- Market participants are focused on the Fed’s policy meeting.

- Markets expect the Fed to cut rates by a total of 73 basis points this year.

- The ECB’s Martins Kazaks said he supported market expectations for three cuts in 2024.

Today’s EUR/USD forecast paints a bearish picture as the dollar flexes its muscles in anticipation of the upcoming FOMC policy meeting. Meanwhile, ECB policymakers are getting more comfortable with market expectations of interest rate cuts, weakening the euro.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

Market participants are focused on the Fed’s policy meeting, which ends later in the day. The Fed is likely to keep rates at current levels, but the focus will be on the press conference and economic projections.

Investors are eager to hear what policymakers have to say about recent inflation data. Powell’s press conference could shed some light on the outlook for a rate cut in 2024, which has changed significantly since the start of the year. At this point, markets expect the Fed to cut rates by a total of 73 bps this year. This is a big drop from 150 basis points at the beginning of the year. If policymakers take a more hawkish tone, this number could drop further. Furthermore, investors could raise expectations for the first rate cut by July.

On the other hand, European Central Bank policy makers are ready for the first rate cut in June. In particular, ECB policymaker Martins Kazaks said on Tuesday that he supported market expectations for three cuts in 2024.

The outlook for interest rate cuts appears to be much clearer in the Eurozone than in the US. While ECB policymakers are poised for cuts, Fed policymakers may remain cautious amid high inflation. Accordingly, EUR/USD could see further declines.

EUR/USD key events today

- Federal funds rate

- Economic projections of the FOMC

- FOMC statement

- FOMC press conference

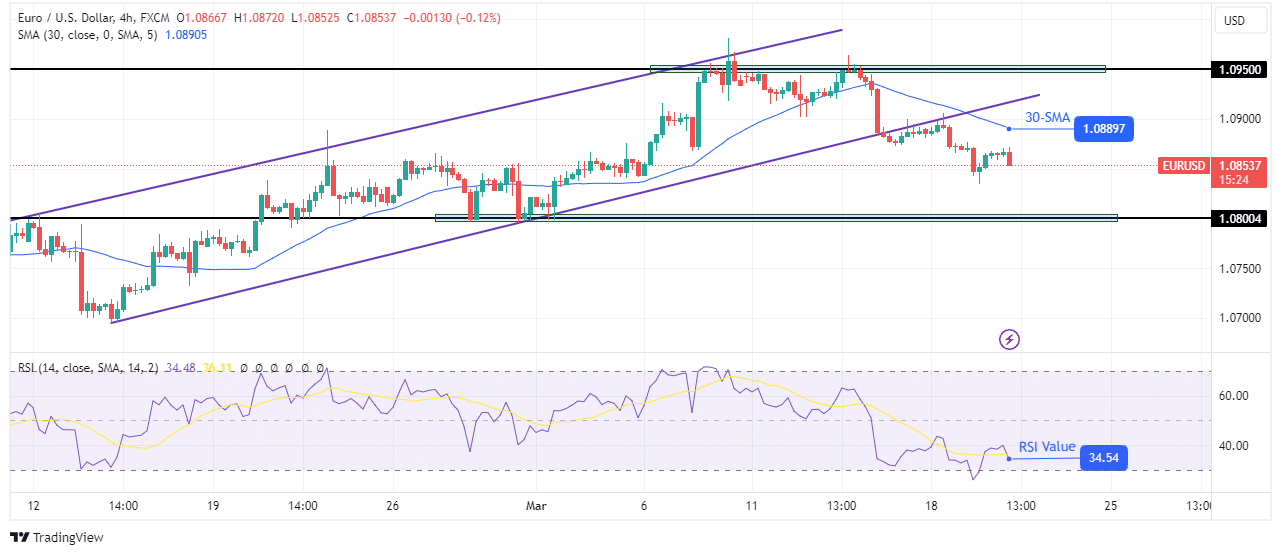

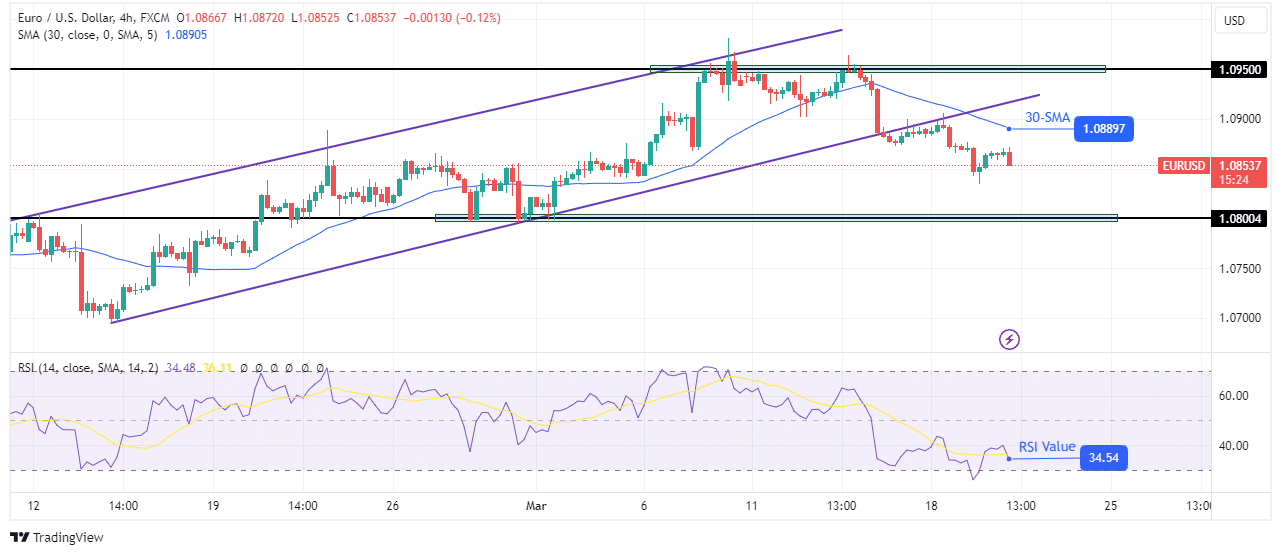

EUR/USD Technical Forecast: Channel Breakout

On the charts, the EUR/USD trend has reversed from bullish to bearish. The bears confirmed the new direction when they broke out of their bullish channel. Moreover, the price retested the channel support before making lower lows.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

At the same time, the 30-SMA is now looking down, showing a downtrend. Meanwhile, the RSI is trading in bearish territory below 50, indicating solid bearish momentum. The price was poised for a reversal when it hit the 1.0950 barrier. It made a double top before breaking below the SMA and bullish channel. Given the strong bearish bias, the price may soon retest the key support level of 1.0800.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.