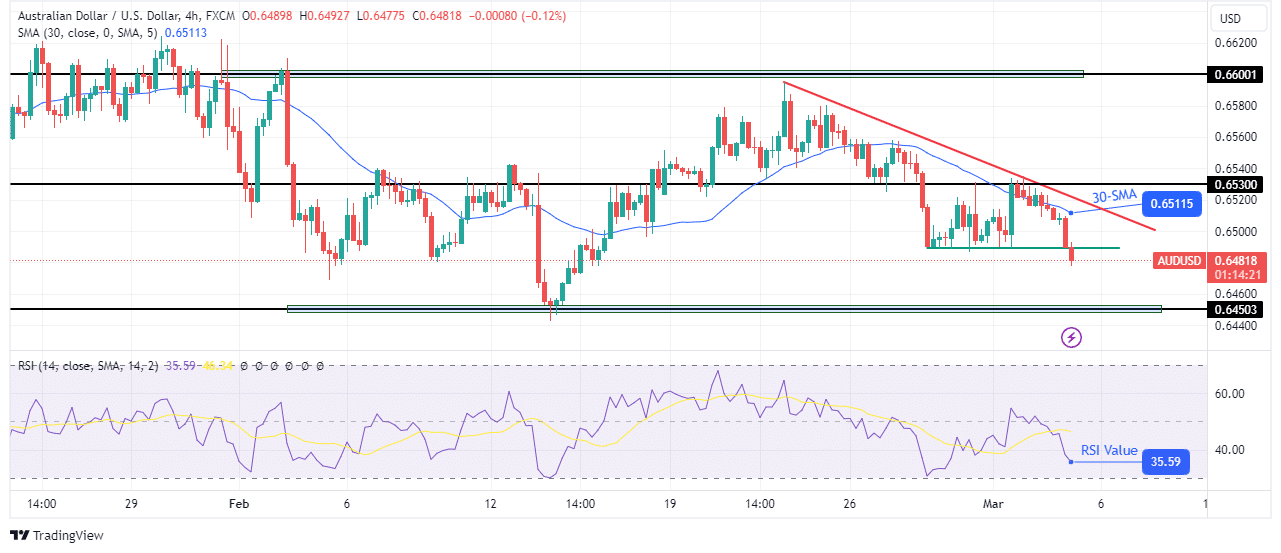

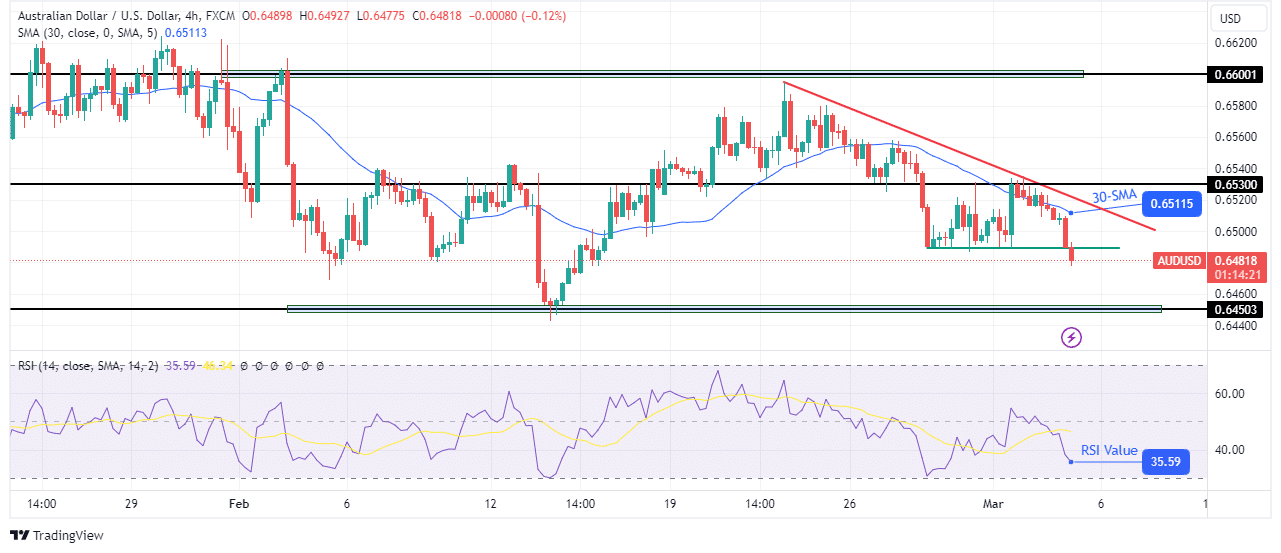

On the technical side, the AUD/USD pair has broken below the previous low and is likely to make a new low soon. Moreover, the price fell well below the 30-SMA, showing a sharp decline. Meanwhile, the RSI is heading towards the oversold region, indicating solid bearish momentum.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

With such strong bearish momentum, the price is likely to reach the 0.6450 support level soon. In addition, if the bulls come back at any point, it will be difficult for them to break above the 30-SMA and the bearish trend line. A bearish trend will develop if the price continues to make a series of lower lows and highs.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.