- The weekly AUD/USD forecast is overshadowed by strong US retail sales data and worsening risk sentiment.

- Poor employment data from Australia and tensions from the Middle East weighed on Aussies.

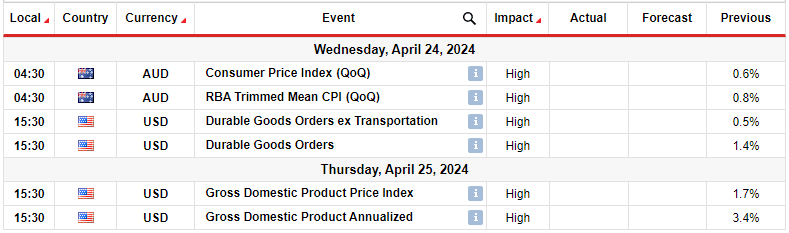

- Australia will release its CPI report next week.

The weekly AUD/USD forecast reveals a bearish trend due to the twin forces of dollar resilience and escalating geopolitical tensions.

AUD/USD Ups and Downs

Australians ended the week with a bearish candle amid economic data from the US and Australia. As the week began, the US released better-than-expected retail sales data, pointing to strong consumer spending in the economy. As a result, rate cut bets fell and the dollar rose. Moreover, Powell’s speech on Tuesday confirmed that the Fed will keep interest rates higher for longer to fight inflation.

-Are you looking for automated trading? Check out our detailed guide-

Meanwhile, poor employment data from Australia and tensions in the Middle East weighed on the Aussie. Australians lost their jobs in March, pointing to a slowing labor market.

Next week’s key events for AUD/USD

Australia will release its CPI report next week, while the US will release durable goods orders and GDP data. The CPI report will play a significant role in shaping the outlook for an RBA rate cut. There is currently a 65% chance that the RBA will cut rates in December. Therefore, if the report shows further easing in inflation, bets for a December cut could increase. Meanwhile, the RBA could cut rates next year if inflation remains stubborn.

The Fed’s rate cut outlook could change with next week’s data. Stronger-than-expected durable goods orders and economic growth would lead to lower rate cut expectations. The opposite is also true.

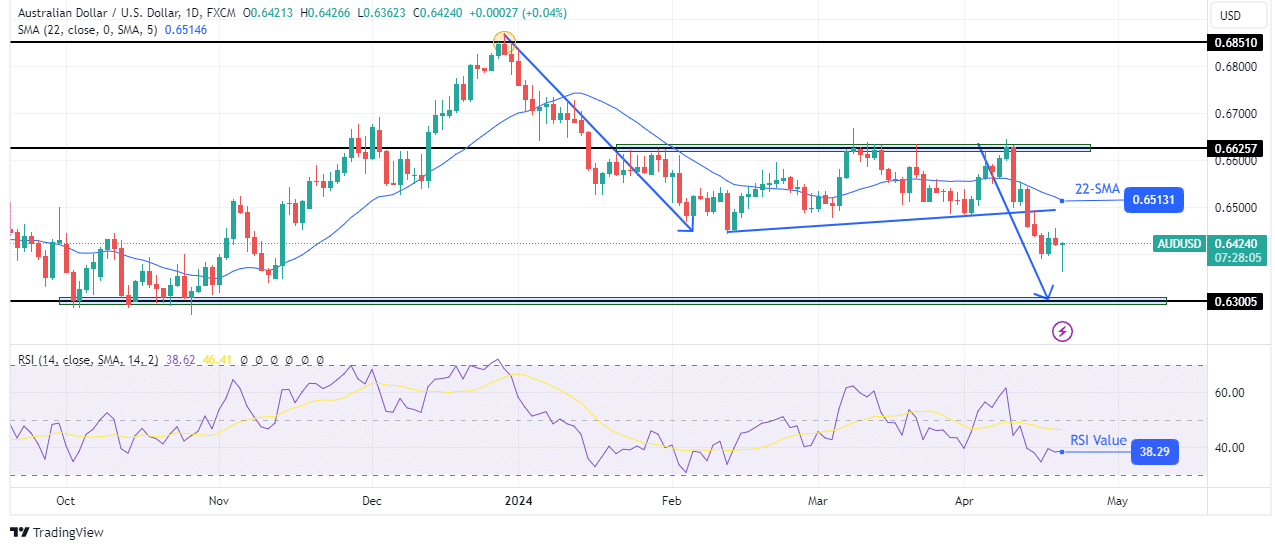

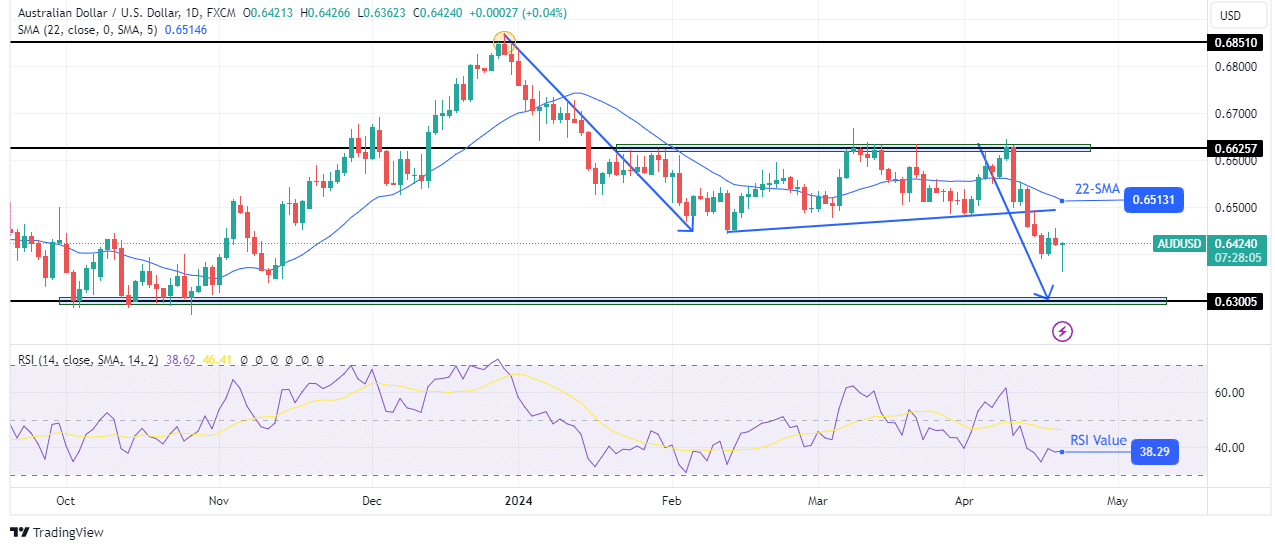

AUD/USD Weekly Technical Forecast: Bearish around 0.6851 support after range break

On the daily chart, the AUD/USD price is falling after breaking out of the consolidation. Initially, the price started a steep downtrend at the key level of 0.6625. However, it stalled and moved sideways below the key resistance level of 0.6300. Moreover, it respected the support trend line and bounced higher every time it retested the level.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

At the same time, the price continued to break through the 22-SMA, showing a lack of direction. However, the bears confirmed the continuation of the previous downtrend with a break below the support trend line. In addition, the price has fallen well below the 30-SMA and the RSI well below 50, indicating strong bearish momentum.

This move could continue next week, with the bears targeting the key support level of 0.6851.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money