- By Friday, investors were still soaking up the US CPI report.

- Investors believe the Fed will implement its first rate cut in September.

- Next week, Australia will reveal the state of its labor market.

The weekly AUD/USD forecast paints a more bearish picture as the US inflation report puts the Fed in a worse position than other major central banks.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

AUD/USD Ups and Downs

The AUD/USD pair ended the week on a bearish candle, while the greenback strengthened after an upbeat inflation report. There were no major reports from Australia, meaning the US inflation report was the main catalyst. By Friday, investors were still absorbing the CPI report, which showed inflation at a higher than expected 0.4% in March.

Ahead of the report, investors were still betting on the Fed’s first rate cut in June. However, following the report, markets believe the Fed will implement its first tapering in September. However, there is uncertainty about the outlook. Consequently, there is uncertainty about the monetary policy of most major central banks waiting for the Fed to lead.

Next week’s key events for AUD/USD

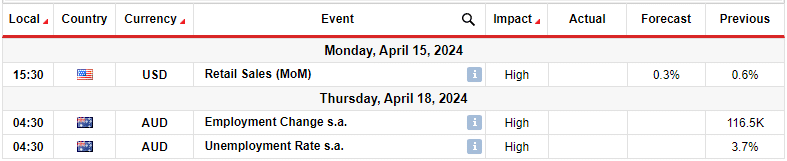

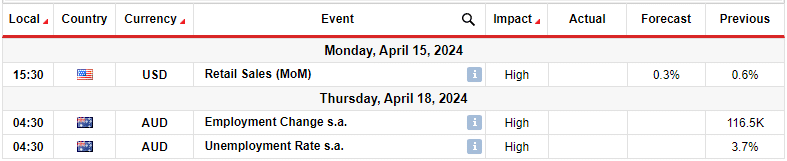

Next week, the US will release retail sales data. Meanwhile, Australia will reveal the state of its labor market. Forecasts predict a drop in sales in the US to 0.3%. This would indicate a decline in consumer spending and demand in the economy. Therefore, it would be a relief for the Fed. However, recent data from the US has been consistently higher than expected. Therefore, there is a chance that the figure will be a surprise.

On the other hand, Australian employment data will help shape the outlook for an RBA rate cut. A strong labor market would defy expectations, while weakness would pressure the central bank to cut rates.

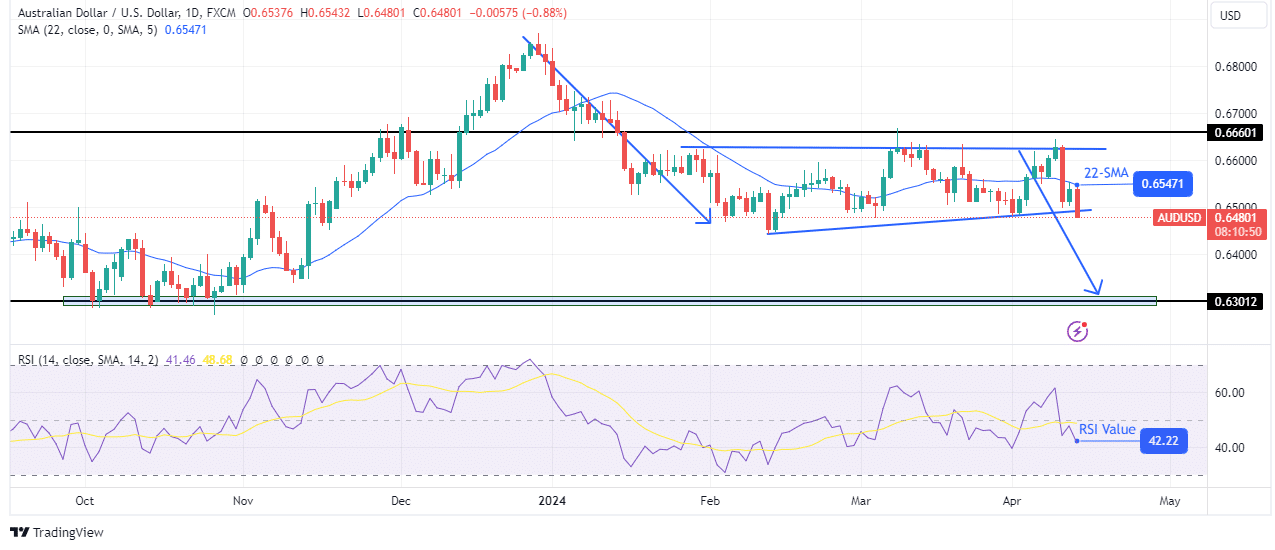

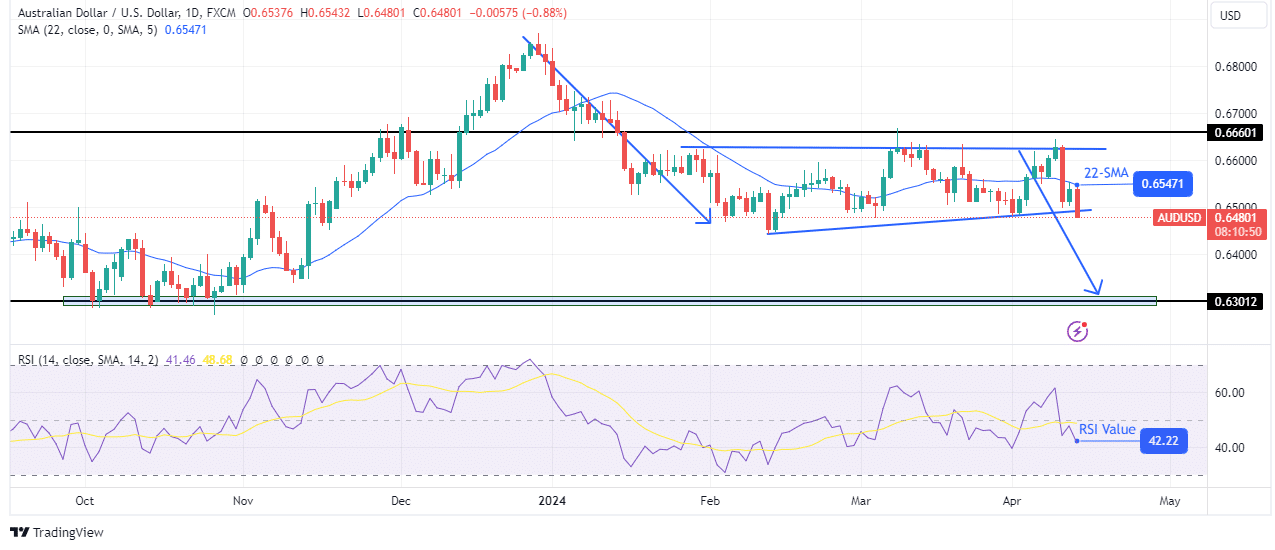

AUD/USD Weekly Technical Forecast: Bears brace for another push

AUD/USD price is bearish on the technical side, it is below the 22-SMA with RSI below 50. After a solid bearish move, the price is stuck in a corrective sideways movement below the key level of 0.6660. During this period of consolidation, the price crossed the 22-SMA with no clear direction.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

Furthermore, he respected clear support and resistance levels. However, the bears are now challenging the support level with a strong candle. The move comes after the price made a bearish candle against resistance. If it breaks below support, it is likely to make another strong, bearish move that mirrors the previous one.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.