- Consumer and producer prices rose more than expected.

- The data showed a smaller-than-expected increase in US retail sales.

- Investors await political decisions in the US and Australia.

The weekly AUD/USD outlook is bearish as Fed policymakers may tone down their dovish tones in response to lingering inflationary pressures.

AUD/USD Ups and Downs

AUD/USD ended the week lower as the greenback strengthened amid signs that US inflation remains high. As the week began, the US released a report on consumer inflation. Notably, the numbers were higher than expected, leading to lower rate cut expectations. In addition, Thursday’s data showed a bigger-than-expected jump, raising concerns that high inflation has returned.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

Meanwhile, other data showed a smaller-than-expected increase in US retail sales. Moreover, initial US jobless claims fell last week. The mixed data increased uncertainty about the Fed’s rate cut prospects.

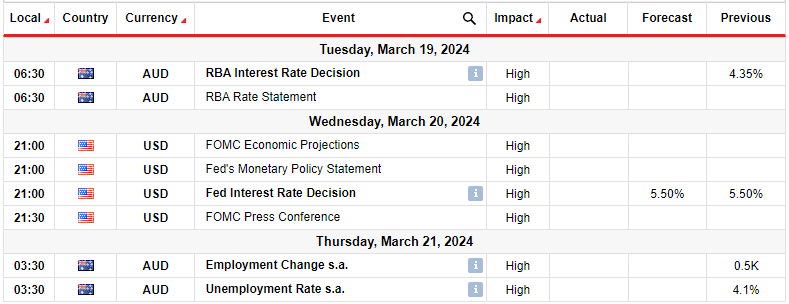

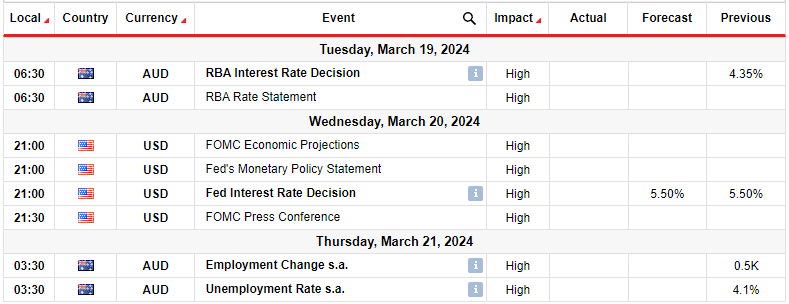

Next week’s key events for AUD/USD

Next week, investors will focus on policy decisions from the Reserve Bank of Australia and the Federal Reserve. Furthermore, Australia will release employment and unemployment data, showing the state of the labor market.

A Reuters poll showed the Reserve Bank of Australia was likely to keep rates on hold at its meeting on Tuesday. Notably, at the last meeting, RBA Governor Michelle Bullock said there is still a chance for a rate hike. However, markets believe the next move will be a cut. However, there is no certainty when RBA will start reducing interest rates.

Meanwhile, the Fed is likely to hold rates at 5.50% as policymakers continue to assess incoming economic data. However, a press conference after the decision could change the prospects for a rate cut.

