- The price of gold ended the week higher as the dollar fell.

- US inflation has cooled, putting pressure on the dollar.

- Gold may experience a technical correction amid profit taking.

The weekly gold forecast is bullish as the price rose 2.5% last week. The US dollar weakened and US government bond yields fell. The upcoming week lacks significant macroeconomic events, providing an opportunity to focus on technical analysis of KSAU/USD for potential trading opportunities.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

The ups and downs of the past week

Gold underwent a technical correction to the upside on Monday, fueled by the absence of impactful data releases. On Tuesday, gold gained momentum, surpassing $1,970. Notably, the US Consumer Price Index (CPI) indicated a monthly decrease in inflation from 0.4% in September to -0.1% in October, falling to 3.2% for the year.

Over the same period, core CPI, excluding volatile energy and food prices, rose 4%. The USD faced significant selling pressure, falling over 3% as the 10-year US Treasury yield fell below 4.5%. Accordingly, KSAU/USD saw an increase of more than 1%.

US retail sales for October fell 0.1%, beating market forecasts for a 0.3% decline. However, initial jobless claims rose on Thursday, weighing on the dollar’s performance. Additionally, the Federal Reserve reported a 0.6% drop in industrial production for October. Despite mid-week volatility, gold advanced, moving towards $1,980.

Even on the last trading day of the week, with UST yields falling, gold continued its upward trend, peaking above $1,990, which represents the highest point in recent memory. The positive mood was fueled by Federal Reserve Vice President Philip Jefferson’s statement that the bank’s balance sheet has no immediate end in sight. Demand for gold remained strong, with Indian buyers overlooking local price increases during Diwali celebrations and continued gold accumulation in China while maintaining high premiums.

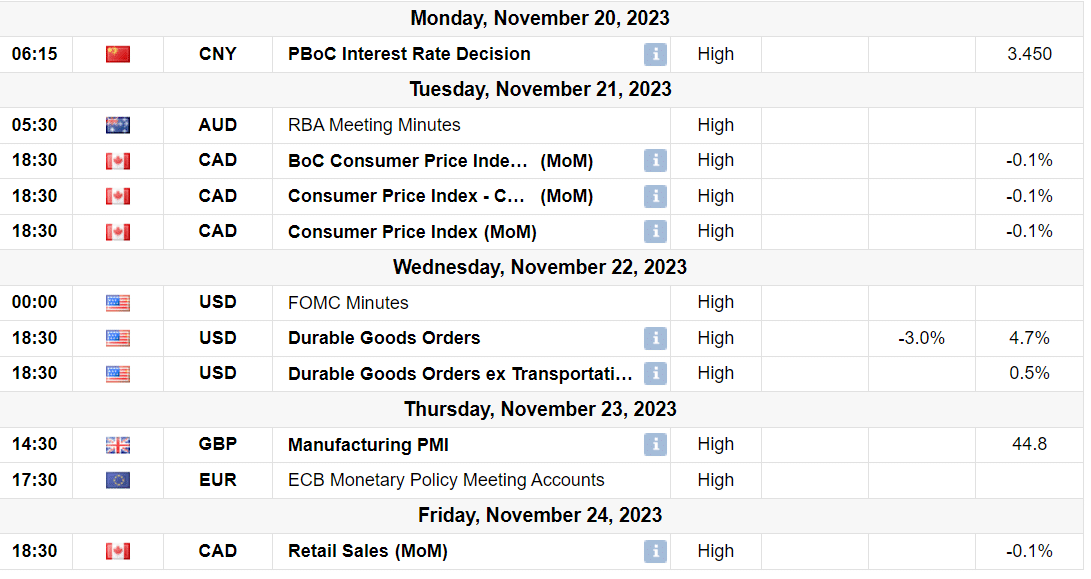

Gold key events next week

The Federal Reserve will release the minutes of its meeting on Tuesday, but market reactions are expected to be muted as the focus shifts to a potential Fed policy change in 2015.

