- The Fed’s Waller suggested the possibility of rate cuts in the coming months.

- The dollar fell more than 0.5% to 146.675 yen, its weakest point in more than two months.

- A key measure of Japan’s inflation trend accelerated to 2.2% in October.

The USD/JPI forecast showed a bearish bias entering the middle of the week, as the dollar fell to a three-month low. The drop came after Fed Governor Christopher Waller, a historically hawkish and influential figure at the central bank, on Tuesday suggested the possibility of a rate cut in the coming months. Consequently, this fueled market expectations that US interest rates had peaked. As a result, the dollar fell over 0.5% to 146.675 yen, its weakest point in more than two months.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

Kyle Rhoda, senior financial market analyst at Capital.com, noted Waller’s shift from a relatively hawkish stance to a more dovish one. Moreover, the change signaled a potential consensus among board members that rates may have peaked. Therefore, rate cuts could begin next year.

In particular, current market prices indicate a 40% chance that the Fed will start easing monetary policy as early as next March. It was up from roughly 22% the previous day.

Elsewhere, data on Tuesday revealed a key measure of Japan’s inflation trend accelerated to 2.2 percent in October, a new record high. That signals increasing pressure on prices and strengthens the case for the central bank to reduce its monetary stimulus. At the upcoming policy meeting on 18-19. In December, policymakers will consider this data, among other factors.

Notably, the Bank of Japan (BOJ) remains a global dovish side, maintaining ultra-loose policy. Meanwhile, other major central banks have aggressively raised interest rates to fight inflation.

USD/JPI Key Events Today

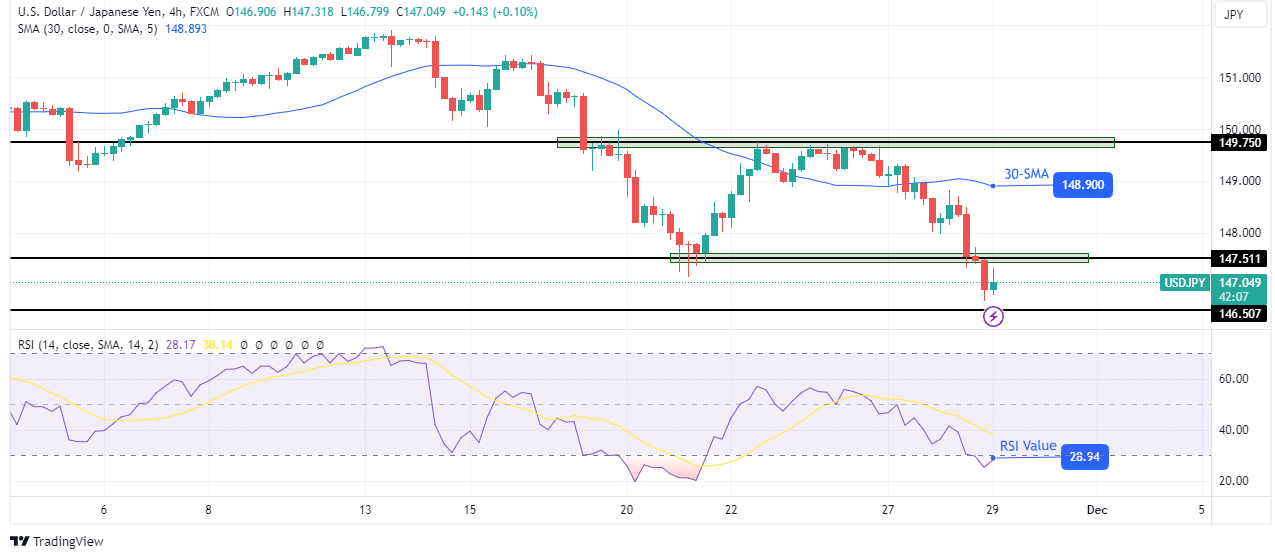

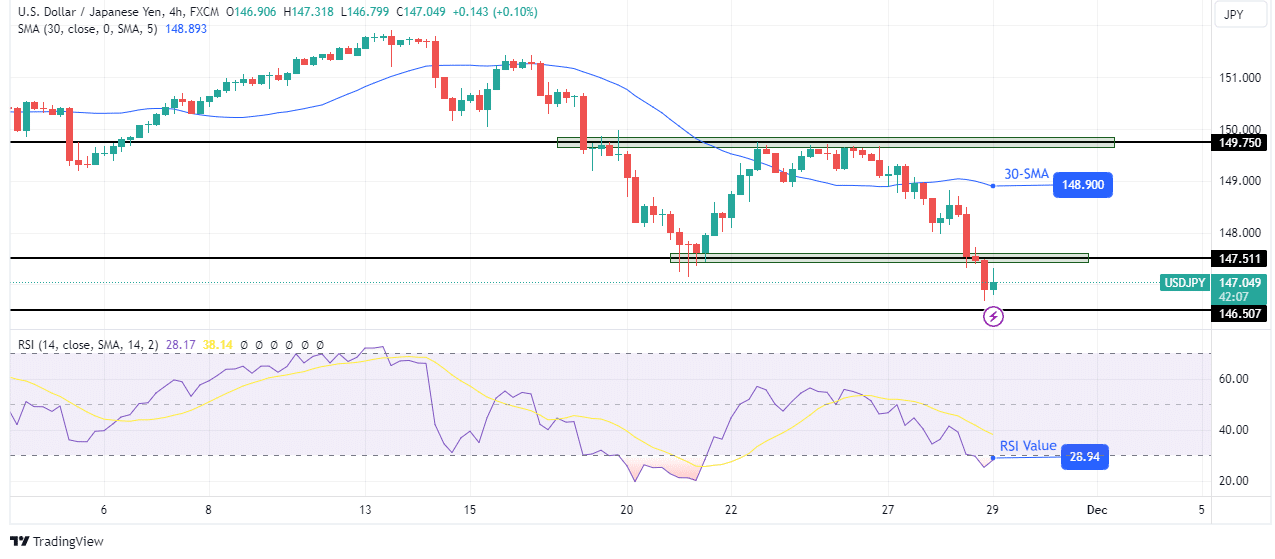

USD/JPI Technical Forecast: Price in freefall after falling resistance

On the technical side, the USD/JPI price fell after failing to break the 149.75 resistance level. Initially, the bulls tried to take control by pushing the price above the 30-SMA. However, the bears were waiting to continue the downtrend at the 149.75 level.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Bearish bias is strong, with price well below the 30-SMA and RSI in oversold territory. Furthermore, the price broke below the 147.51 level to make a lower low. Consequently, the downtrend is likely to continue, with bears targeting the next support level at 146.50.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.