- The Weekly Forecast AUD / USD shows the potential upside down until the dollar loses the ground.

- Moody reduced the U.S. Government’s credit rating on Monday.

- RBA lowered interest rates and signaled more to come.

The Weekly Forecast AAUD / USD shows upside down the potential until the dollar loses the country in American fiscal health problems.

UPS and DOWNS AUD / USD

The couple / USD pair had a bull week until the dollar fell to American fiscal health concern. The Australian dollar is strengthened despite the rate by the Australian Reserve Bank.

–Are you interested in learning more about Canadian forex brokers? See our detailed guide-

Moody reduced the U.S. Government’s credit rating on Monday, referring to a growing debt. In addition, Trump’s tax account, which could increase debt burden, raised concern about fiscal health in the country. As a result, the US dollar fell, allowing Aussie to climb. However, it was briefly facilitated after RBA reduced interest rates and signaled more to come.

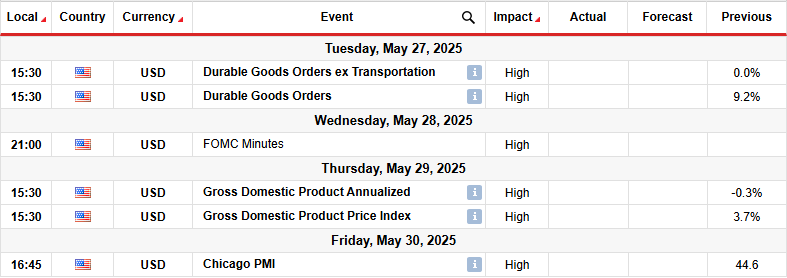

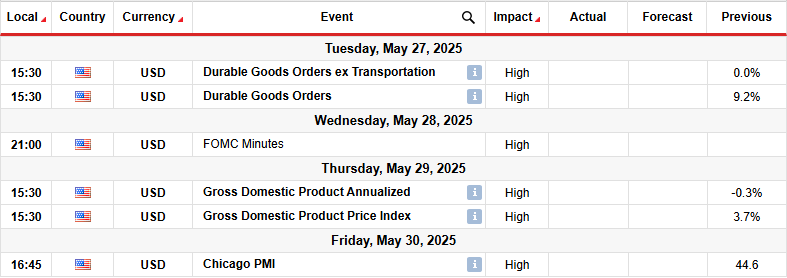

Key events next week for AUD / USD

Next week, market participants will focus on the key editions of the United States, including permanent orders of goods, FOMC minutes and GDP. Permanent orders for goods and GDP reports will show the state of the economy, shape the appearance to reduce the rates of the feedback rates.

The traders will focus on the FOMC meeting, which may contain clues in appearance to reduce the rates of the feedback rates. Careful logs will lower bets for the September Stope. On the other hand, if creators are acted care about the economy, the betting can be increased, weighed on the dollar.

AUD / USD Sunday technique Technical forecast: The bulls face a solid resistance zone

On the technical page, the price of AUD / USD is on the edge of breaking above the solid resistance zone containing 0.5 FIB retrebant and a key psychological level of 0.6500. Earlier, the price traded in the steep string below the 22nd. However, the downhill slowed after the bulls broke above the SMA and requested a corrective move.

–Are you interested in learning more about high brokers? See our detailed guide-

However, the bears made the last impulsive leg, which restarted the support level of 0.6003. From here, the bulls appeared and took on the forehead by pressing the price above the 22nd. However, the new rally is paused when it filled the current resilience zone. The pause above this zone would strengthen bias for Bikare and confirmed the new direction. Moreover, it would allow AUD / USD to climb the next level of 0.6802.

On the other hand, if the resistance zone keeps the company, the price will probably be switched below the SMA and continue its previous crasher.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.