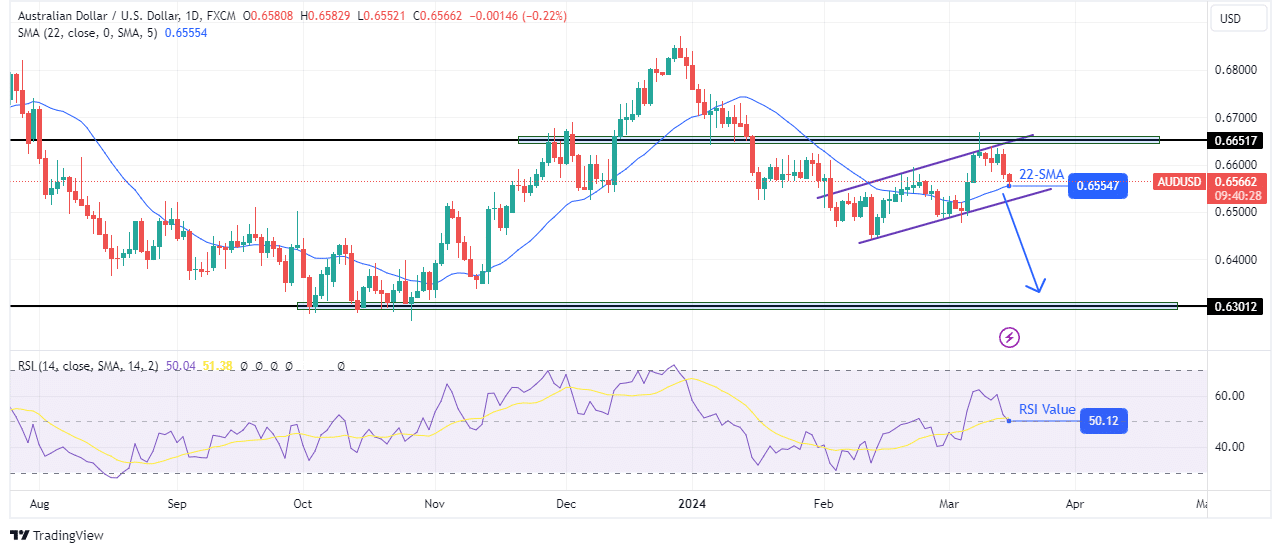

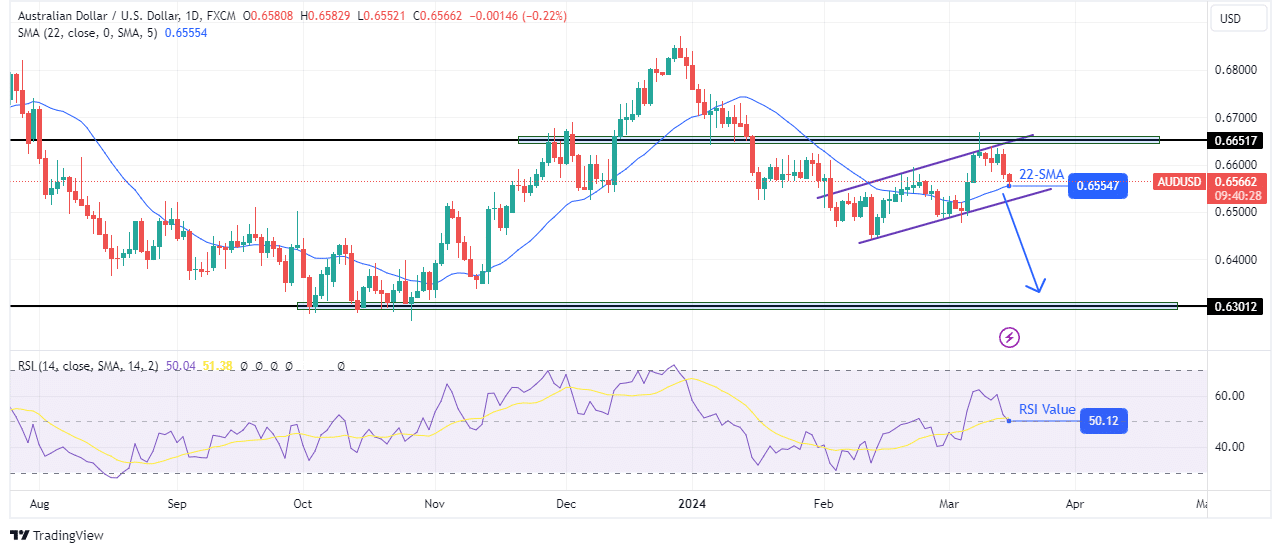

AUD/USD Weekly Technical Forecast: Bears Challenge Bulls at 22-SMA

On the daily chart, AUD/USD is in a bullish correction after a sharp decline. The price is above the 22-SMA with the RSI above 50, indicating that the bulls are in the lead. However, the upward movement is shallow and limited in the channel. Furthermore, the price reverses after finding resistance at the key level of 0.6651.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Bears will eventually break below the SMA and channel support if this is a corrective move. A break below would allow the price to make another impulsive leg to the 0.6301 support level. However, if the bulls gain control of the market, the price will jump higher to break above the 0.6651 level and make a new high.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.