- Business conditions in Australia remained stable in October.

- Australian consumer confidence fell after last week’s rate hike.

- Traders are focused on US inflation figures due later on Tuesday.

Bearish sentiment prevailed in the AUD/USD price analysis as the release of Australian economic data failed to impress buyers. Business conditions in Australia remained stable in October. Meanwhile, consumer confidence fell after last week’s interest rate hike by the Reserve Bank of Australia.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The National Australia Bank (NAB) survey showed a 1-point increase in the business conditions index to +13 in October. On the other hand, confidence fell by 2 points to -2. Although the survey found a slight decline in cost pressures in October, levels remained high.

The growth of labor and procurement costs decreased at a quarterly rate of 1.8%, while the growth of retail prices maintained a quarterly pace of 1.9%. However, overall price growth fell to its lowest level since mid-2020 at 1.0%.

At the same time, traders were focused on US inflation figures due later on Tuesday. Recent statements from Fed policymakers contradicted market expectations that the Fed had ended its cycle of aggressive rate hikes.

NAB’s Catril commented: “Overall, the market is also worn out by all the messages coming from central banks. Moreover, the ‘higher for longer’ and wait-and-see mode keeps volatility low.” Further, Catril highlighted the importance of the upcoming CPI number. “We have to wait for that CPI number tonight, which could be a bit of a shock.” If it’s strong, then it obviously brings the idea that another rate hike from the Fed is possible.

AUD/USD key events today

It will be a volatile day for the pair as the US will release a major economic report:

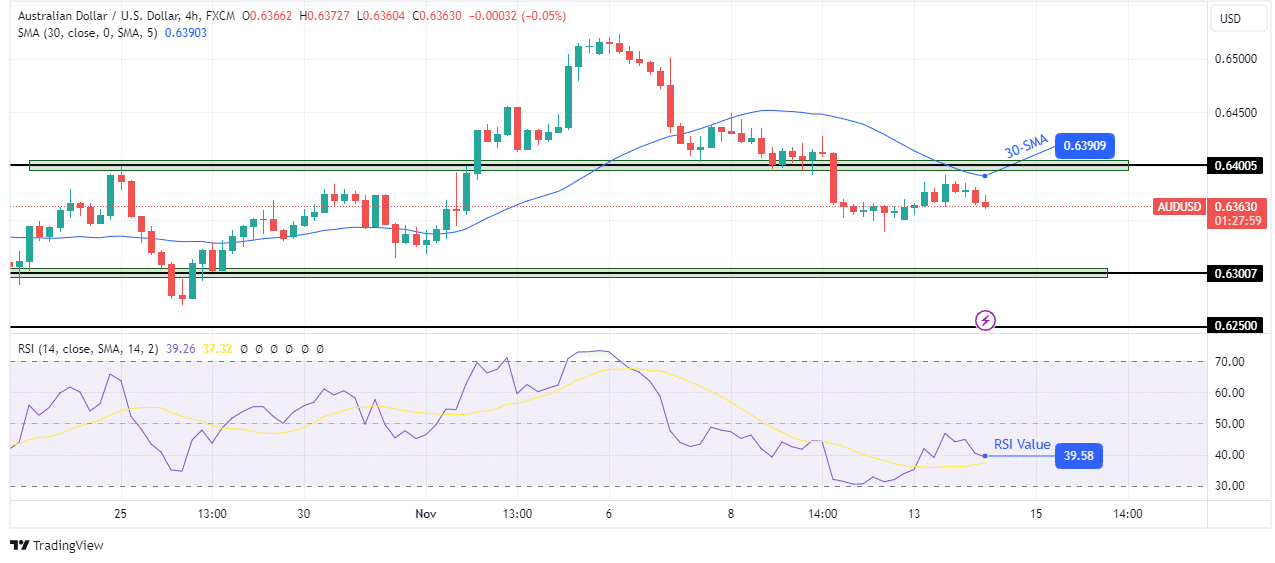

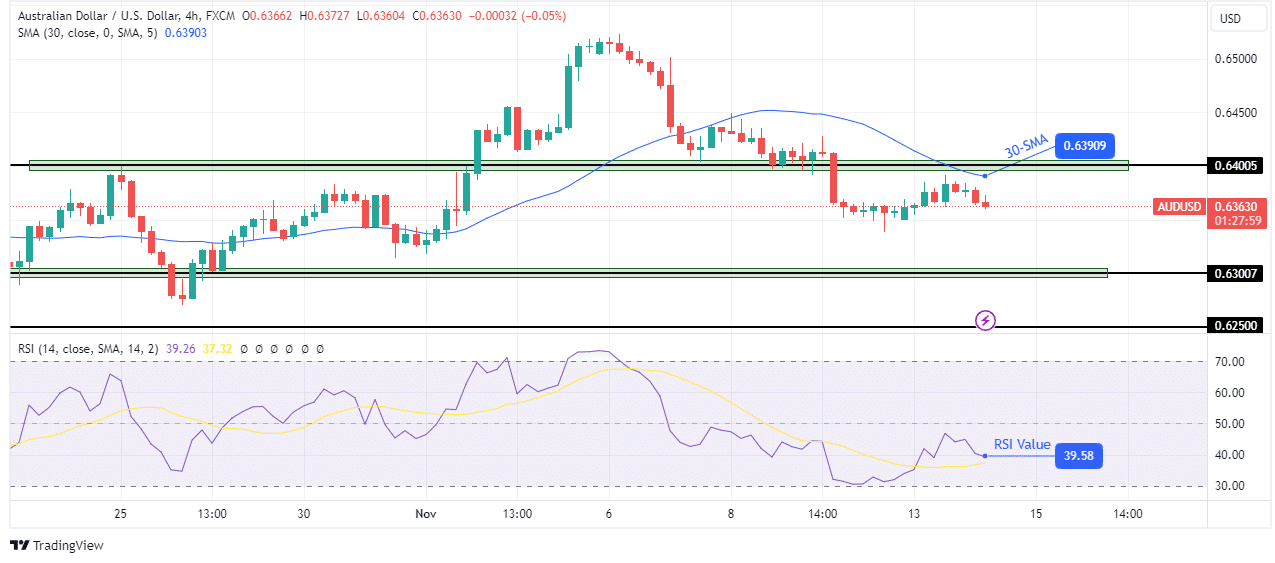

AUD/USD Price Technical Analysis: Bears have set their sights on 0.6300 support.

The bias for AUD/USD is bearish as the price breaks below the 30-SMA. The change from bullish to bearish came when the price broke below the 30-SMA. Furthermore, it strengthened after the bears broke through the key 0.6400 level to make new lows.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

Looking at the RSI, there is solid bearish momentum as it sits below the 50 level. The price recently pulled back towards the 30-SMA resistance. However, the rebound was weak, and the bears seem poised to continue their downtrend. Moving forward, the bears will target the 0.6300 support level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.