- RBA’s top policymaker warned that the bank could still raise rates to lower inflation.

- Traders are adjusting their policy outlook for the RBA and the Fed.

- Market participants are eagerly awaiting the US inflation report.

AUD/USD weekly forecast takes a neutral tone. This balance comes from hawkish remarks echoed by both RBA and Fed policymakers.

AUD/USD Ups and Downs

The Aussie fluctuated last week, with both the Australian and US dollars showing strength. However, the week ended with a slight increase in the pair. The Australian dollar strengthened after the RBA’s policy meeting on Tuesday, where the central bank kept rates on hold. Moreover, the RBA’s chief policymaker warned that the bank could still raise rates to reduce inflation.

RBA Governor Michelle Bullock echoed these hawkish remarks when she spoke on Friday, sending rate cut bets tumbling. The same happened in the US, with more upbeat data and hawkish sentiments from Fed policymakers. Traders are adjusting their policy outlook for the RBA and the Fed, with both likely to delay rate cuts.

Next week’s key events for AUD/USD

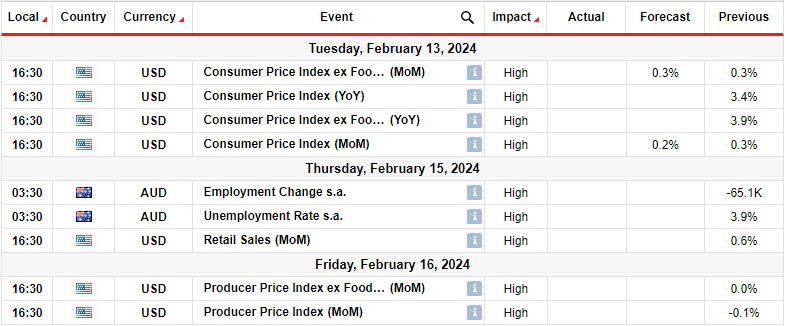

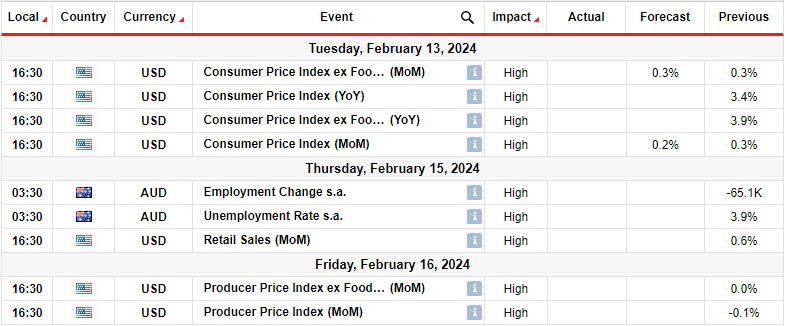

Next week, Australia will release employment data. The latest report showed a significant drop in employment in the country. Another such drop could increase bets on an RBA rate cut. On the other hand, the US will report on consumer and producer inflation. In addition, a report on retail sales will be published.

Market participants are eagerly awaiting the US inflation report as it will provide clues on the Fed’s next policy move. Recent data from the country has clouded expectations of an early Fed rate cut. So the inflation figure will determine whether an early rate cut is still possible.

