- Inflation in Australia has decreased from 2.7% to 2.1% per annum.

- The US economy added 12,000 jobs, well below the forecast of 106,000.

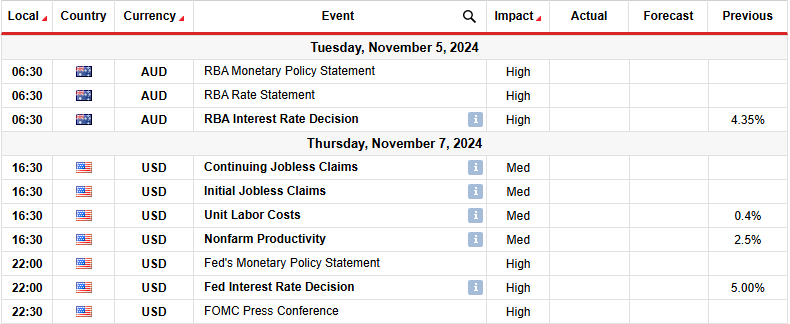

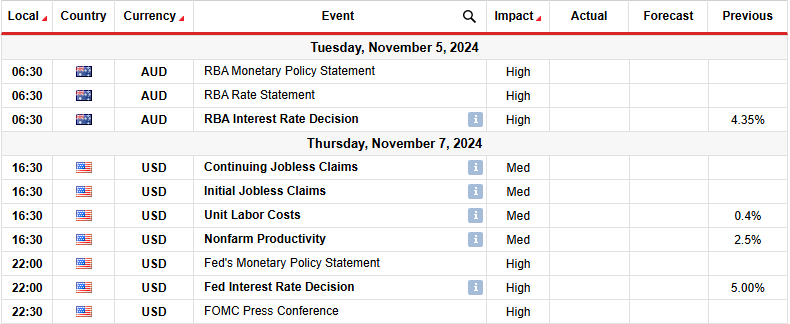

- Traders will be watching the RBA and Fed policy meetings.

The AUD/USD weekly forecast points to uncertainty ahead of a busy week with the US presidential election and RBA rate decision.

AUD/USD Ups and Downs

Australians had a down week amid economic reports from Australia and the US. The first report from Australia revealed that inflation eased from 2.7% to 2.1% annually, which is weighing on the Australian dollar. However, core inflation remained a concern keeping rate cut expectations low.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, US data showed weaker-than-expected economic growth in the third quarter. Inflation accelerated 0.3% in September, keeping expectations of a Fed rate cut unchanged.

The latest report for the week revealed weaker-than-expected job growth. The economy added 12,000 jobs, well below the forecast of 106,000. However, the dollar soon recovered amid uncertainty ahead of the US presidential election.

Next week’s key events for AUD/USD

Next week, traders will be watching policy meetings from the Reserve Bank of Australia and the Federal Reserve. Economists believe the RBA will keep rates unchanged as inflation concerns remain. At the same time, they do not expect a rate cut in Australia this year.

Meanwhile, the US central bank is set to cut interest rates by 25 basis points. The latest employment data solidified bets for a rate cut this November. However, markets are still accepting new prospects for a gradual rate cut. There is a chance that the policy makers will sound like a hawk. The US economy has shown unexpected resilience, leading some to predict just one contraction this year. A hawkish tone could lift the dollar.

AUD/USD weekly technical forecast: Inclined to test 0.6501 support

From the technical side, AUD/USD the price is approaching the support level of 0.6501. The bearish bias is strong as the price is trading well below the 22-SMA and the RSI is near the oversold region.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Bears maintained a steep decline as the price fell below the SMA. As a result, the price failed to make any meaningful retracement to the SMA line. However, the steep decline cannot continue without a pullback.

If the price reaches the 0.6501 support next week, it could stop, allowing the bulls to revisit the SMA resistance. If the SMA remains firm, the price is likely to break below 0.6501 to retest the 0.6401 support level. On the other hand, a break above the SMA would signal a change in sentiment to the bullish side.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.