- The dollar strengthened on upbeat employment data and reduced rate cut bets.

- Analysts said the jobs report meant the Fed was unlikely to cut rates before March.

- The Fed has forecast a rate cut of approximately 75 basis points in 2024.

A rally in the dollar, fueled by an upbeat jobs report, sets a bearish tone for the weekly AUD/USD forecast. The jobs report showed that the US economy remains hot and may need high rates for longer.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

AUD/USD Ups and Downs

The Aussie ended the week lower as the dollar strengthened on upbeat employment data and reduced rate cut bets. It is significant that at the beginning of the week the dollar strengthened as investors became less confident about the Fed rate cut in March. Later, the non-farm payrolls report provided another boost.

Analysts said the jobs report meant the Fed was unlikely to cut rates before March. Moreover, they noted that the futures market will eventually align more with the Fed’s projection of a rate cut of approximately 75 basis points in 2024.

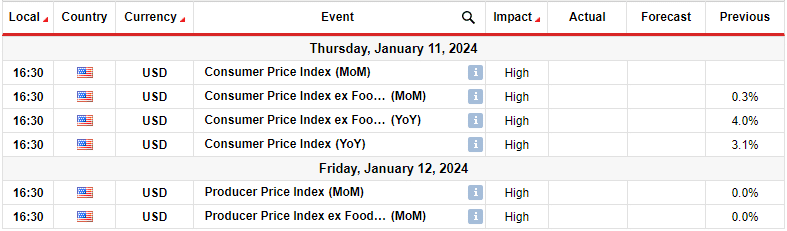

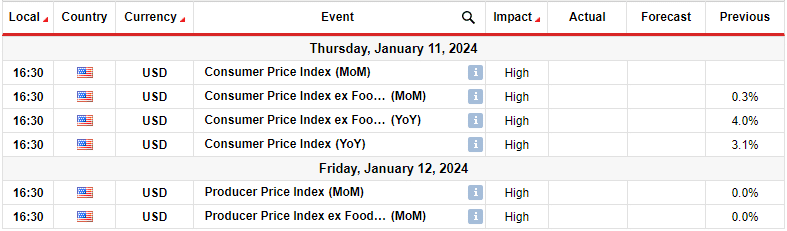

Next week’s key events for AUD/USD

Next week’s calendar will include inflation data from the US. The US will release reports on the consumer price index and producer prices. These reports will greatly influence the pair as they will determine when the Fed will start cutting rates.

A higher-than-expected consumer inflation reading could dampen bets for a rate cut as early as March. On the other hand, easing inflation would increase bets for a March cut. Consequently, it would weaken the dollar and support the rise of the pound.

