- The Reserve Bank of Australia kept rates on hold on Tuesday and took a more neutral tone.

- The Fed had a more dovish policy meeting, weakening the dollar.

- The US released better-than-expected manufacturing PMI data.

The weekly AUD/USD forecast shows a bearish outlook as the greenback flexes its muscles again, buoyed by the resilience of the US economy.

AUD/USD Ups and Downs

AUD/USD had a bearish week where the RBA was less hawkish. Notably, the Reserve Bank of Australia kept interest rates on hold on Tuesday and took a more neutral tone, reducing talk of a rate hike. As a result, bets on a rate cut have increased. Meanwhile, the Fed had a more dovish policy meeting, sending the dollar lower.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

On Thursday, the pair rose when Australia released its jobs report. Employment jumped while the unemployment rate fell, indicating a tight labor market. Finally, the pair fell when the US released better-than-expected manufacturing PMI data. Moreover, initial jobless claims fell last week, indicating a tightening labor market.

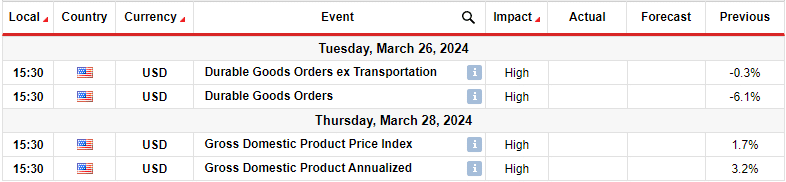

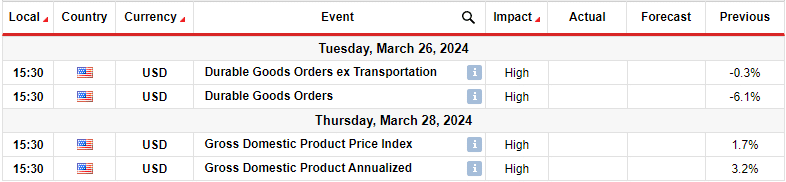

Next week’s key events for AUD/USD

Next week could be relatively slow after a week full of high-impact events. Investors will focus only on US data, including durable goods orders and gross domestic product. These reports will show the state of the economy, influencing the Fed’s rate cut prospects.

Durable goods orders are a good indicator of the manufacturing sector, which makes up a large part of the US economy. Moreover, it shows the state of consumer spending. If consumers can afford big purchases, that’s a good indicator of a strong economy.

Meanwhile, gross domestic product will show economic growth and whether higher interest rates have affected the economy.

