- The European Central Bank is poised to maintain historically high borrowing costs.

- Investor expectations point to a possible ECB rate cut in the spring.

- The Fed recently signaled lower borrowing costs in the US.

On Thursday, growth in the EUR/USD outlook continued, supported by the Federal Reserve and in anticipation of the upcoming European Central Bank (ECB) meeting. Looking ahead, the ECB is expected to maintain historically high borrowing costs, reinforcing positive sentiment around the currency pair.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

But President Christine Lagarde is facing pressure to defend or abandon her guidance to keep rates unchanged for the next few quarters. Meanwhile, investor expectations point to a possible rate cut in the spring. Consequently, such a move would position the ECB as the first major central bank to reverse course on interest rate hikes.

Still, Lagarde is likely to resist speculation of a rate cut, especially after a year and a half and ten consecutive hikes aimed at reducing inflation. On the other hand, yesterday’s Fed meeting signaled lower borrowing costs ahead, suggesting up to three cuts. This makes any resistance from the ECB difficult.

After the Fed’s dovish comments, the euro gained over 1% against the dollar, and expectations for a rate cut rose. Currently, markets are pricing in 155 basis points of ECB easing next year, including two moves through April.

This price is in line with expectations for the Fed to make two moves by May 1, with 155 basis points from 2024. Moreover, updated economic projections are likely to bolster expectations of an ECB turnaround, as they are expected to reveal lower inflation and growth, particularly for the following years.

EUR/USD key events today

- retail in the US

- First jobless claims in the US

- ECB policy meeting

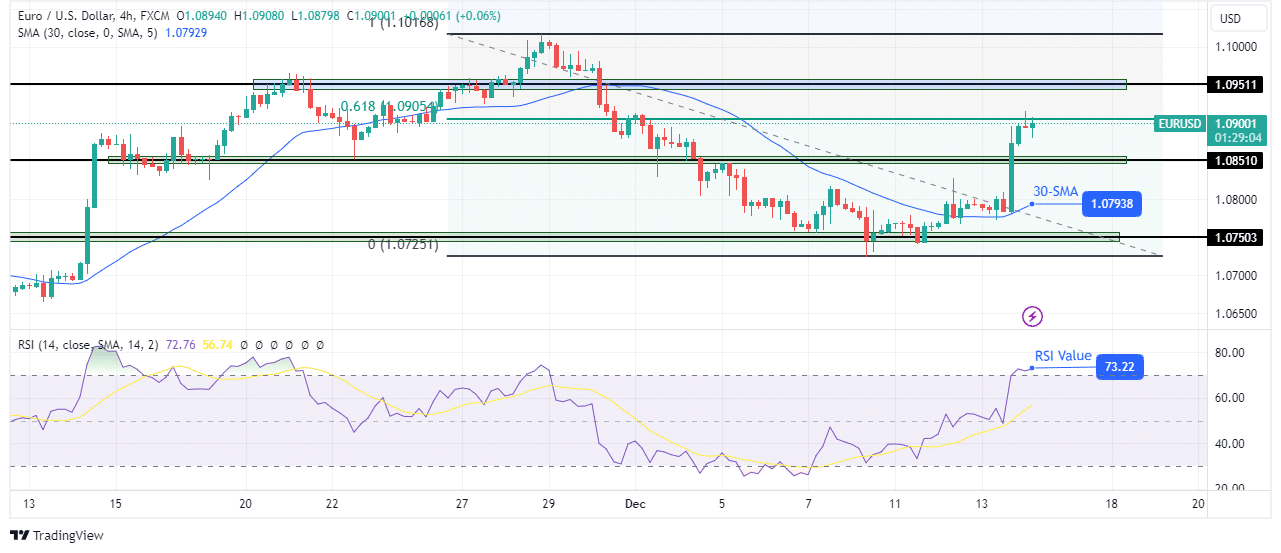

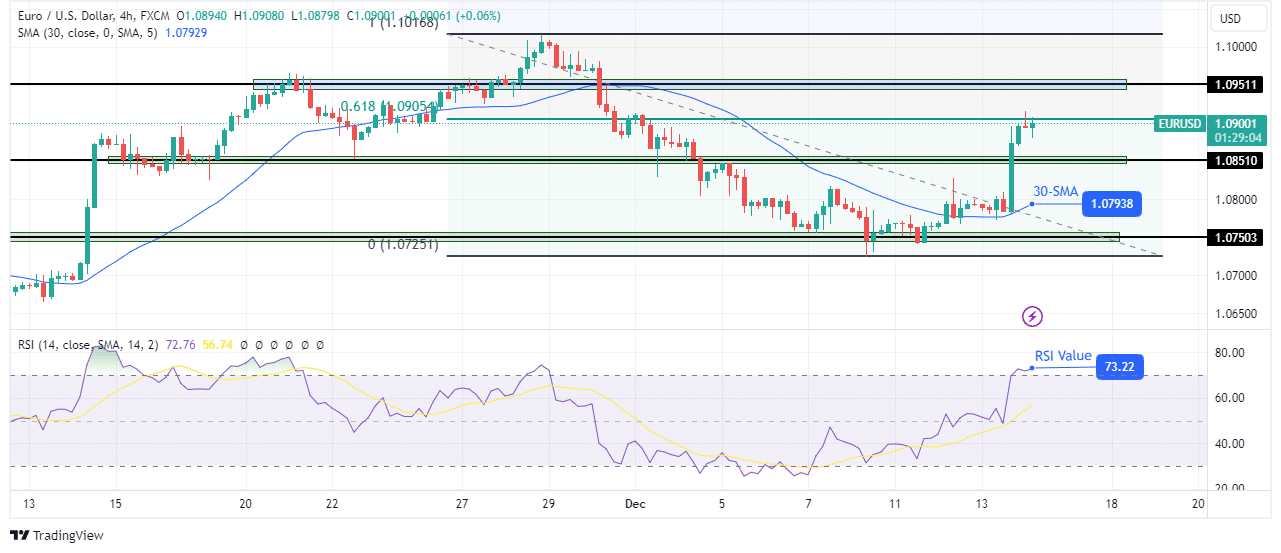

EUR/USD Technical Outlook: A pullback is looming as buyers face strong resistance

The bias for EUR/USD on the charts is bullish. This change in sentiment occurred recently when the downtrend found strong support at the key 1.0750 level. Consequently, the bears weakened as the price started to move sideways before breaking above the 30-SMA resistance. After pulling back to retest the SMA, the price bounced back with a strong bullish candle, breaking the key level of 1.0851.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

However, the recent bullish move is a reversal of the previous bearish trend. Moreover, the price has returned to the key level of 0.618 fib. The bullish move could pause at this level to retest 1.0851 before the bullish move resumes.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.