- The US central bank implemented its first rate cut on Wednesday, sending the dollar sinking.

- Australian employment data showed faster-than-expected job growth.

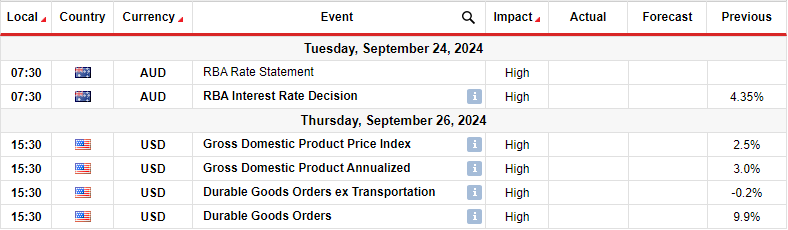

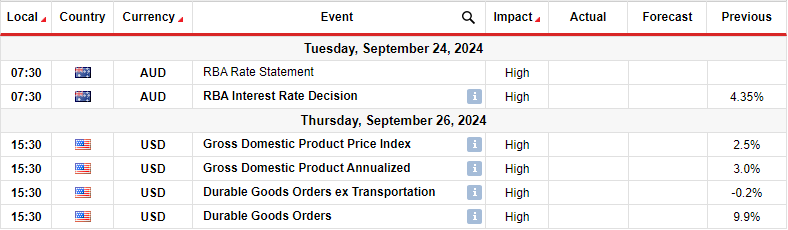

- Market participants will focus on the Reserve Bank of Australia’s monetary policy meeting.

AUD/USD weekly forecast supports more upside for the Aussie due to policy divergence between the Fed and the RBA.

AUD/USD Ups and Downs

The Aussie had a bullish week. The dollar fell after the Fed’s massive rate cut, while the Australian dollar rose on upbeat domestic data.

The US central bank made its first rate cut on Wednesday, sinking the dollar. Economists had forecast a decrease of 25 bps. Ahead of the meeting, sales and inflation data also pointed to a small cut. However, policymakers surprised with a whopping 50 bps rate cut.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

Meanwhile, the Australian dollar got a boost from employment data that showed faster-than-expected growth. A solid labor market reduces the likelihood of an RBA rate cut this year.

Next week’s key events for AUD/USD

Next week, market participants will focus on the Reserve Bank of Australia’s monetary policy meeting. It will also pay attention to US GDP and durable goods orders data.

A Reuters poll recently showed economists expect the RBA to keep rates unchanged at Tuesday’s meeting. Moreover, they expect the first rate cut in the first quarter of 2025. Recent data on the Australian labor market showed a resilient economy, reducing the likelihood of a near-term rate cut.

Meanwhile, the Fed began its easing cycle with massive tapering. However, market participants will continue to watch economic data such as GDP for clues about the next rate cut. Currently, the market is predicting a 44% chance of another 50 bps cut in November.

AUD/USD Weekly Technical Forecast: Bulls retry 0.6800

On the technical side, the AUD/USD price has reached the key resistance level of 0.6800. The price is trading above the 22-SMA and the RSI is above 50, supporting the bullish bias. The bulls have remained strong since the pair found support at the 0.6650 level.

-Are you looking for the best CFD broker? Check out our detailed guide-

Although the price closed just above 0.6800, the RSI shows that the bullish momentum is weaker than in the last attempt to break this level. Therefore, even if the price climbs higher next week, the RSI could make a bearish divergence. However, a break above 0.6800 would allow AUD/USD to return to the 0.6901 level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.