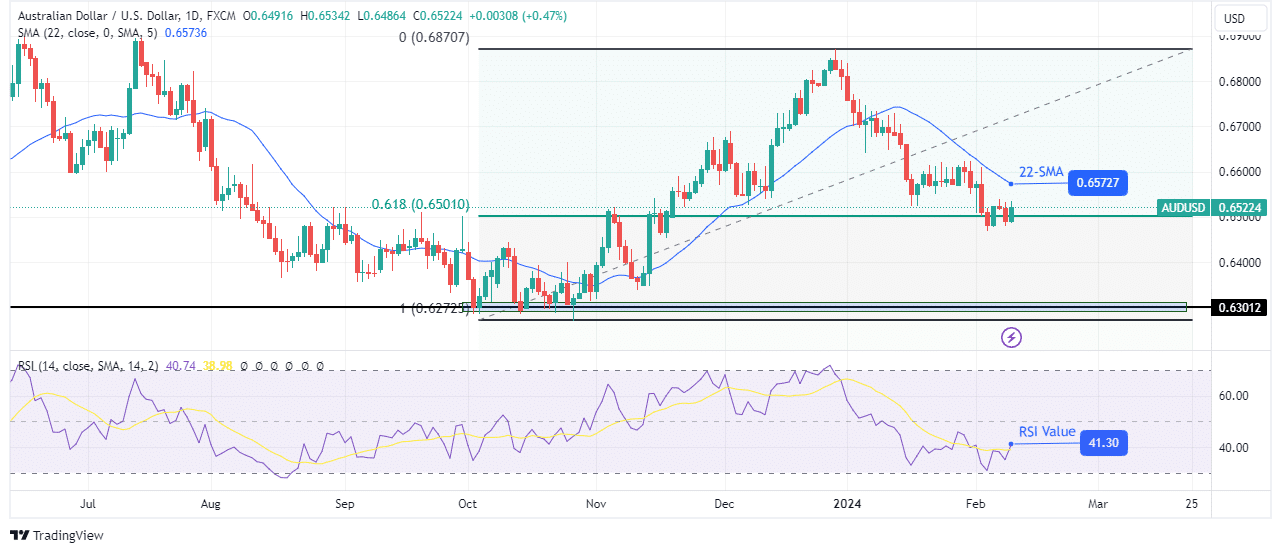

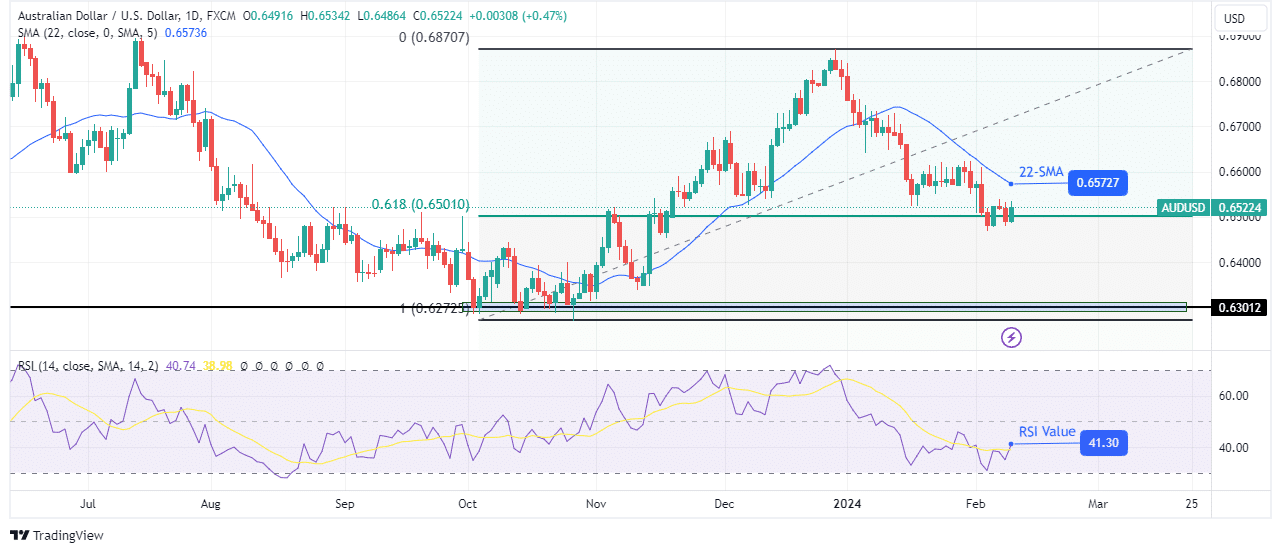

AUD/USD weekly technical forecast: Bears pause at 0.618 fib retracement

On the technical side, AUD/USD is in a downtrend after a sharp reversal at the 0.6870 level. The price declined from this level with solid bearish momentum, breaking below the 22-SMA. Consequently, there was a sudden shift in sentiment from bullish to bearish.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

Furthermore, the price started making lower lows and lower highs. However, this decline was halted after retracing 0.618 from the previous bullish move. This key fib level could lead to a pullback to retest the 22-SMA or a consolidation before the downtrend resumes.

However, the bearish bias is strong and the price is likely to break below the fib level. If that happens, it could fall to the 0.6301 level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money