- Investors eagerly awaited the US GDP report.

- The ECB is likely to keep rates steady.

- Markets are currently pointing to a 43% probability of a Fed rate cut in March, down significantly from 88% a month ago.

The EUR/USD outlook was modestly bullish on Thursday, with the pair showing strength ahead of a key European Central Bank policy meeting. In addition, there was anticipation of the US GDP report, which could provide clues about the potential direction of US interest rates.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The ECB is likely to keep rates steady. However, investors will pay attention to the strength of official resistance to expectations of interest rate cuts. Market participants expect a 130 basis point cut from the ECB throughout the year. The ECB concluded its fastest cycle of interest rate hikes in September. However, policymakers say discussions about rate cuts are premature.

Meanwhile, markets expect the Fed to maintain its current stance in the US next week. However, the focus will be on Chairman Jerome Powell’s comments. Markets are currently pointing to the likelihood of a 43% cut in March, down significantly from 88% a month ago. At the same time, traders are cutting prices by 134 basis points this year, down from 160 basis points at the end of 2023.

The dollar is up roughly 2% this month as traders significantly cut expectations for an early and significant rate cut from the Fed. This change followed hawkish remarks from policy makers. Moreover, recent data have highlighted the resilience of the US economy.

Namely, Wednesday’s data revealed an increase in business activity in the US, accompanied by a decrease in inflation. The prices companies charge for their products have fallen to their lowest level in 3 1/2 years.

EUR/USD key events today

- ECB monetary policy meeting

- US Gross Domestic Product

- First jobless claims in the US

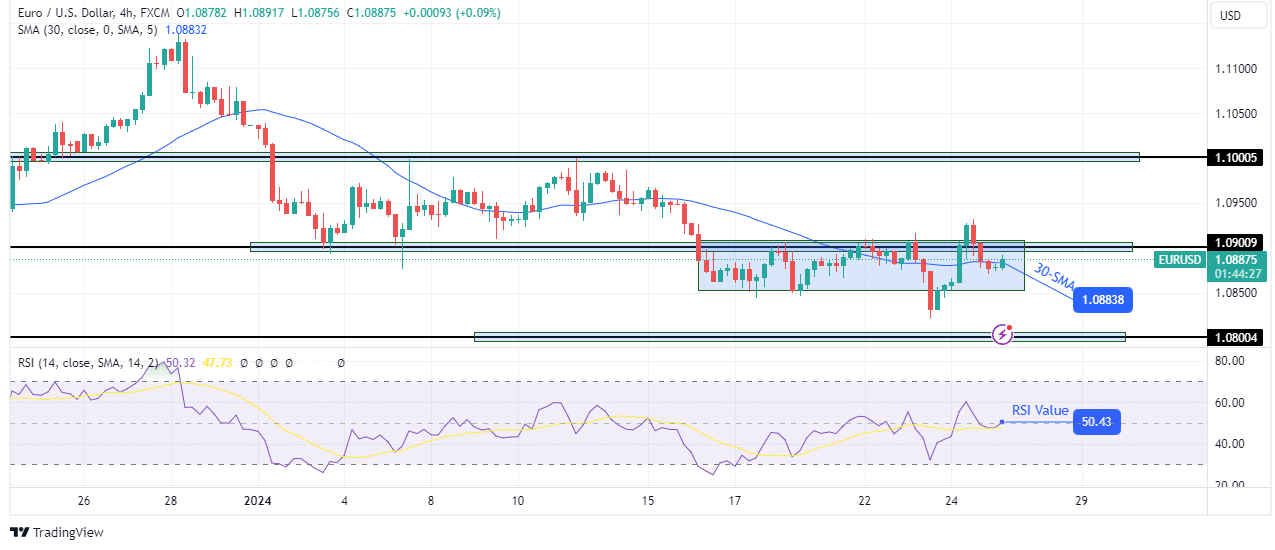

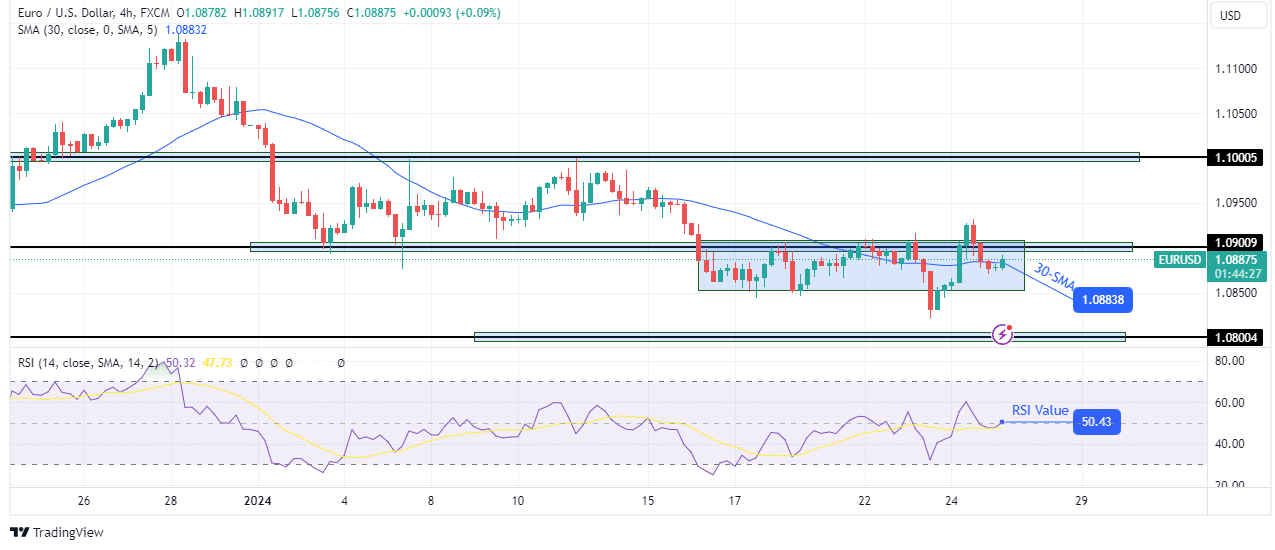

Technical Outlook EUR/USD: Sideways near 1.0900

The pair is moving sideways on the charts, caught near the key 1.0900 level. Price is moving through the 30-SMA, showing the market is in a range. However, the larger scale shows that the trend is bearish as the price makes lower lows and highs. Moreover, the price makes consistent impulses and corrective moves.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Currently EUR/USD is in a corrective move. Given the bearish bias on a larger scale, the next move could be a bearish impulse leg. Consequently, the price may soon fall to the 1.0800 support.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.