- China’s economy grew more than expected in the first quarter.

- Fed policymakers have played down expectations of a rate cut.

- Powell noted that the US economy needs restrictive policies a little longer.

AUD/USD price analysis reveals a subtle bullish bias as the Aussie bounces back, boosted by encouraging economic data from China. Yet, amid this optimistic backdrop, a shadow looms. The dollar stands firm, boosted by Fed Chairman Powell’s hawkish remarks.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

Namely, data from Tuesday showed that the Chinese economy grew more than expected in the first quarter. The economy grew by 5.3%, compared to estimates of 4.6%. This was a big relief for policy makers trying to support the economy. As a result, the Aussie, the yuan’s proxy, strengthened.

However, the AUD/USD downtrend remains intact, as fundamental indicators point to continued dollar strength.

The dollar strengthened further on Tuesday as Fed policymakers scaled back interest rate cut expectations. In particular, Powell avoided making any comments regarding the timing of the rate cut. Instead, he noted that the U.S. economy needs restrictive policies a little longer. This means longer interest rates.

Markets are betting that the Fed’s first rate cut will come in September. Moreover, they expect only 40bps of total rate cuts in 2024. This is a big drop from the 160bps expected when the year started.

Furthermore, geopolitical tensions in the Middle East have raised concerns that high fuel prices could lead to a return of high inflation.

AUD/USD key events today

Markets are not expecting any key reports from Australia or the US today. Therefore, investors will continue to absorb the remarks of policymakers.

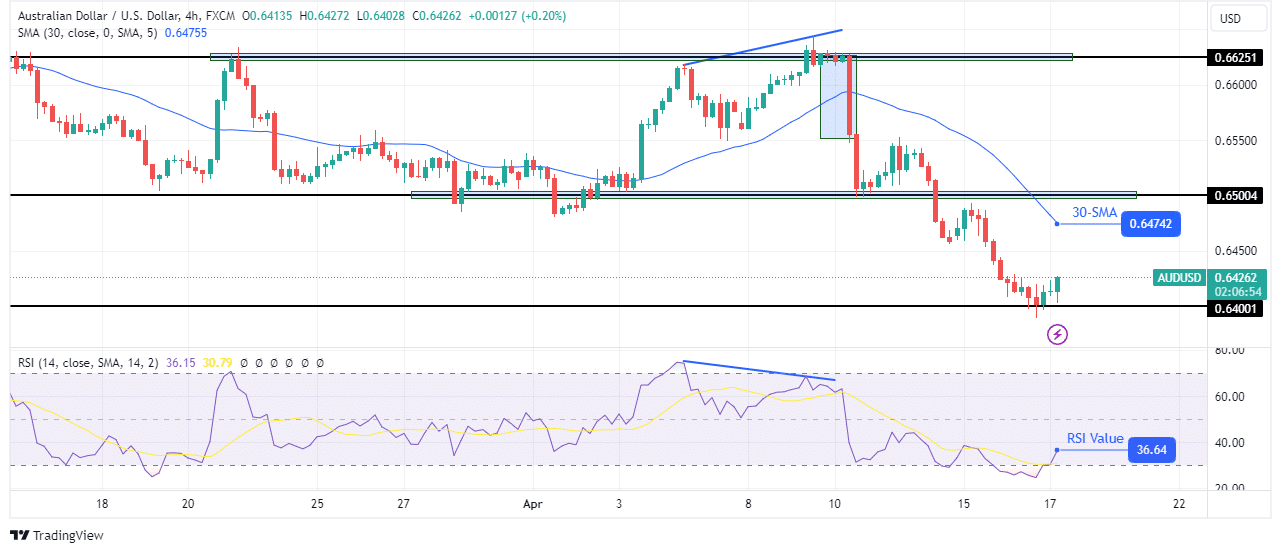

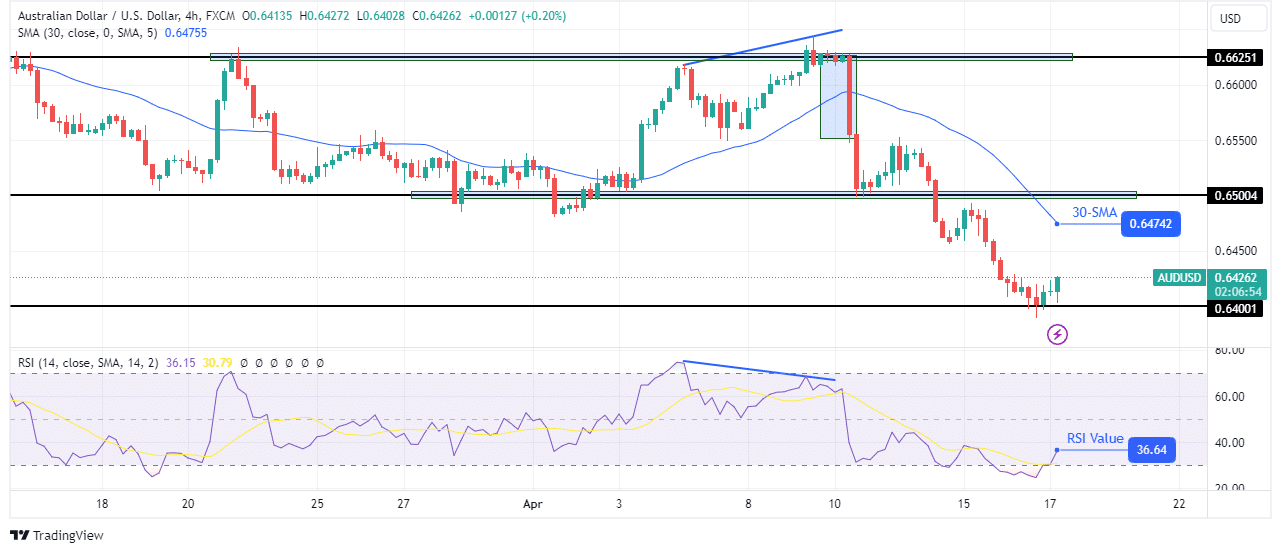

AUD/USD Price Technical Analysis: Temporary recovery from 0.6400 support

On the technical side, the AUD/USD price is in a strong downtrend which is paused at the key support level of 0.6400. Still, the price is well below the 30-SMA and the RSI is well below 50, supporting a solid bearish bias.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

Bears took control when bullish momentum weakened near the key resistance level of 0.6625. The RSI made a bearish divergence and the price made a bearish engulfing candle that broke below the 30-SMA. Moreover, the price fell below the key support level of 0.6500. Therefore, the current break can only retest the 30-SMA before the price falls further.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.