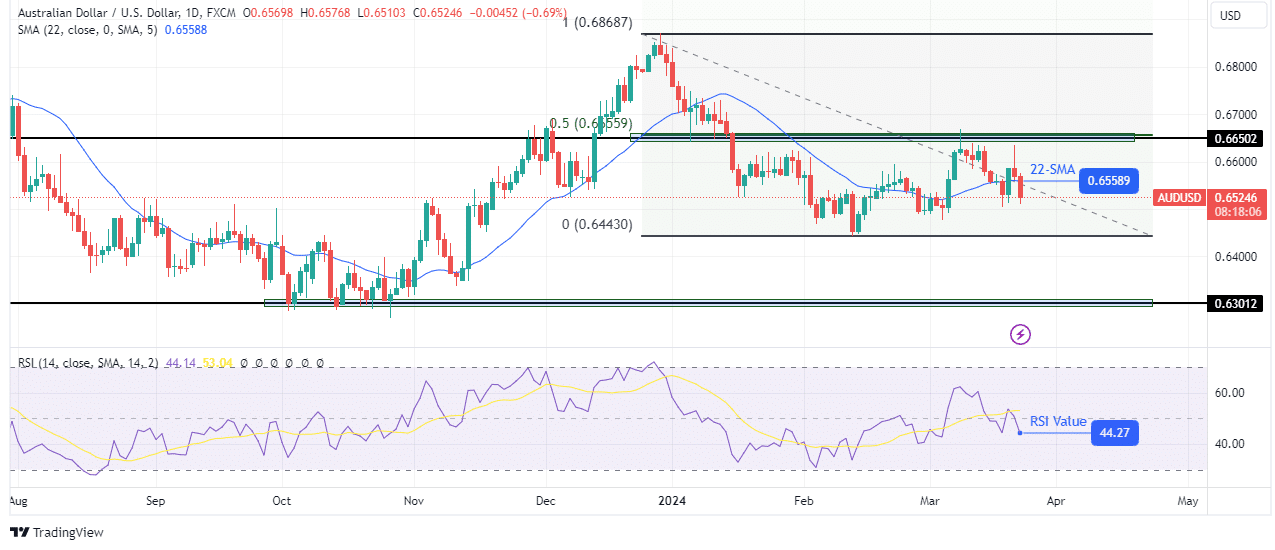

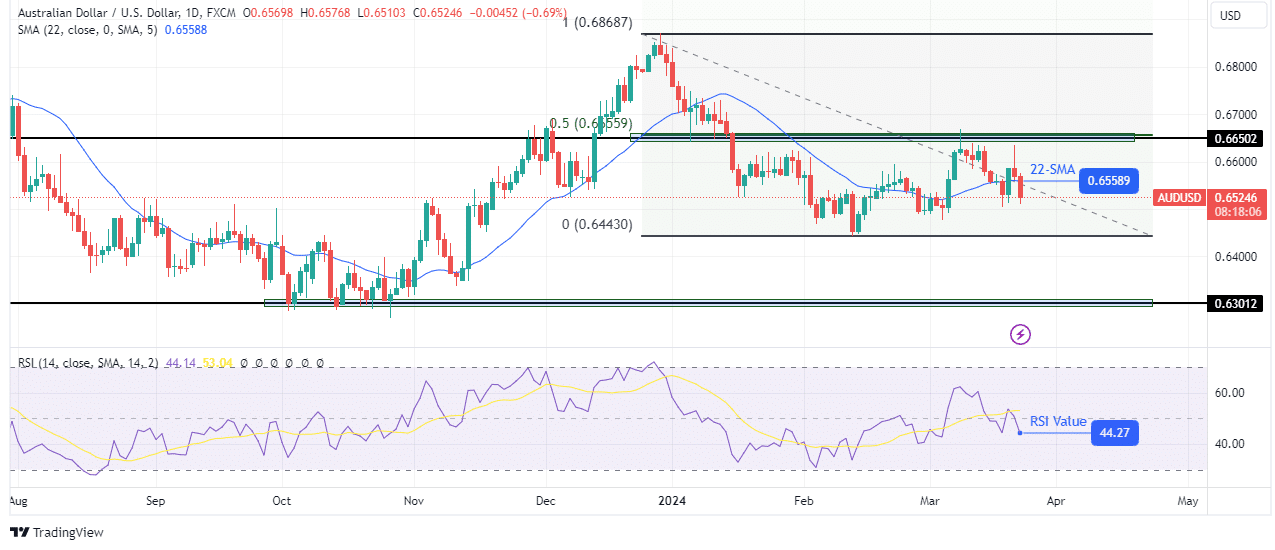

AUD/USD weekly technical forecast: 0.5 Fib resistance remains firm

On the technical side, AUD/USD is falling after finding resistance at the 0.5 key Fib retracement level. Bears took control when price broke below the 22-SMA and continued to make lower lows. However, the decline stalled when the bulls broke above the 22-SMA, allowing AUD/USD to recover.

-Are you interested in learning more about forex indicators? Click here for details –

Unfortunately, the rebound was shallow, indicating that it was a corrective move. As a result, the bears regained control when the price recovered 50% of the previous decline. However, to confirm the continuation of the previous trend, the bears must start making lower and lower lows. If the decline continues next week, the price will target the support level of 0.6301.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.