- Investors awaited a key US jobs report later in the week.

- Canada added more jobs than expected last month, data showed.

- Canada’s manufacturing sector shrank in November.

There was a bullish change in the USD/CAD outlook on Monday. The dollar bounced back, even as investors took note of Fed Chairman Jerome Powell’s cautious remarks. Moreover, they awaited a key jobs report later in the week that could weigh on the outlook for US interest rates.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, the Canadian dollar jumped to a two-month high against the US dollar on Friday. The move followed positive domestic data that revealed the economy added more jobs than expected last month.

In November, employment in Canada rose by 24,900 jobs, beating economists’ expectations for an increase of 15,000. However, the number of working hours fell and the unemployment rate rose to 5.8%.

These jobs data added to positive sentiment around the Canadian dollar. In particular, the currency has already benefited from recent broad-based weakness in the US dollar.

In addition, the data showed that Canada’s manufacturing sector shrank in November as global industrial weakness weighed on output and new orders.

At the same time, the US dollar weakened against a basket of major currencies as Federal Reserve Chairman Jerome Powell warned of further interest rate adjustments. Moreover, the price of oil, a significant Canadian export, was lower by 2.5%. This drop was due to concerns over the latest round of OPEC+ production cuts in the market.

USD/CAD Key Events Today

The pair is likely to move sideways as there will be no key economic reports from Canada or the US.

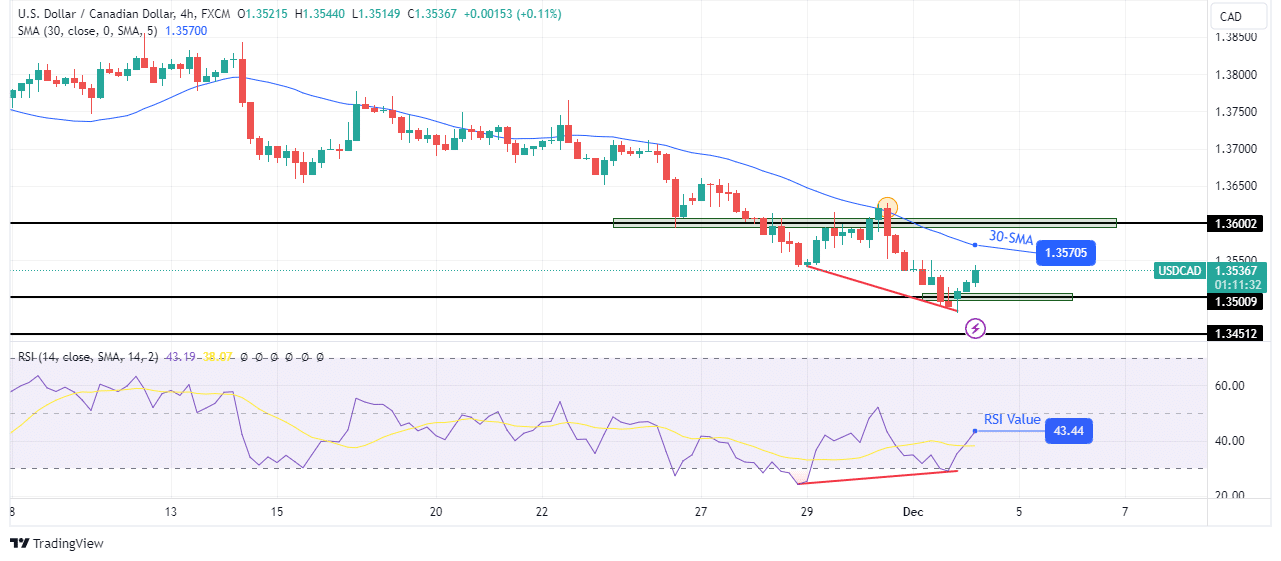

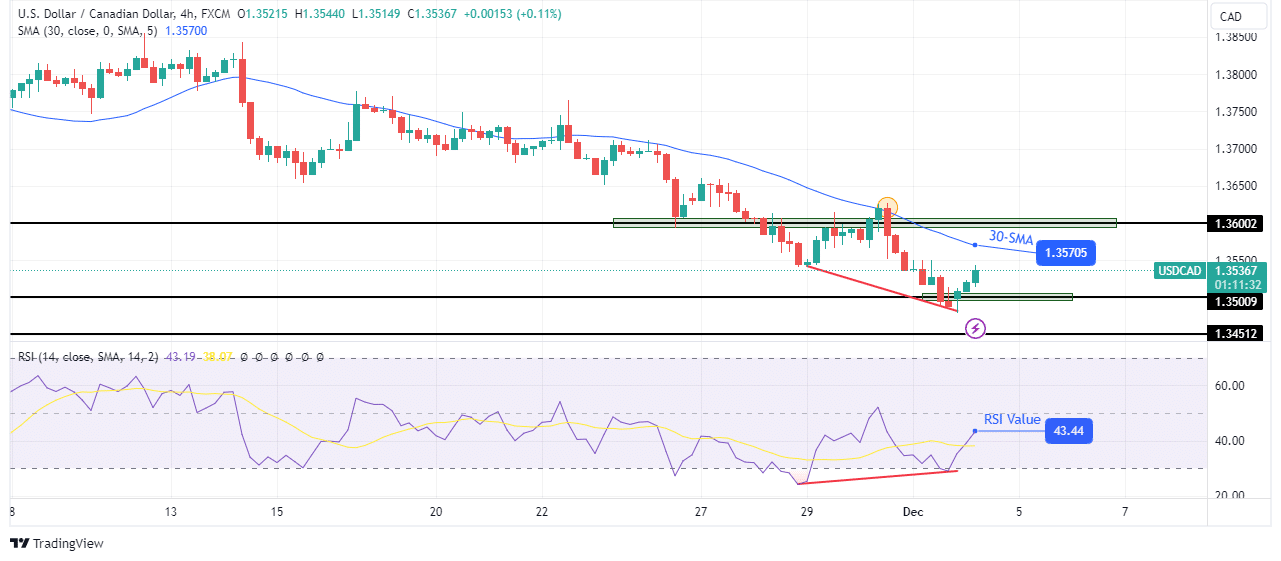

USD/CAD Technical Outlook: 1.3500 support triggers recovery

On the charts, the bias is bearish. However, the price recovers after respecting the key support level of 1.3500. The bears were in the lead for a long time, pushing the price to new lows. At the same time, the bulls continued to challenge the uptrend at the 30-SMA, but failed to push above.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

The downtrend has stalled at the key level of 1.3500, which is a new low in the decline. However, the RSI is showing weaker momentum at this level, which has allowed the bulls to emerge for a rebound. However, since the bearish bias is strong, the bulls could pause at the 30-SMA resistance, where the bears will continue to decline. A break below the key 1.3500 level would allow the price to retest the 1.3451 level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.