- Wholesale inflation in the US increased by 0.6% in February.

- Investors cut bets on a Fed rate cut in June.

- The RBA is likely to keep rates on hold at its meeting next week.

AUD/USD price analysis paints a bearish picture on Friday amid continued dollar gains following a significant jump in US wholesale inflation. Meanwhile, a Reuters poll of economists found the RBA is likely to keep rates on hold at next week’s meeting.

The dollar rose on Thursday after the US released the producer price index (PPI) report. Wholesale inflation rose 0.6% in February, against estimates for a 0.3% increase. There are fears that inflation in the US is increasing as consumer prices also rose more than expected.

Consequently, investors cut back on bets for a rate cut in June. However, there is a lot of uncertainty in the market. It is noticeable that the economy is showing signs of slowing down. Retail sales missed forecasts, showing weaker consumer spending. Meanwhile, US unemployment jumped in February, pointing to a weaker labor market.

With inflation high and the economy slowing, markets will await guidance from Fed policymakers on interest rate cuts. That could happen next week, when the central bank will make a policy decision. The outcome of the meeting will likely be to keep interest rates on hold.

Meanwhile, in Australia there is no clear prospect of a rate cut as the RBA has remained hawkish. While the Fed could start cutting rates in June, economists expect the first RBA cut in September. However, there is still no clear majority. Still, markets believe the central bank is done hiking and will keep rates on hold on Tuesday.

AUD/USD key events today

- Empire State Index of Production

- US consumer sentiment

AUD/USD Price Technical Analysis: Bearish as 0.6600 level eases

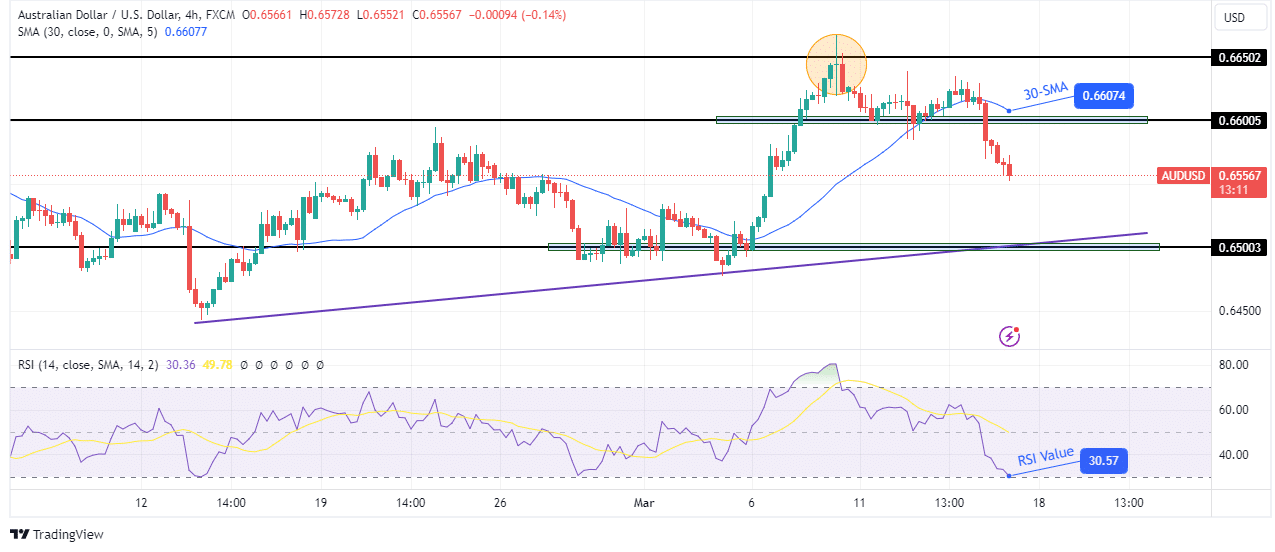

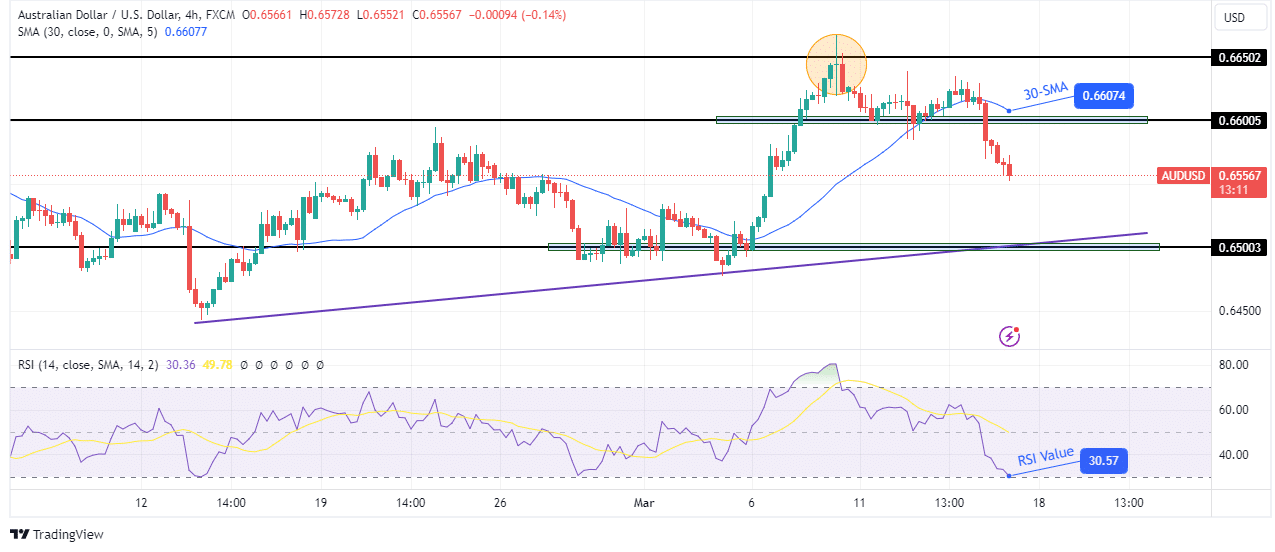

On the charts, AUD/USD is in freefall after breaking below the 30-SMA and the key support level of 0.6600. The price fell well below the 30-SMA, showing a sharp decline. At the same time, the RSI is almost oversold, a sign that bearish momentum is strong.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The price reversed when it failed to break the key level of 0.6650. Furthermore, there was a large doji candle at the level that showed indecision. Price made a strong bearish candle after the doji, showing that the bears are ready to take over. Therefore, the decline is likely to reach the key support level of 0.6500 and the support of the shallow trend line.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.