- Australia’s CPI showed cooler-than-expected underlying price pressures.

- Business activity in the US manufacturing sector fell to the lowest level in the last 8 months.

- US non-farm payrolls missed forecasts.

The AUD/USD weekly forecast points south after Australian inflation data boosted expectations for a rate cut by the Reserve Bank of Australia.

AUD/USD Ups and Downs

The AUD/USD pair had a bearish week, with the Australian and US dollars struggling. Earlier in the week, Australia released inflation data, which showed cooler-than-expected underlying price pressures. As a result, markets have increased the likelihood of an RBA rate cut in November.

-Are you looking for automated trading? Check out our detailed guide-

Soon after, US data showed the economy slowing faster than expected. Business activity in the manufacturing sector fell to the lowest level in the last 8 months. Meanwhile, nonfarm payrolls missed forecasts and unemployment jumped to 4.3%.

However, the dollar barely fell due to safe-haven demand. It is noticeable that during the week investors bought dollars because of the fear of the escalation of the Middle East war.

Next week’s key events for AUD/USD

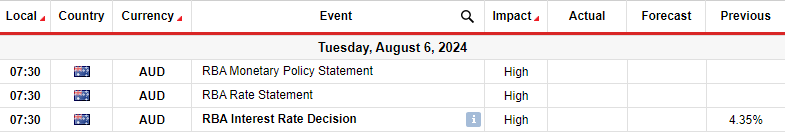

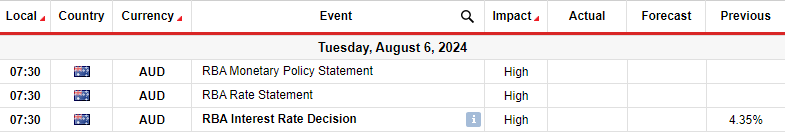

Next week, investors will focus on the Reserve Bank of Australia’s policy meeting. The Reserve Bank of Australia is likely to keep rates unchanged at the meeting. However, the focus will be on post-meeting messages.

Markets have long backed off bets on an RBA rate cut, expecting the first in mid-2025. However, this outlook has recently changed following the Australian inflation report. Notably, core inflation unexpectedly cooled in the second quarter, raising expectations for a rate cut this year. Investors now expect the first cut in November.

If policymakers take a slightly more dovish tone, the Aussie could fall. On the other hand, they could be cautious, boosting the Australian dollar.

AUD/USD Weekly Technical Forecast: Bears attack towards 0.6401 support

On the technical side, the AUD/USD price declined sharply from the key level of 0.6801. It has fallen well below the 22-SMA, with the RSI in the oversold region, indicating solid bearish momentum. The decline briefly stalled when it reached the Fib retracement level of 0.618. However, the bears soon broke below with a solid candle.

-If you are interested in Forex day trading, please read our getting started guide-

In the coming week, the bearish trend could continue above the 0.786 Fib to retest the 0.6401 support level. Here the downtrend could pause and pull back to retest the 22-SMA resistance. However, the bearish bias will remain if the price remains below the SMA and RSI below 50.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.