- The Reserve Bank of Australia kept rates on hold but discussed the possibility of a hike.

- The US released data showing weaker-than-expected retail sales.

- Business activity data revealed stronger-than-expected expansion in the U.S. manufacturing and service sectors.

The weekly AUD/USD forecast is slightly bullish as the Aussie maintains its lead thanks to a hawkish central bank.

AUD/USD Ups and Downs

The AUD/USD pair had a bullish week as the Australian dollar strengthened after the RBA policy meeting and the US dollar fluctuated amid mixed data. The Reserve Bank of Australia kept interest rates on hold, but discussed the possibility of a hike, given high inflation. This led to a decline in bets for a reduction in December.

–Are you interested in learning more about the next cryptocurrency to explode? Check out our detailed guide-

Meanwhile, the US released data showing weaker-than-expected retail sales. This was another sign of poor economic activity that could prompt the Fed to cut interest rates. However, as the week ended, business activity data revealed a stronger-than-expected expansion in the manufacturing and services sectors.

Next week’s key event for AUD/USD

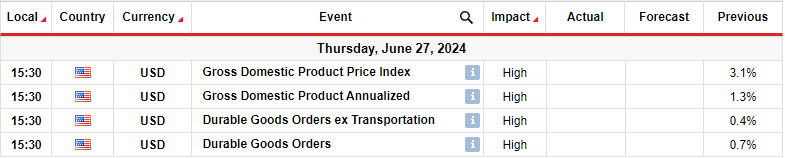

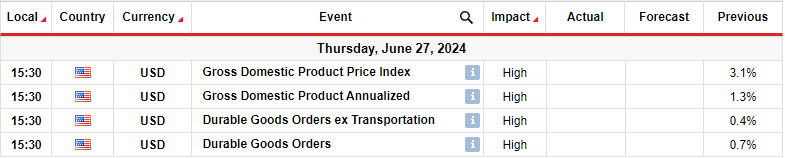

Next week, investors will focus on data from the US, including GDP and durable goods orders. These reports will have a big impact on Fed rate cut expectations. Recent data from the US, including the latest GDP report, point to a slowing economy. This was also seen in the retail sales report. If this trend continues next week, the likelihood that the US central bank will cut rates in September will increase.

However, if there is a move, as seen in Friday’s PMI data, the Fed is likely to cut just once this year.

AUD/USD Weekly Technical Forecast: Price action bounded between 0.6580 and 0.6701

On the technical side, the AUD/USD price is trading in a tight range between the support at 0.6580 and the resistance level at 0.6701. Initially, the price bounced off the 0.6401 support level, pushing above the 22-SMA. This indicated a change in sentiment towards bullishness.

–Are you interested in learning more about forex tools? Check out our detailed guide-

However, the bulls could only push the price down to the resistance level of 0.6701, near the Fib level of 0.618. Here the price entered a period of consolidation. Bears and bulls are fighting for control in this area.

Therefore, this consolidation could continue in the coming week. However, if one side wins, there is a better chance that the price will break above 0.6701 since the previous move was bullish.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.