- Inflation in Australia fell sharply in November.

- US consumer inflation was higher than expected.

- The data showed a fall in producer inflation in the US.

Expect a downward trajectory in the AUD/USD weekly forecast as Australian inflation data reinforces the RBA’s newly adopted stance. Meanwhile, across the Pacific, the US reported higher-than-expected consumer inflation, setting the stage for further declines in the pair.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

AUD/USD Ups and Downs

The pair had a bearish week shaped by inflation data from the US and Australia. Inflation in Australia fell sharply in November, reinforcing the view that the RBA is done raising interest rates. Accordingly, investors still expect a 50 basis point easing in 2024.

Meanwhile, the US had a mixed bag of inflation data. Consumer inflation is higher than expected. As a result, investors reduced bets on a Fed rate cut. Meanwhile, data on Friday showed a drop in US producer inflation. However, after all this, investors still expect the US rate cut to begin in March.

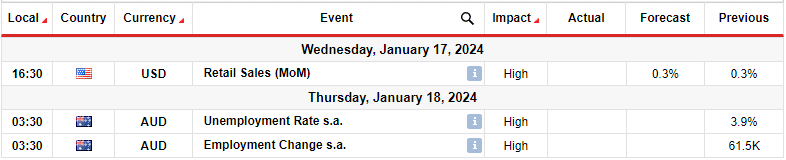

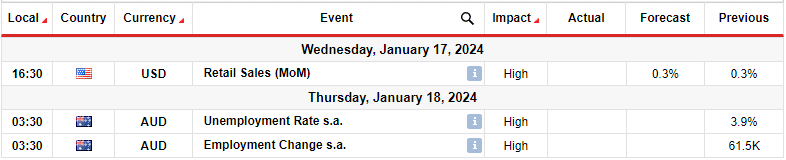

Next week’s key events for AUD/USD

Next week, traders will be watching US retail sales and employment reports from Australia. The Australian labor market remains tight. Notably, vacancies in Australia saw a slight decline in the three months leading up to the end of November. This indicates that demand for workers remains strong despite a slight general easing in the labor market.

However, a slight easing in the market contributed to slower wage growth. Consequently, there is less pressure on the Reserve Bank of Australia to consider another rate hike. So, if the labor market continues to weaken, it will strengthen the RBA’s bearish stance.

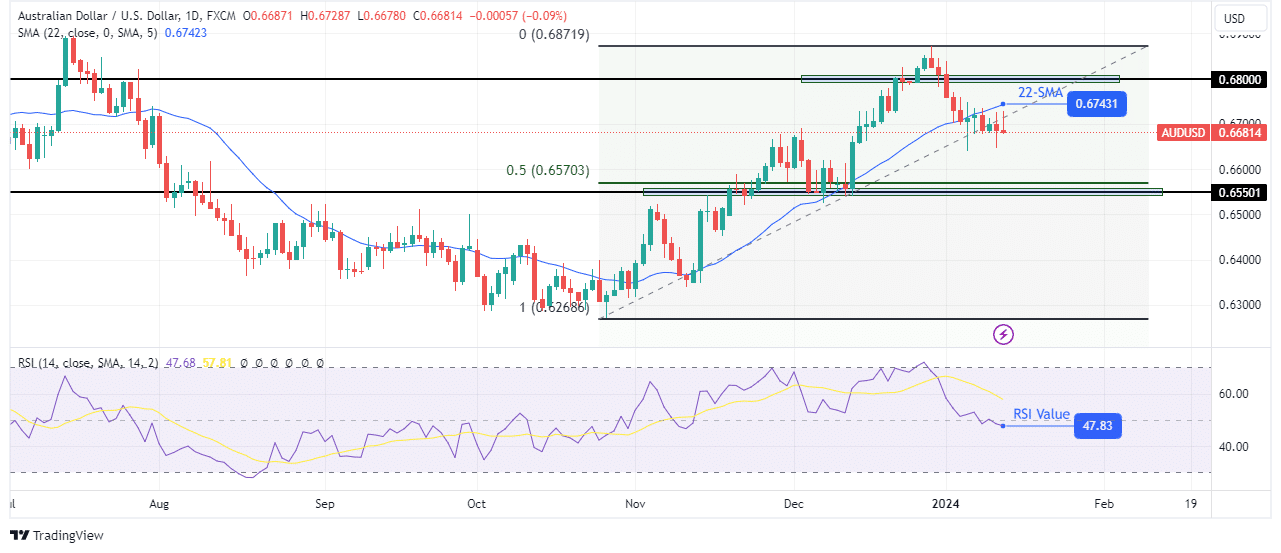

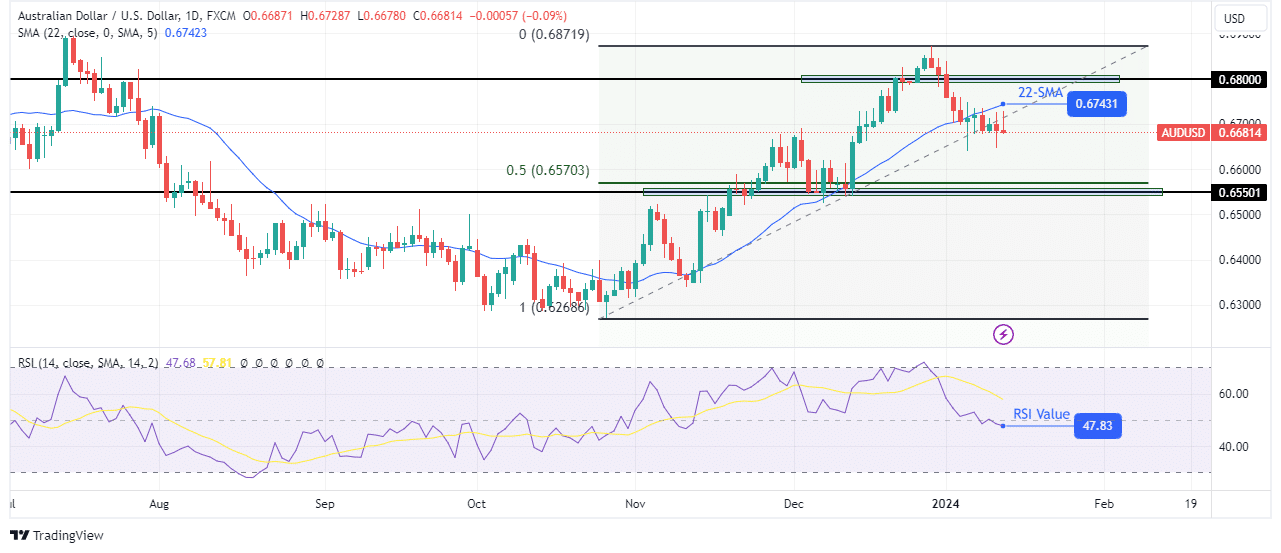

AUD/USD Weekly Technical Forecast: Bears take lead, breaking 22-SMA barrier

On the technical side, AUD/USD has broken below the 22-SMA, which is a sign that the bears are challenging the bullish trend. At the same time, the RSI fell into sub-50 territory, signaling a change in sentiment.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

The previous bullish trend was strong, with price making higher highs and lows above the 22-SMA support. However, the bulls could not sustain a move above the key resistance level of 0.6800. At this point, the bears have taken over, sending the price below the 22-SMA.

Consequently, AUD/USD could fall further next week to reach the 0.6550 support level. This level is also close to the 0.5 Fib retracement level, forming a strong support zone.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.