- US jobless claims fell more than expected.

- Business activity in the US manufacturing and service sectors improved.

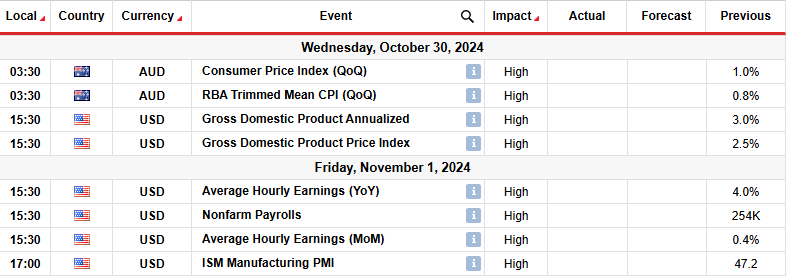

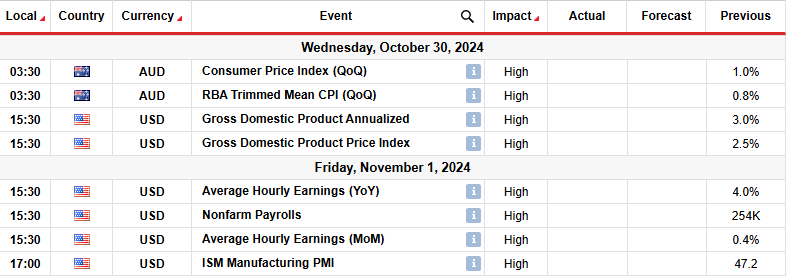

- Market participants will be paying attention to inflation data in Australia.

The AUD/USD weekly forecast points to continued resilience in the US economy, keeping the greenback firm against the Australian dollar.

AUD/USD Ups and Downs

The AUD/USD pair ended the week lower as the dollar rallied following upbeat US economic data. At the same time, Middle East tensions increased the demand for dollars. The US released two major reports on jobless claims and business activity.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Jobless claims fell more than expected, indicating tough conditions in the labor market. As a result, rate cut expectations eased, boosting the dollar. A separate report found that business activity in the manufacturing and services sectors improved as demand picked up. At the same time, the war between Israel and Hezbollah escalated, sending traders to shelter assets like the dollar.

Next week’s key events for AUD/USD

In the coming week, market participants will pay attention to inflation data in Australia. Meanwhile, the US will release data on manufacturing GDP PMI and non-farm payrolls. Australia’s CPI numbers will significantly shape the outlook for a rate cut by the Reserve Bank of Australia. If inflation surprises to the upside, the Australian will strengthen as rate cut expectations fall.

On the other hand, the non-farm payrolls report will be among the last major reports before the Fed’s November meeting. The upbeat report is likely to reduce the likelihood of a rate cut. On the other hand, an unexpected drop in job growth could set back rate-cut bets in a big way.

AUD/USD Weekly Technical Forecast: Break to 0.6650 confirms new downtrend

From the technical side, AUD/USD the price reversed to the downside on the daily chart. Bears took control when price broke below the 22-SMA support line. Furthermore, the price broke below the 0.6650 support to make a lower low, confirming a reversal. Meanwhile, the RSI has fallen into bearish territory and is trading near the oversold region, indicating solid momentum.

–Are you interested in learning more about forex signals? Check out our detailed guide-

Moreover, AUD/USD broke below the 0.5 Fib retracement level, signaling a significant pullback or reversal. A strong bearish bias means the price is likely to retest 0.6501 next week. In addition, the price could make a first lower high, further confirming the new downtrend. This bias will remain as long as the price remains below the 22-SMA and the RSI trades below 50.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money