- The US CPI number was higher than expected, showing increased pressure on prices.

- Wholesale inflation missed forecasts, weakening the dollar.

- The US will release retail sales data showing consumer spending.

The weekly AUD/USD forecast shows a decline against the strong greenback as US data dampens hopes for a Fed rate cut in November.

AUD/USD Ups and Downs

Australians had a worse week with no major economic reports out of Australia. Meanwhile, the US released several key reports that increased the likelihood of a pause during the Fed’s November meeting.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

The US CPI number was higher than expected, showing increased pressure on prices. Although he softened bets on a rate cut, policymakers are confident that inflation will reach the 2% target. Meanwhile, wholesale inflation missed forecasts, weakening the dollar.

Another report showed a higher-than-expected number of jobless claims, indicating weakness in the labor market. Market participants also reviewed minutes from the FOMC meeting, which showed a strong dovish stance ahead of strong September employment data.

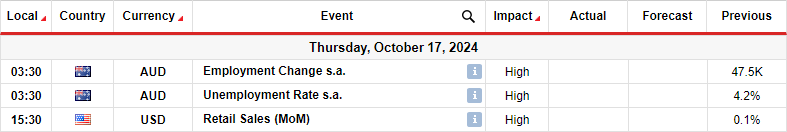

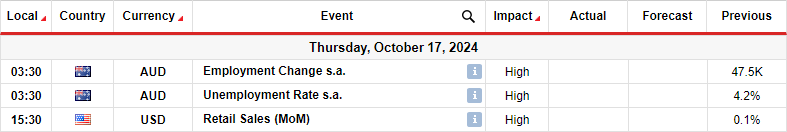

Next week’s key events for AUD/USD

Next week, Australia will release employment data that could influence the RBA’s policy outlook. Australia’s labor market has shown resilience in the past, leading to a hawkish tone from RBA policymakers. In the last report, there were 47,500 jobs, with an unemployment rate of 4.2%.

This month’s report could show continued resilience or signs of a cooling labor market. A robust report would boost the Aussie by pushing back the timing of the first rate cut. On the other hand, if there are signs of weakness, market participants will increase their bets on a December cut.

Meanwhile, the US will release retail sales data showing consumer spending. The jump in sales will point to strong consumer spending, reducing bets on a November Fed rate cut. The opposite is also true.

AUD/USD Weekly Technical Forecast: Bears Break Channel Limits

On the technical side, the AUD/USD price broke its bullish trend line in a sharp bearish move. The bulls gave up control when the price reached the resistance level of 0.6901. They confirmed this change in control when price broke below the 22-SMA and channel support line.

–Are you interested in learning more about making money on forex? Check out our detailed guide-

However, the price is currently facing the support level of 0.6700. Therefore, it could bounce higher to retest the recently broken channel line before climbing or bouncing lower to break below 0.6700. A break below this level would open the way to the next significant support at 0.6501.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.