- Powell’s speech gave no indication of when the rate cuts would begin.

- Bank of America has revised its outlook and expects the first Fed tapering in December or later.

- Inflation in the Eurozone is on a clear path towards the 2% target.

A hint of bullish sentiment appears in the EUR/USD forecast as the dollar pulls back after a strong rally. Yet amid this glimmer of optimism, the euro bears are standing firm, and economic indicators are signaling further downward pressure.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

Notably, the dollar rose on Tuesday as Fed policymakers sounded more hawkish, dampening expectations of a rate cut. Investors paid close attention to Powell’s speech, which lacked any indication of when rate cuts would begin. Moreover, the chairman of the Federal Reserve said that the US needs a tight monetary policy a little longer.

These recent remarks followed the US retail sales report, which pointed to strong consumer spending. The incoming data completely changed the outlook for interest rates in the US. In particular, Bank of America revised its outlook and expects the first Fed tapering in December or later. At the same time, investors are betting on September for the start of rate cuts.

This is the exact opposite of the Eurozone. On Tuesday, ECB policymakers continued to support the first cut in June. Unlike the US, inflation in the Eurozone is on a clear path to the 2% target. Moreover, the economy is slowing down. So there is nothing holding the ECB back.

If the ECB cuts in June, it will be well ahead of the Fed. Moreover, market participants expect a reduction of 77 basis points in the Eurozone. This is much higher than the 40bps expected in the US. This divergence is likely to keep the EUR/USD pair in a strong downtrend.

EUR/USD key events today

Investors do not expect volatility today, as neither the US nor the Eurozone will release major economic reports.

EUR/USD Technical Forecast: Decline Halts as Bears Exhaust

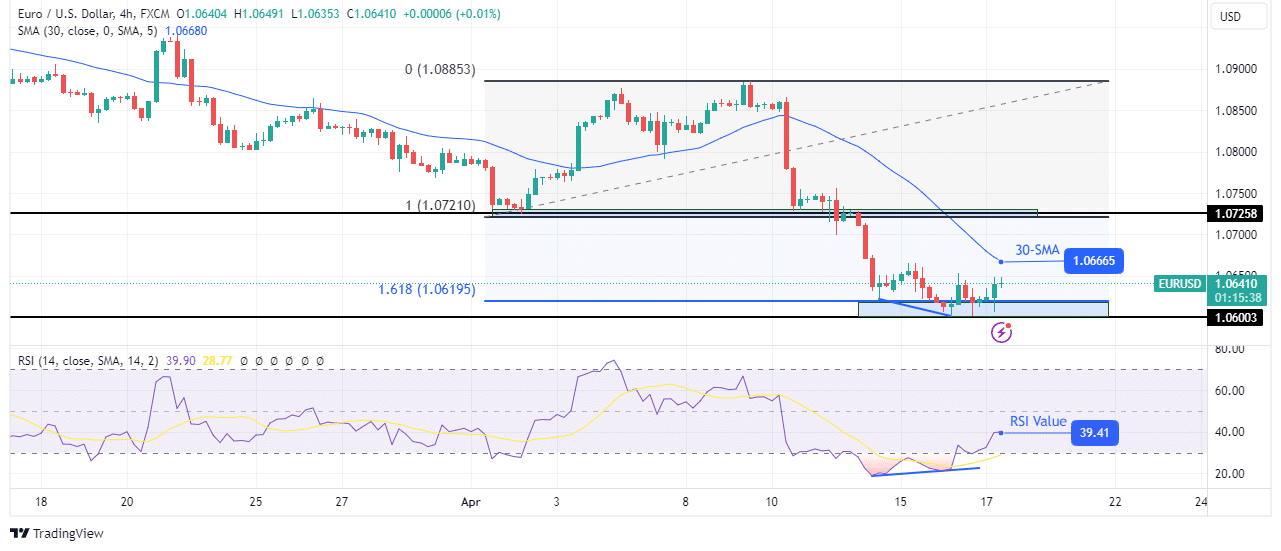

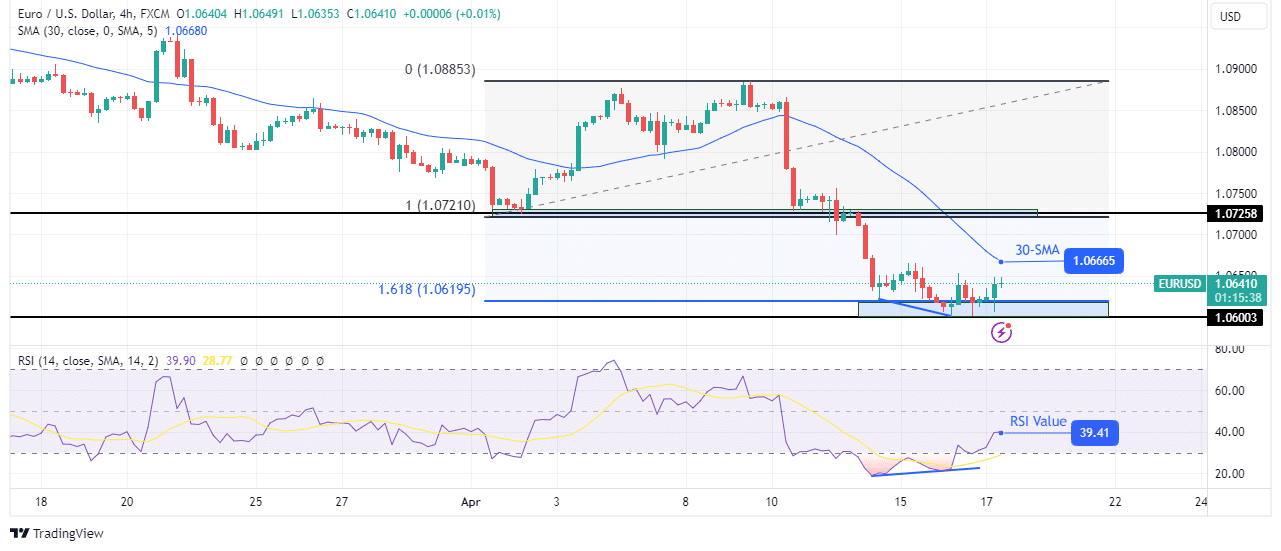

On the technical side, the bias for the EUR/USD pair is bearish. However, the decline was stopped at the main support zone consisting of the 1.618 Fib extension and 1.0600 key support levels.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

Furthermore, the RSI has shown a bullish divergence in the oversold region, indicating exhaustion in the downtrend. Therefore, there is a good chance that the bulls will encourage a retest of the 30-SMA. The price could even rise to retest the key 1.0600 level before continuing lower.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.