- EUR/USD outlook is slightly bullish after Fed caution.

- Powell insisted that the central bank needs more confidence to start cutting interest rates.

- Fabio Panetta said the ECB can continue to reduce borrowing costs.

The EUR/USD forecast is bullish as the dollar pulls back after gains in the previous session due to Powell’s cautious remarks. Meanwhile, ECB policymakers are calling for further rate cuts, which could put further pressure on the euro.

–Are you interested in learning more about Bitcoin price prediction? Check out our detailed guide-

Markets took Powell’s speech on Tuesday as cautious. However, there were dovish tones that mostly kept the reduced rate bets steady. The recent jobs report raised market expectations that the Fed will cut rates in September. Therefore, investors expected a similar reaction from the Fed.

Unfortunately, Powell insisted that the central bank needs more confidence to start cutting interest rates. Policymakers decided to wait until the last minute to call for a rate cut. The last time inflation showed signs of easing, it reversed after most officials took a more dovish stance. So they had to change their tone. To avoid another such outcome, the Fed will wait for more data to gain confidence that inflation will fall to its 2% target.

The next big report will be released on Thursday. The US will release data on consumer inflation that could point to further easing of price pressures. Economists expect the annual figure to decrease to 3.3%. Meanwhile, the monthly figure could increase slightly to 0.1%.

Elsewhere, ECB policymakers are calling for further rate cuts as inflation approaches the central bank’s target. Fabio Panetta said the ECB can continue to reduce borrowing costs as inflation remains in line with the central bank’s expectations. Moreover, since interest rates remain high, they will eventually reduce stubborn services inflation.

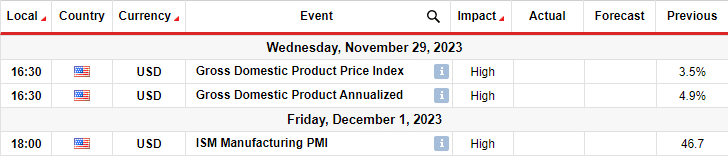

EUR/USD key events today

- Testimony of Fed Chairman Powell

EUR/USD Technical Forecast: Price is preparing to bounce higher after retesting the SMA

On the technical side, the EUR/USD price has found support at the 30-SMA line and could bounce higher. The pair was in a bullish trend as it found solid support at the 1.0675 level. An uptrend means that the SMA acts as support and the price bounces higher each time it retests the level.

–Are you interested in learning more about crypto robots? Check out our detailed guide-

Therefore, if the trend remains strong, the price may soon challenge resistance at 1.0850 for a new high. However, if the bears gain momentum, the price will break below the SMA to retest support levels such as the trendline and the 1.0750 level.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.