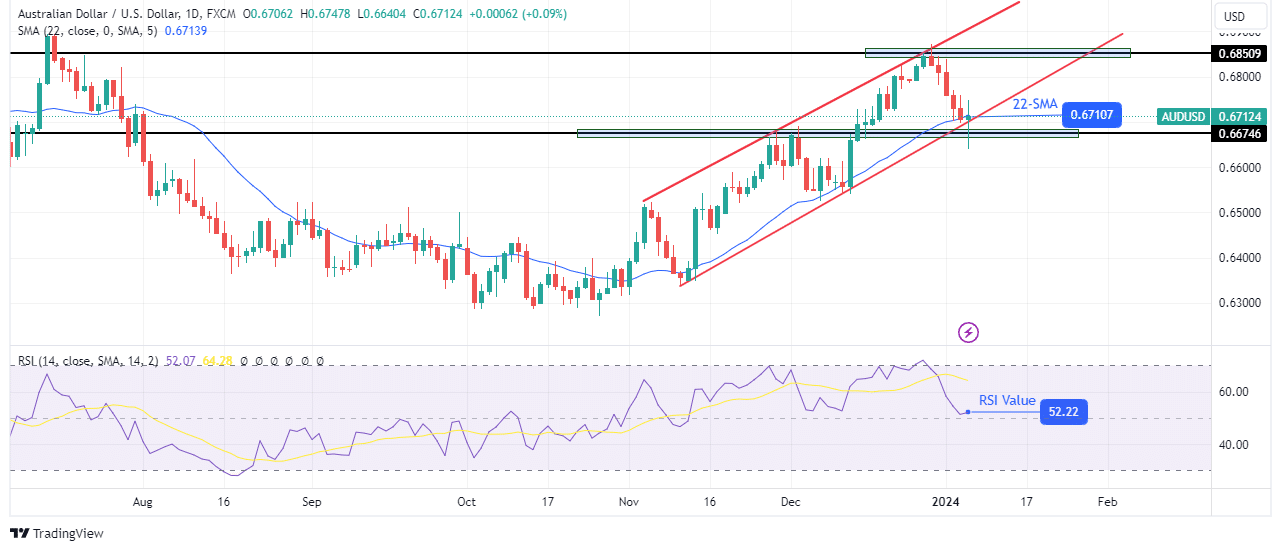

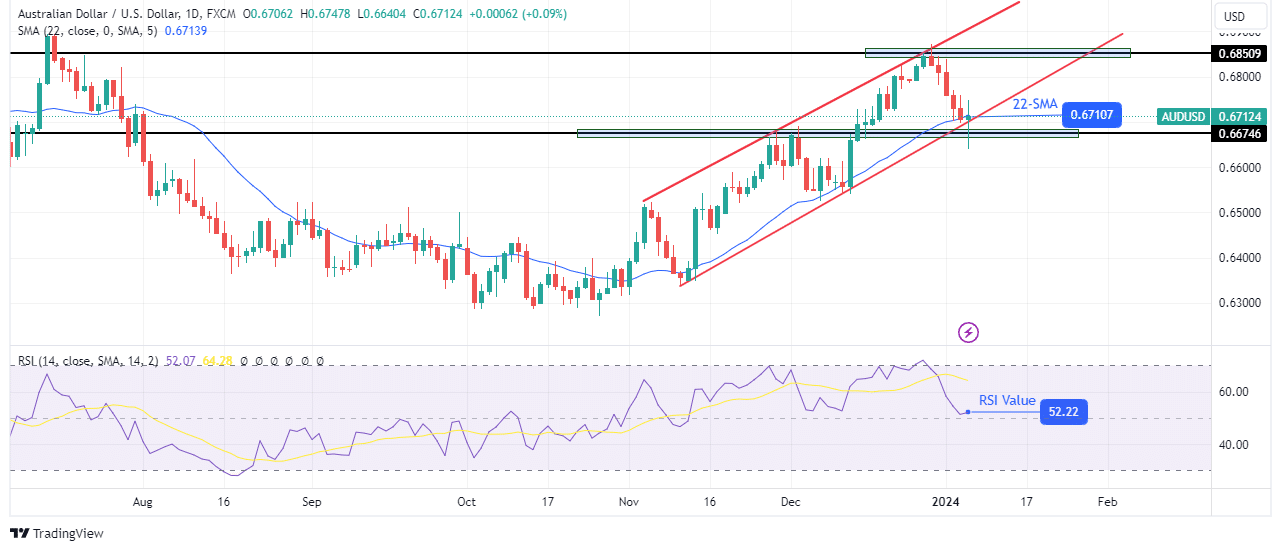

AUD/USD Weekly Technical Forecast: Bears Test Channel Support

On the technical side, AUD/USD is trading in a bullish channel, respecting its support and resistance. At the same time, the price respects the 22-SMA support and bounces higher every time it touches the line. Meanwhile, the RSI has been trading above 50 since the price crossed above the 22-SMA, supporting the bullish momentum.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

The bullish move recently stalled at the 0.6850 resistance level, prompting a pullback. The bears managed to push the price down to a solid support zone consisting of the 22-SMA and the 0.6674 support level. Moreover, the price has reached the support of the channel.

Therefore, the bulls are likely to return next week to continue the uptrend from this support zone. On the other hand, if the price breaks below this zone, it will signal a change in sentiment to the downside and a possible reversal.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money