Wednesday’s US economic document includes October durable goods orders and weekly initial jobless claims. The market’s response is likely to follow the usual pattern, with worse-than-forecast numbers weighing on the dollar and stronger supporting numbers.

US markets close on Thursday for the Thanksgiving holiday, followed by a half-day on Friday. Weak trading conditions may limit market response to preliminary S&P Global manufacturing and services PMI surveys for November.

Given current market trends, investors should closely monitor technical changes in KSAU/USD for potential opportunities.

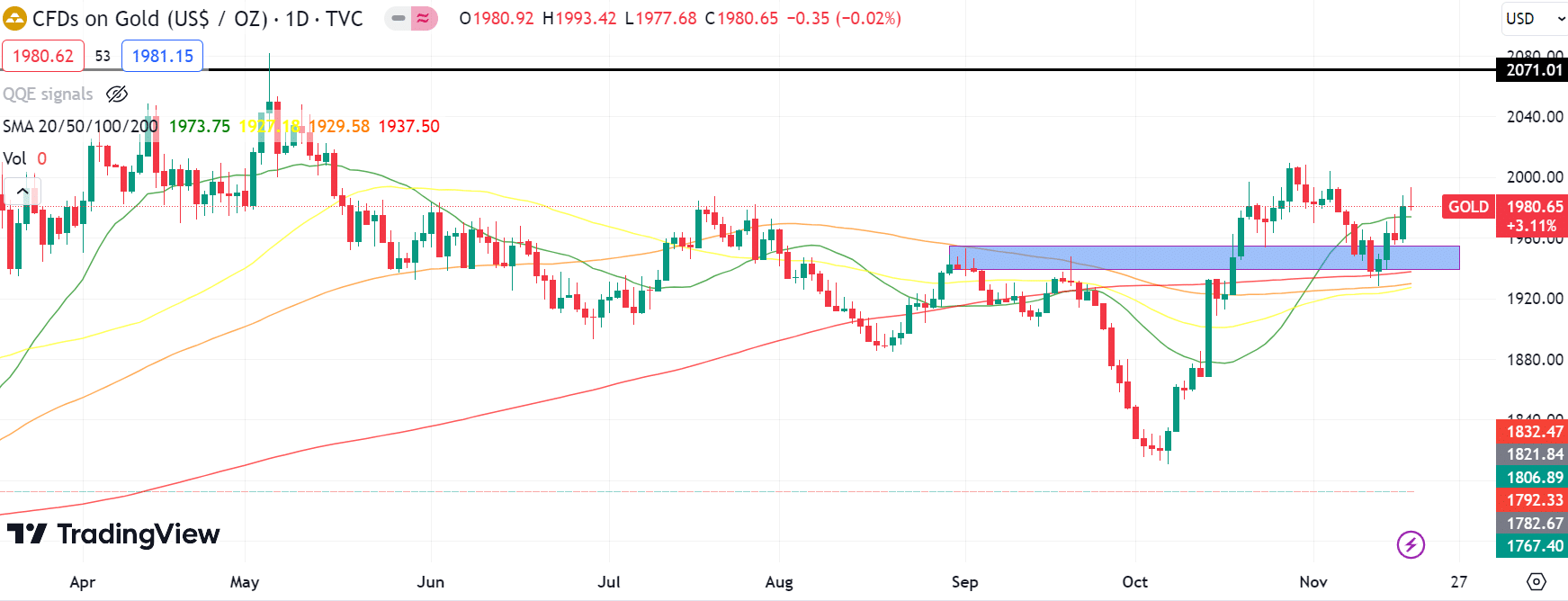

Gold weekly technical forecast: Buyers await pullback

The goldThe user’s daily chart shows the price slowly climbing to an all-time high of $2,075. Price maintains a good bid tone above key SMAs. However, Friday’s close suggests a slight correction to the downside amid profit-taking.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

So the metal can rally to buy traction when it falls into a demand zone. A zone break can attract sellers, changing the outlook to bearish.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.