- Weekly AUD / USD PERFORMANCE IN THE SOUTH WHILE THE PARTICIPANTS IN THE MARKET BETS ON RATE RATE RATE.

- Data during the week revealed a stronger salary growth in Australia in K1.

- The dollar had a strong week on long-term optimism due to the truce to enter the US China.

Point forecast AUD / USD in South While market participants are betting at RBA Rate next week.

UPS and DOWNS AUD / USD

The price of AUD / USD had a bear week despite the rise of employment data from Australia. Data during the week revealed more powerful salary growth in the first quarter. Moreover, a special report has shown greater than the expected increase in employment. However, despite the positive data, traders held bets of cutting speeds next week, weight on the Australian dollar.

–Are you interested in more about purchasing NFT tokens? See our detailed guide-

In the meantime, in the US, inflation figures were colder than expected, increasing pressure on the supply to lower borrowing costs. However, sales figures came into something better than expected. The dollar had a strong week on long-term optimism due to the truce to enter the US China.

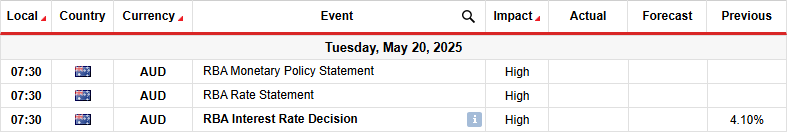

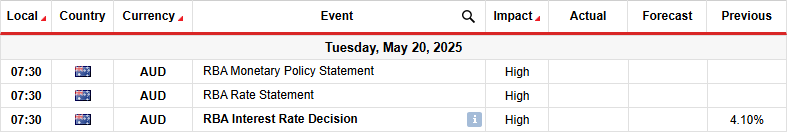

Key events next week for AUD / USD

Next week market participants will focus on the Spare Bank of Australia’s Meeting. Despite strong employment data during the week, traders held their bets for reducing the rate of 25 BPS.

RBA policy makers are more focused on inflation that relieves it. At the same time, Trump Tariffs reduced global growth, forcing most central banks to consider faster harmonized cycles.

Traders will also focus on messages about future rates cuts. Although the Central Bank could decrease next week, market participants this year price prices less incisions due to a solid labor market.

On the technical page, the AUD / USD price paused below the flakes of 0.6500 after breaking its consolidation space. The price retreated to retire 22-SMA until the RSI trades a little over 50 years, suggesting bacara bias.

–Are you interested in learning more about Forex Robots? See our detailed guide-

Initially, the price was caught ranging between the support of 0.6150 and resistance levels of 0,6351. The bears were the first to try to break the break. However, they failed to withstand the move lower. Shortly afterwards, the bulls have gained enough momentum to break over the resistance of the range.

However, the break was weak, marked by small candles. Moreover, the bulls did not find their leg above the range area. A break above the 0.6500 key would make a higher high, strengthening of bicocracy. Otherwise, the price will remain in consolidation.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.