- The dollar rose on Friday on a positive jobs report.

- The US reported an additional 303,000 jobs in March and a drop in the unemployment rate.

- The European Central Bank will meet on Thursday this week.

An early session drop pointed to a bearish outlook for EUR/USD, with the greenback standing firm in anticipation of this week’s inflation data. At the same time, investors were preparing for the European Central Bank meeting later in the week.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

The dollar rose on Friday on a positive jobs report. However, it ended lower last week after mixed data. Meanwhile, bets on a rate cut fluctuated as investors kept adjusting to incoming data.

Data on service activity in the US at the beginning of last week gave the impression that the economy is slowing down. Consequently, traders thought it would also reduce inflation. However, this view changed when the US reported an additional 303,000 jobs in March and a drop in the unemployment rate. It was a sign that the demand in the labor market is still high.

Therefore, there is a greater risk that inflation will rise if the Fed starts cutting interest rates too soon. Investors will now focus on inflation data due on Wednesday. A warmer-than-expected report would likely lead to a better outlook for the Fed.

The European Central Bank will meet on Thursday this week. Traders expect the central bank to keep rates on hold and signal the first cut in June. Unlike the Fed, ECB policymakers are more confident that inflation is moving towards the 2% target. This increases the chance that the ECB will cut rates before the Fed.

EUR/USD key events today

It will be a slow start to the week for the EUR/USD pair as neither the Eurozone nor the US will release any key reports.

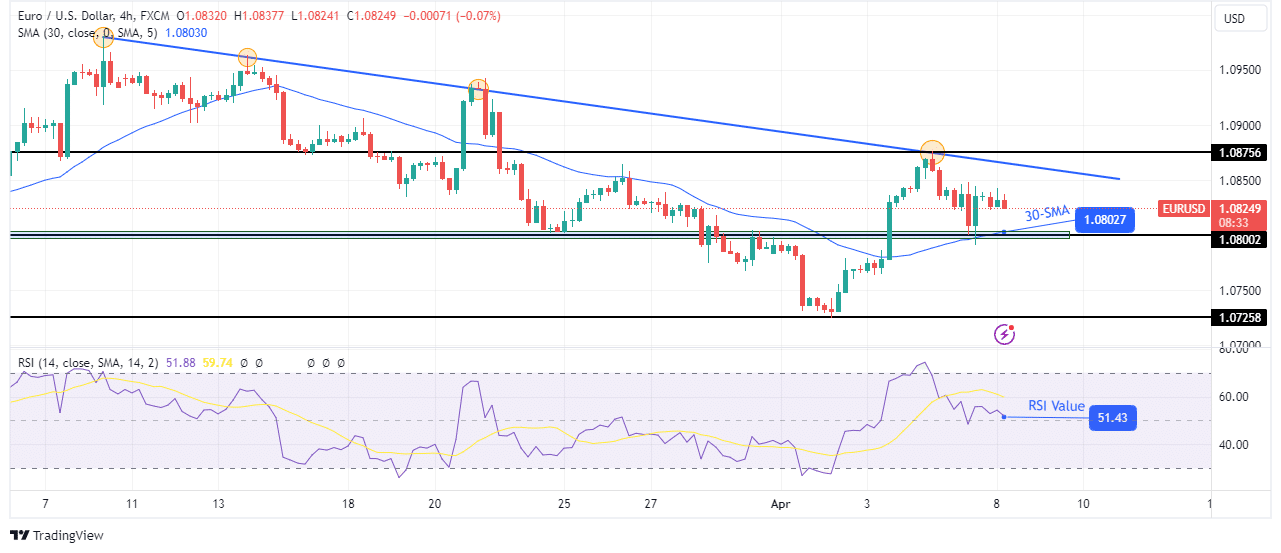

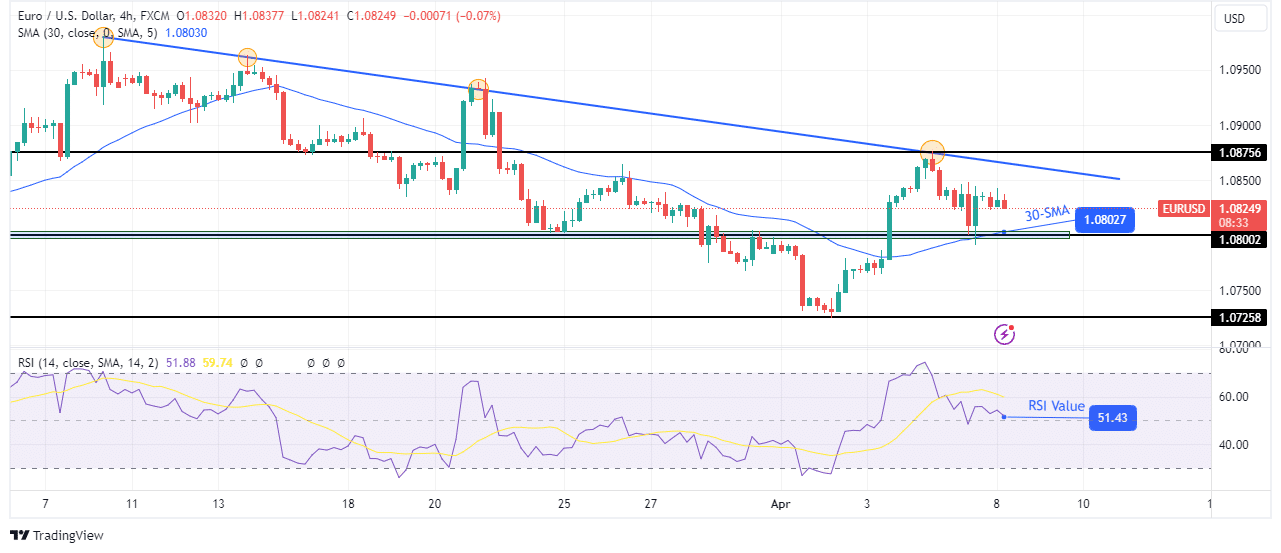

Technical Outlook EUR/USD: The price is pulling back from the trend barrier

On the charts, the EUR/USD price is falling after meeting a strong trendline resistance at the 1.0875 level. However, indicators on the chart indicate a bullish bias. The 30-SMA points up and is below the price, indicating an uptrend. At the same time, the RSI is trading above 50 in bullish territory.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Therefore, if the price respects the SMA as support, it will rise to retest the resistance trend line. On the other hand, if the bears are ready to take over, the price will break below the SMA and key support at 1.0800.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.