- The dollar weakened after a two-day rally as investors took profits.

- The dollar’s recent rally began when the US released upbeat employment data.

- Traders estimate a 21.5% probability that the Fed will cut rates in March.

The EUR/USD forecast was bullish as the dollar weakened after a two-day rally with investors taking profits. However, analysts believe that the dollar’s pullback is only technical as the price returns to the recent rally. Notably, fundamentals continue to support a stronger dollar.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

The dollar’s recent rally began when the US released upbeat employment data. The numbers were much higher than expected, indicating a strong labor market. Accordingly, the dollar rose as bets on a Fed rate cut fell. Furthermore, the jobs report revealed the fact that the US economy still needs high rates to cool demand.

Moreover, Powell boosted the dollar with comments that dampened hopes for a March rate cut. He said there is still no clear evidence that inflation will consistently fall to the 2 percent target. Therefore, the Fed is unlikely to be in a hurry to cut interest rates.

Currently, traders are placing a 21.5% probability that the Fed will cut rates in March. This is down significantly from the 68.1% probability when the year started.

Meanwhile, policymakers are also playing down expectations of a rate cut in the eurozone. The ECB’s Isabelle Schnabel called for patience on interest rate cuts. According to her, the ECB should slowly reduce interest rates because there is a chance that inflation will flare up. Moreover, tensions in the Red Sea could lead to a spike in oil prices which could increase inflation.

EUR/USD key events today

The pair is likely to drift as there will be no major releases from the Eurozone or the US.

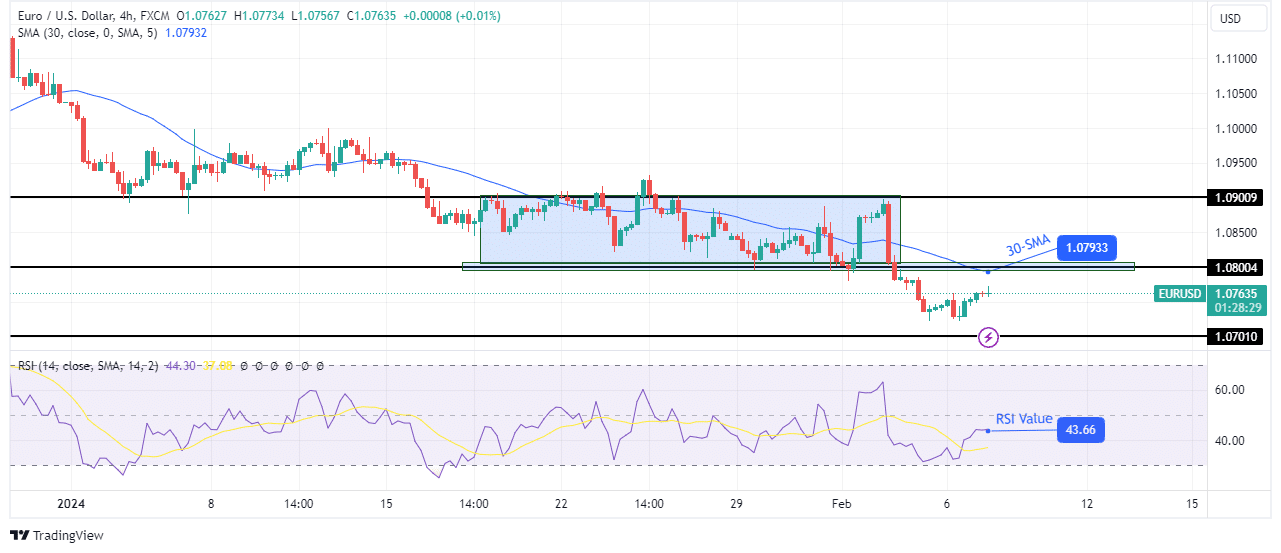

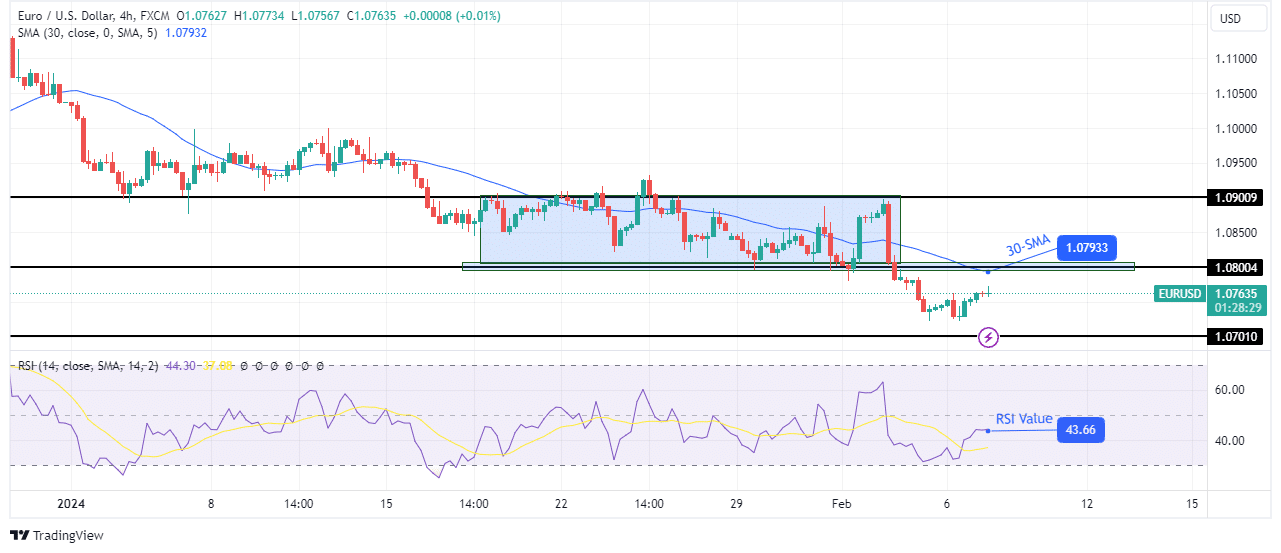

EUR/USD Technical Forecast: Price breaks below 1.0800 support, ending consolidation

On the charts, the EUR/USD price finally broke below the 1.0800 support level, ending the period of consolidation. As a result, the price made a lower low, indicating a continuation of the bearish trend. At the same time, the RSI made a new run near the oversold level, showing solid bearish momentum.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

However, the decline was halted, allowing the price to retrace its recent move. Given the bearish bias, it is likely to respect the 30-SMA and 1.0800 resistance levels and bounce lower for a new low. The next target for the downtrend is support at 1.0701.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money