- Data on business activity showed expansion in the manufacturing and service sectors in the US.

- US GDP data was higher than expected.

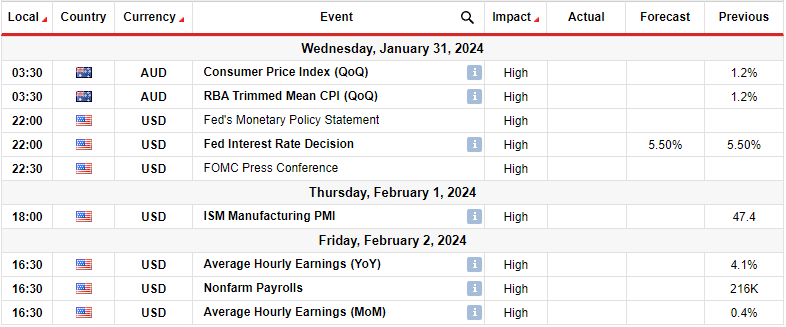

- Australia will release consumer inflation data next week.

The weekly AUD/USD forecast is bearish as a resilient US economy has changed the outlook, reducing expectations for a Fed rate cut.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

AUD/USD Ups and Downs

Australia had a bad week as the dollar strengthened on upbeat US data. Last week, the US released data on business activity showing expansion in the manufacturing and service sectors. Furthermore, GDP data was higher than expected, showing the resilience of the US economy.

Additionally, this indicated that the Fed would not need to cut rates anytime soon. As a result, the dollar strengthened, pushing AUD/USD lower. Meanwhile, the core PCE price index came in as expected.

Next week’s key events for AUD/USD

Australia will release consumer inflation data next week. Meanwhile, the US will release production and employment data. In addition, traders will be able to review the minutes of the Fed meeting. This could provide clues as to what will happen next with US interest rates.

Australia’s latest inflation report showed a sharp drop to the lowest level in two years. Consequently, investors have become convinced that RBA is done raising interest rates.

Meanwhile, the key non-farm payrolls report will show the state of the US labor market. A positive report could cause rate cut bets to fall and the dollar to rise.

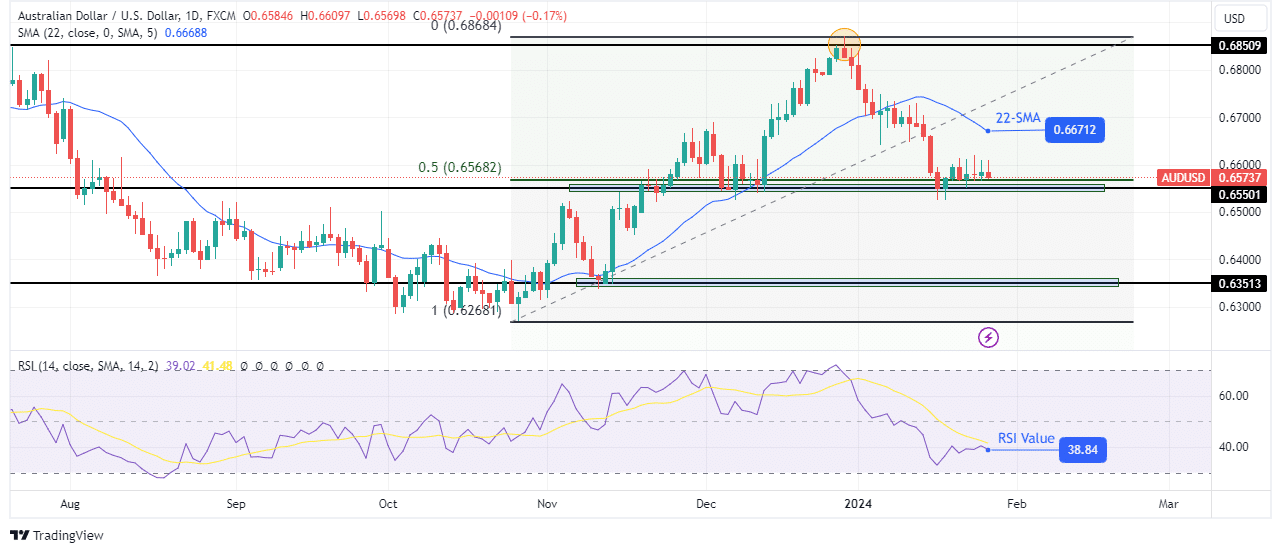

AUD/USD weekly technical forecast: Firm support halts bearish momentum

On the charts, AUD/USD fell sharply after touching the 0.6850 resistance level. As a result, the bias has shifted from bullish to bearish, with price now trading below the 22-SMA. At the same time, the RSI moved from trading near overbought levels to trading closer to the oversold region.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

However, the new bearish momentum stalled at a solid support zone. The price is struggling at the 0.5 fib retracement level and the key support level of 0.6550. Price action shows indecision in the support zone with small candles and large wicks. This indecision may lead to a pullback to the 22-SMA or a break below the support zone.

Given the strong bearish bias, there is a higher chance that the price will break the zone. If that happens, the bears will be free to push the price lower to the 0.6351 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money