- Investors are eagerly awaiting Wednesday’s FOMC policy meeting.

- The US PCE price index on Friday revealed high housing and utility prices.

- ECB policymakers remain confident that inflation is on a clear path to the 2% target.

The EUR/USD outlook is bearish as the dollar strengthens in anticipation of the upcoming FOMC policy meeting. Meanwhile, the euro faces pressure as ECB policymakers express confidence in the eurozone’s fight against inflation.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

The Eurozone CPI recorded a growth of 2.7% compared to the expected 2.6%. This event gave the euro a slight respite, with the main focus on how the US dollar reacts to events such as the FOMC and NFP this week.

Investors are eagerly awaiting Wednesday’s FOMC policy meeting for more clues on the Fed’s rate cut prospects. In particular, markets expect the central bank to keep rates where they are currently. Moreover, policymakers may be hawkish after recent data revealed continued economic strength and persistent inflation. The PCE price index on Friday revealed strong housing and utility prices after a series of better-than-expected reports. Therefore, the Fed could continue to hold interest rates higher for longer.

Meanwhile, eurozone policymakers remain confident that inflation is on a clear path to the 2% target. The ECB’s Klaas Knott said inflation is steadily falling, giving him confidence that the central bank will start cutting interest rates in June. Moreover, he noted that geopolitical tensions pose only a small risk to progress in lowering inflation. However, he remained cautious about cutting rates after the June meeting.

Policymakers will wait to see the effects of the recent increase in oil prices. In addition, the ever-changing Fed policy will shape what the ECB does after June. Too much divergence with the Fed could lead to a weaker currency and higher import prices. This, in turn, could increase inflation in the Eurozone.

EUR/USD key events today

- US Employment Cost Index

- US CB Consumer Confidence

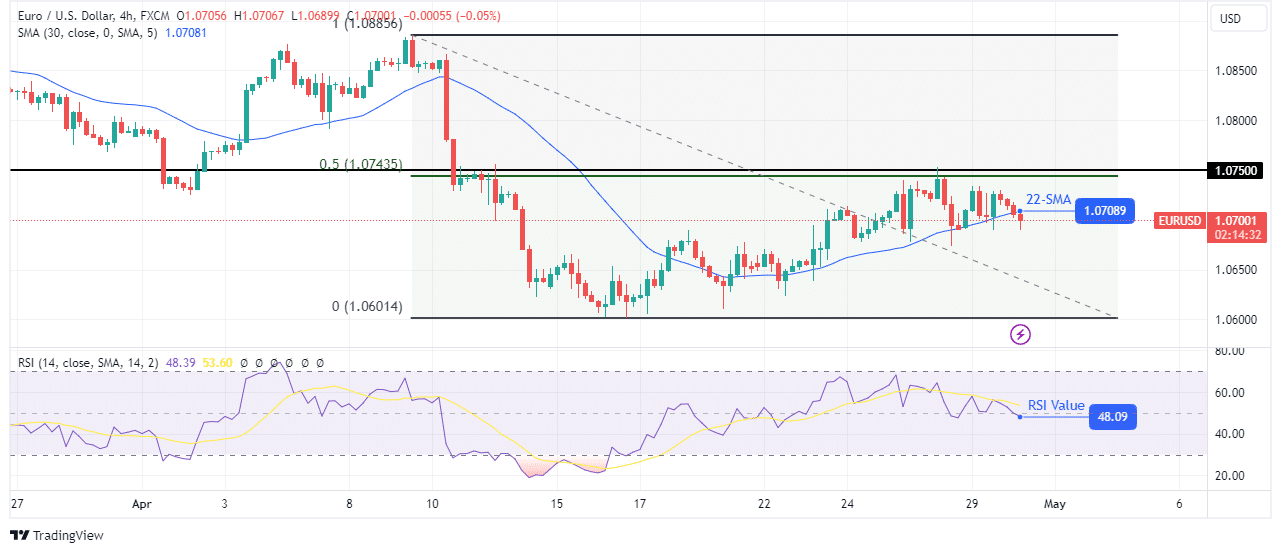

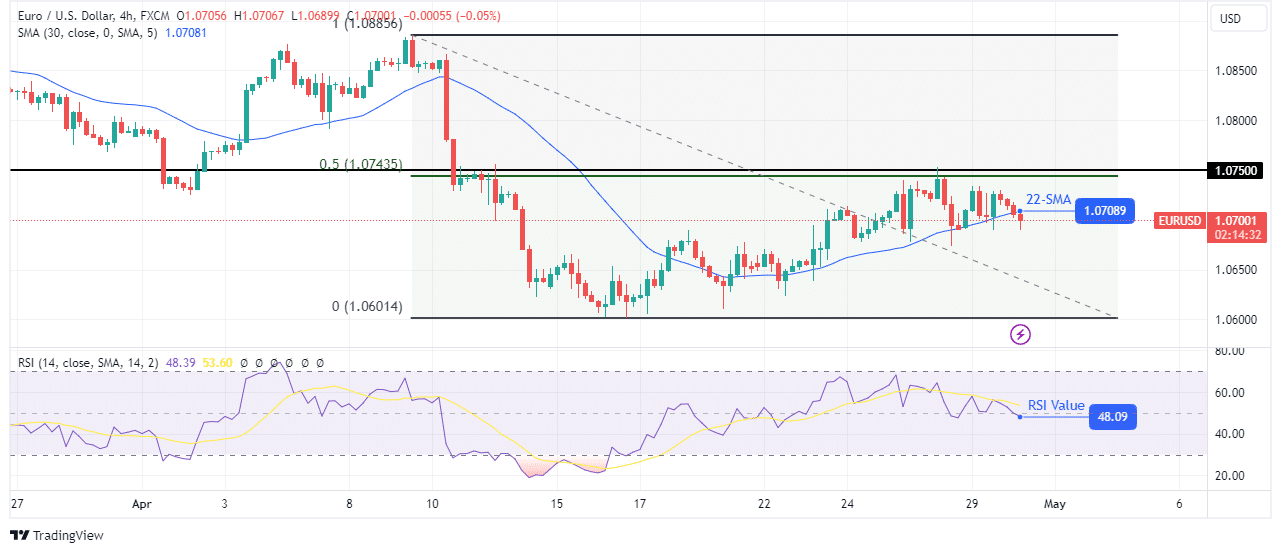

EUR/USD Technical Outlook: Bears challenge uptrend at 30-SMA

On the technical side, the EUR/USD price is on the verge of breaking below the 30-SMA. At the same time, the RSI is trading below 50, showing increased bearish momentum. Bears are challenging the uptrend, which stalled at the 0.5 Fib retracement level.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

The previous bearish move was impulsive and stopped at the key level of 1.0601. At this point, the bulls have taken over, pushing the price above the 30-SMA. However, the uptrend was shallow and the price remained close to the SMA. So it was a corrective move. If the bears break below the SMA, the price could make another impulsive move to retest 1.0601.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.