- Some policymakers have suggested raising interest rates to tame stubborn inflation.

- The data revealed improved business activity in the US manufacturing and services sectors.

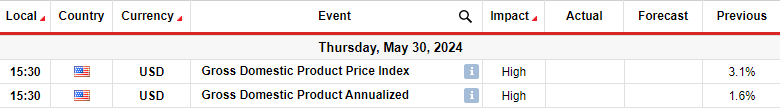

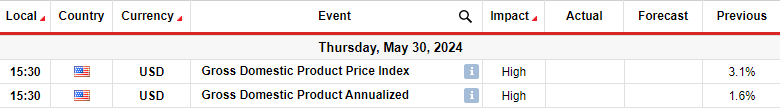

- Investors will focus on US GDP data next week.

The weekly AUD/USD forecast points south as the US dollar recovers amid falling Fed rate cut expectations.

AUD/USD Ups and Downs

The Aussie had a weak week as the dollar rallied amid falling Fed rate cut expectations. The main catalysts this week were the FOMC meeting minutes and US PMI data. When the minutes of the Fed meeting came out, investors were surprised that some policymakers suggested raising interest rates to tame stubborn inflation. As a result, expectations for a cut in September have fallen.

–Are you interested in learning more about forex tools? Check out our detailed guide-

This was followed by US PMI reports, which revealed improved business activity in the manufacturing and services sectors. This gave the greenback another boost, weighing against the Australian dollar.

Next week’s key events for AUD/USD

Next week, investors will focus on just one major report from the US showing gross domestic product. The latest report missed forecasts and sparked fears that high interest rates are hurting the economy. Another bad report would raise expectations that the Fed will cut rates in September.

However, if the economy expands faster than expected, expectations of a rate cut will fall. In particular, recent data, including business activity, show that the economy is doing well. Therefore, if the GDP report continues this trend, there will be less chance of the Fed cutting rates in September.

AUD/USD weekly technical forecast: Temporary pullback to the 0.5 Fib retracement level

On the technical side, the AUD/USD price is in a bullish trend above the 22-SMA, with the RSI supporting the bullish momentum above 50. However, the price pulled back after touching the key psychological level of 0.6700. This is also close to the 0.618 Fib retracement level.

–Are you interested in learning more about the best cryptocurrency exchange? Check out our detailed guide-

However, given the bullish bias, the pullback is likely to be temporary. Furthermore, the price encountered strong support at the 0.5 Fib retracement level and the 22-SMA. The price action indicated that the price could reverse as it made a bullish candle.

In the coming week, there is a good chance that the price will bounce off the support zone to retest 0.6851. A break above this level would make a higher high, confirming the continuation of the bullish trend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.