- The US released data showing a slowdown in services growth.

- The non-manufacturing PMI fell from 52.6 in February to 51.4 last month.

- Eurozone inflation fell to 2.4% in March from 2.6% the previous month.

EUR/USD forecast finds bulls leading as dollar falters on signs of easing inflation. Furthermore, the EUR/USD pair gained despite heightened expectations of a rate cut in the Eurozone.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

On Wednesday, the US released data showing a slowdown in services growth. This is a relief for the Fed as it indicates moderation in inflation. Consequently, investors have increased bets that the central bank will start cutting interest rates in June.

The non-manufacturing PMI fell from 52.6 in February to 51.4 last month. Although the sector is still expanding, it has slowed down. Inflation in the services sector has been a major pain point for most central banks. Although headline inflation has moderated significantly, service inflation is falling at a much slower pace as demand remains high.

On Friday, the US will release the non-farm payrolls report, which shows the state of employment. This report will heavily influence rate cut bets if it falls below or above the forecast.

In the eurozone, data on Wednesday revealed a big drop in headline and core inflation. In March, inflation fell to 2.4% from 2.6% the previous month. This gives the European Central Bank enough reason to start cutting interest rates in June. However, analysts believe some policymakers will remain cautious as services inflation remains high at 4%.

EUR/USD key events today

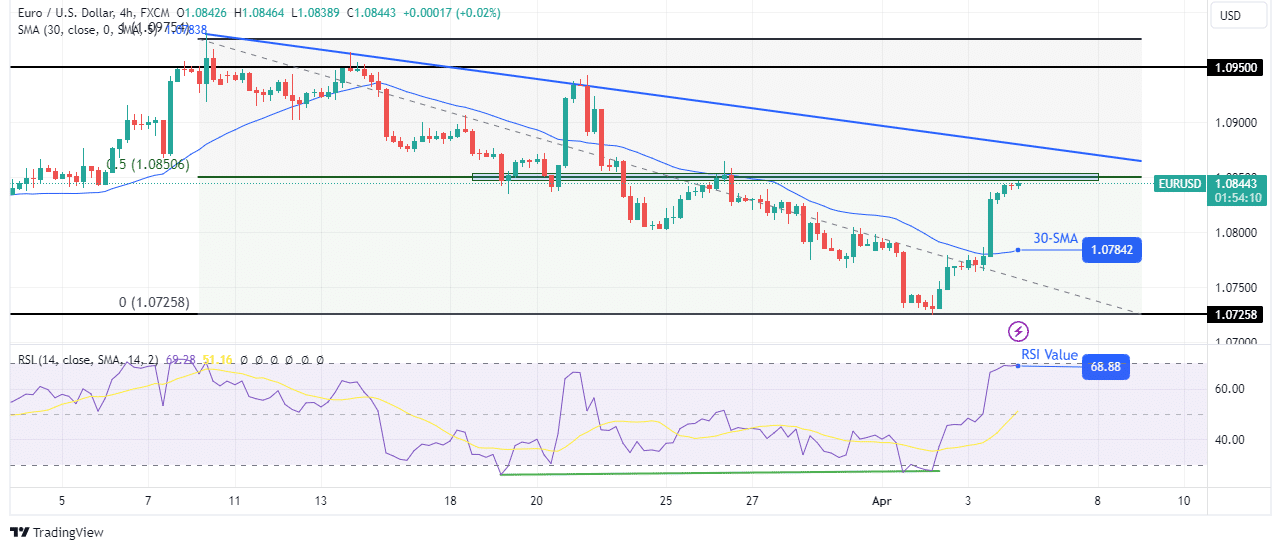

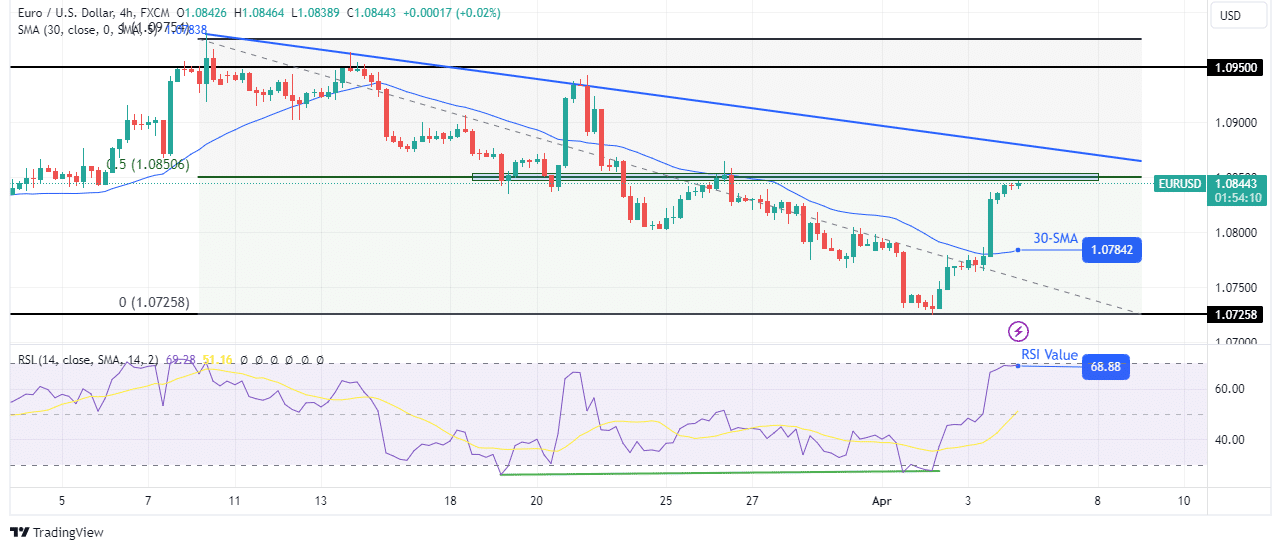

EUR/USD Technical Forecast: Bulls take the lead with solid momentum

On the technical side, the EUR/USD price rose sharply, breaking above the 30-SMA. This growth led to a change in sentiment from bearish to bullish. Moreover, there was a build-up of bullish momentum when the RSI rose to trade just below the overbought region. The change came after the RSI made a slight bullish divergence.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

However, the price is approaching a strong barrier consisting of the 0.5 Fib level and the key resistance at 1.0850. In addition, there is a resistance trend line above this area that could stop a bullish move. If the price pauses, it could pull back to retest the 30-SMA support. However, if bullish momentum builds, it could break through these resistance levels to make new highs and confirm a bullish reversal.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.