- Investors believe the BoE’s first rate cut may not come until June.

- The upcoming BoE meeting next week is unlikely to result in any changes to UK rates.

- There was a moderate increase in the number of Americans filing new claims for unemployment benefits.

In Friday’s GBP/USD price analysis, a bearish tone prevails as the pound succumbs to a stronger dollar ahead of a key US jobs report. Investors are eagerly awaiting the release of US non-farm payrolls, eagerly looking for insights that could shed light on the Fed’s next policy decisions.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

A Reuters poll estimated that the unemployment rate in the US remained at 3.9 percent in November. On the other hand, nonfarm payrolls could rise to 180,000 from 150,000 in October.

Meanwhile, investor confidence in an early rate cut by major central banks is growing.

However, futures markets indicate that investors believe the BoE’s first rate cut may not come until June. At the same time, March cuts by the European Central Bank and the Federal Reserve are expected. This belief contributed to limited profit-taking in the pound’s November rally.

The upcoming BoE meeting next week is unlikely to result in any changes to UK rates. However, the market’s attention will be focused on the statement after the meeting.

Elsewhere, recent US data revealed a moderate increase in the number of Americans filing new claims for unemployment benefits. Consequently, this indicates a gradual loss of momentum in the labor market due to higher borrowing costs.

GBP/USD key events today

- Average hourly earnings in the US

- The change in US non-farm employment

- Unemployment rate in the US

- US consumer sentiment

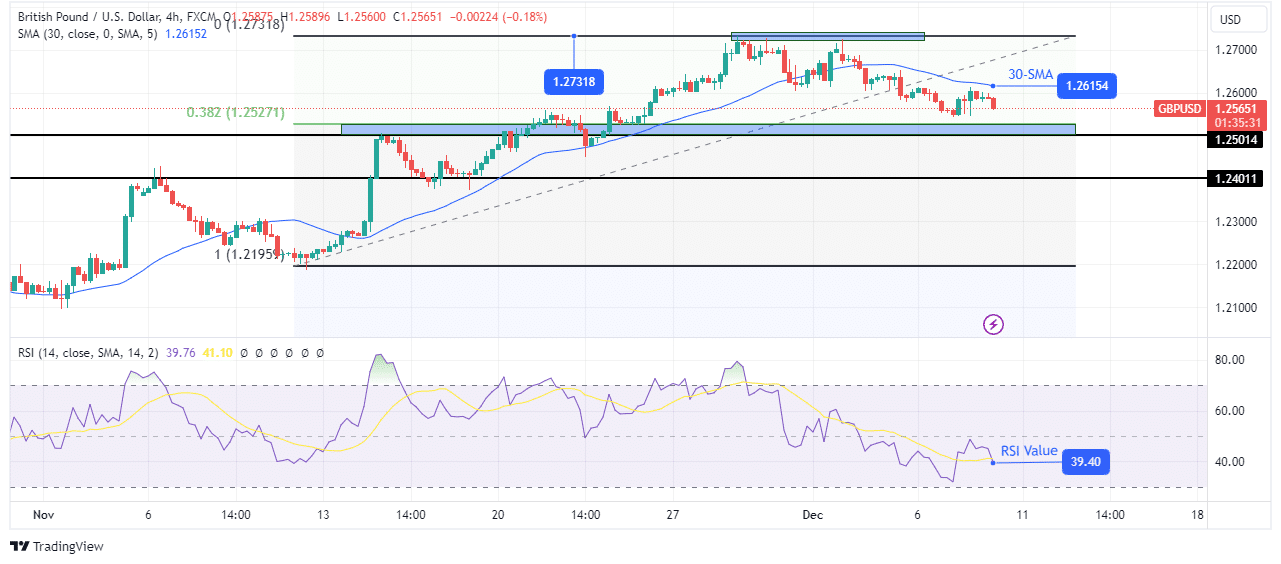

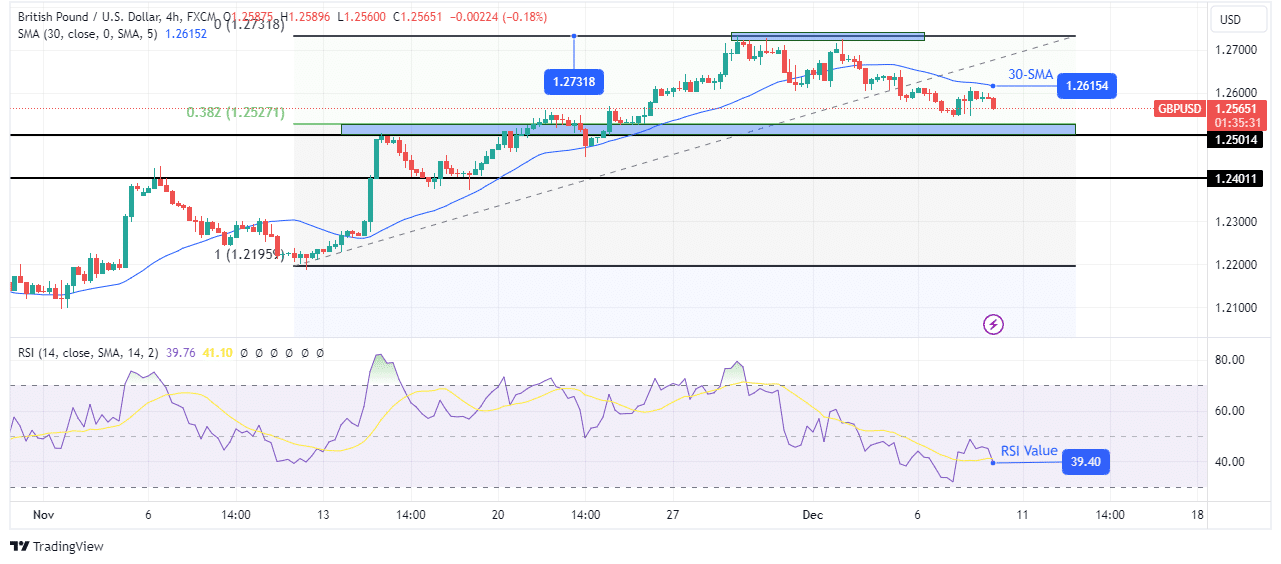

GBP/USD technical price analysis: Price is approaching a resistance support zone

Pound bears are finding their footing below the 30-SMA as a new bearish trend is slowly taking shape. GBP/USD was in a strong uptrend which was paused at the key level of 1.2731. At this point, the bears took control as they pushed the price below the 30-SMA.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Now the price is making lower lows and highs, indicating that the bears are leading the way. However, it will still face strong support levels that could stop the downtrend.

The price is approaching a strong support zone consisting of 0.382 fib retracement and 1.2501 key support levels. A break below this zone would allow the price to retest the key level of 1.2401. However, the bulls could continue the previous uptrend if the zone holds tight.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.