- Australia experienced a larger-than-expected decrease in inflation in October.

- The dollar was weak as the data supported expectations of a Fed rate cut.

- The RBA is likely to keep its key interest rate at 4.35% on Tuesday.

The weekly AUD/USD forecast hints at a somewhat weak outlook. Australians fall as easing inflation in Australia sets stage for dovish central bank.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

AUD/USD Ups and Downs

The Aussie ended the week in the red, down after poor inflation data. Namely, in October, Australia experienced a larger-than-expected reduction in inflation. At the same time, core inflation also experienced a slight decline. This outcome strengthens the case for the central bank to keep interest rates on hold in the coming week.

Meanwhile, the dollar was weak as data supported expectations of a Fed rate cut. US jobless claims rose, indicating a softening labor market. Other data showed a drop in US inflation, supporting calls for a Fed rate cut.

Investors also listened to Powell’s speech, where he said the central bank would take a careful approach to interest rates.

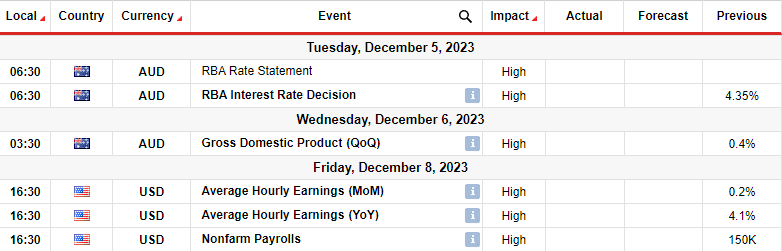

Next week’s key events for AUD/USD

On Tuesday, the Reserve Bank of Australia (RBA) is likely to keep its key interest rate at 4.35%, according to a Reuters poll. Meanwhile, a rate cut is unlikely to come until the fourth quarter of next year.

Ben Picton, senior strategist at Rabobank, sees no change from the RBA next week. However, he suggests they will take a hawkish stance, highlighting the likelihood of a rate hike.

Furthermore, there will be a report on Australia’s GDP to show whether the economy has been growing. Finally, investors will focus on the US jobs report which is likely to weigh on the Fed’s outlook.

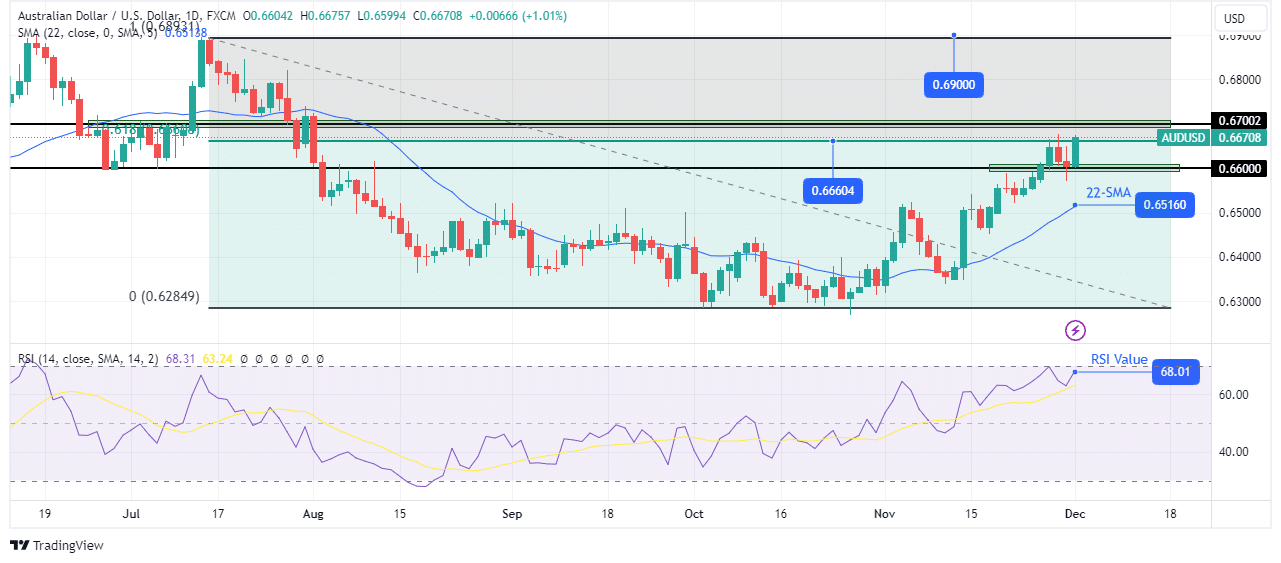

AUD/USD Weekly Technical Forecast: Bulls face tough resistance at 0.618 Fibonacci

On the technical side, AUD/USD has a bullish bias. The price is climbing higher after breaking above and retesting the key 0.6600 level. Furthermore, the bulls confirmed the bullish trend as the price respected the 22-SMA support and made a higher high and low.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

At the same time, the RSI is showing solid bullish momentum near the overbought region. Price action also supports a bullish bias, as bulls make much larger candles than bears. However, the bulls are facing strong resistance as the price pulled back to the key fib level of 0.618. Adding to the resistance is the key level of 0.6700.

The bullish trend will continue if the bulls break above this resistance zone next week. Furthermore, the bulls would have a clear path to the next resistance level at 0.6900. However, if the resistance remains firm, the price is likely to reverse to the 22-SMA or lower.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.