- China reported an expansion in manufacturing activity after six months of contraction.

- The US reported the first expansion in manufacturing activity in more than a year and a half.

- Markets will get plenty of data on the US labor market this week.

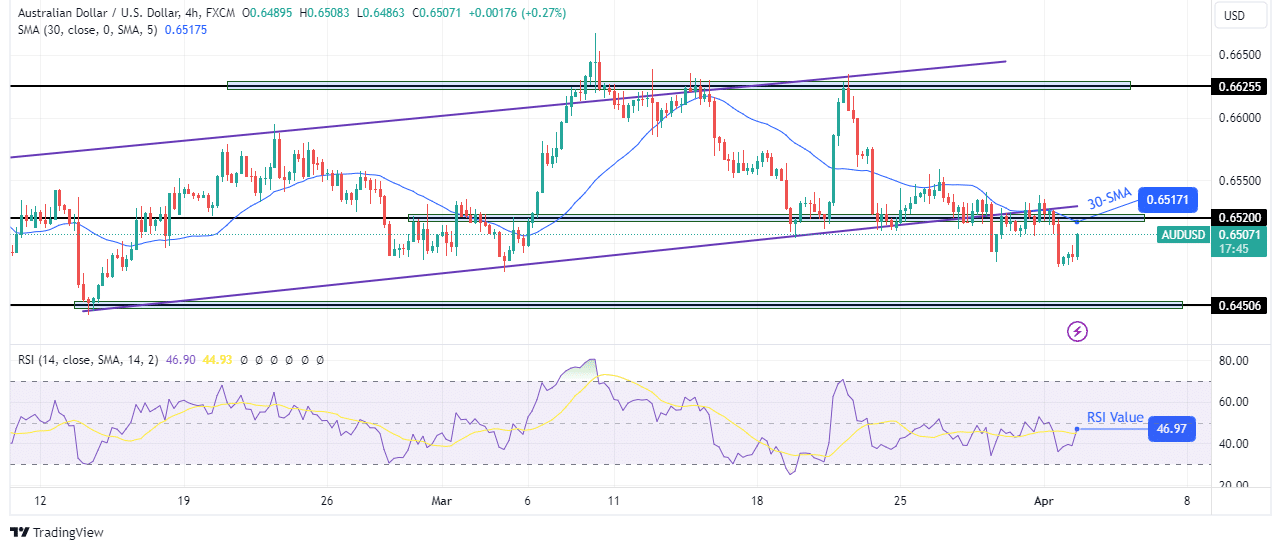

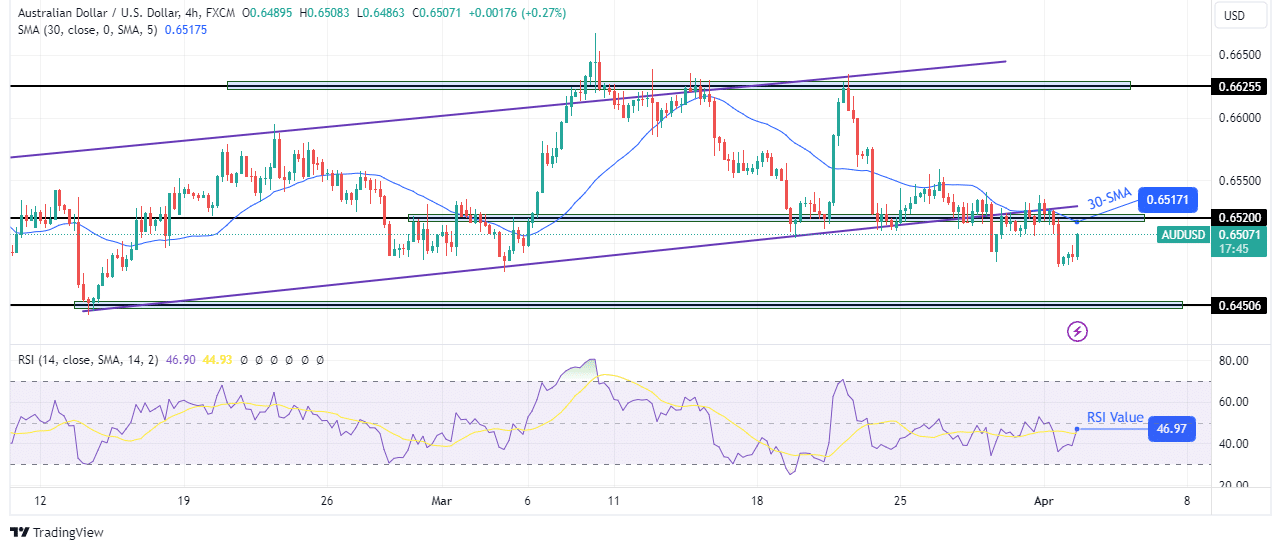

AUD/USD price analysis reveals bullish narrative as dollar eases after strong rally. The dollar rallied on Monday after an upbeat manufacturing report reduced bets on a US rate cut. However, this report followed positive Chinese manufacturing figures, which boosted the Aussie and put the floor on the pair’s excessive declines.

China reported an expansion in manufacturing activity on Sunday after six months of contraction. The Purchasing Managers’ Index rose from 49.1 in February to 50.8 in March, beating forecasts. A value above 50 indicates expansion. Accordingly, the Australian dollar, which is a proxy for the yuan, has increased.

Similarly, the US reported the first expansion in manufacturing activity in more than a year and a half, boosting the dollar on Monday. Increased manufacturing activity reflects a strong economy despite higher interest rates. The Fed has kept interest rates high for some time to reduce the demand in the economy that drives inflation. Therefore, if demand is still high, policymakers will be reluctant to start lowering interest rates.

Last week, data on consumer sentiment, GDP and home sales came in higher than expected, underscoring a strong economy. At the same time, inflation is in a downward trend. Therefore, there is more confidence that the US will avoid a recession caused by higher interest rates.

Markets will get plenty of data on the US labor market this week. These numbers could change the outlook for a rate cut.

AUD/USD key events today

AUD/USD price technical analysis: Price avoids bullish channel, expects new lows

On the charts, the AUD/USD price has broken out of its bullish channel and could soon make new lows. The bias is bearish as price makes lower lows and highs below the 30-SMA. At the same time, the RSI is trading in bearish territory below 50.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Bears broke below channel support before retesting it and making new lows. This confirmed the breaching of the channel. However, the price is currently rising to retest the 0.6520 resistance level and the SMA. Given the bearish bias, there could be a reversal at this resistance and a drop to the 0.6450 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.