- The ECB’s Francois Villeroy said the central bank should not wait too long before starting to cut interest rates.

- The fall in US retail sales in January is larger than expected.

- Markets expect a rate cut of 94 basis points in 2024.

The EUR/USD outlook took a bullish turn, boosted by a somewhat dovish commentary from ECB policymaker Francois Villeneuve. Furthermore, the dollar was weak after falling sharply in the previous session due to poor sales data.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

On Friday, the ECB’s Francois Villeroy said the central bank should not wait too long before starting to cut interest rates. According to him, it would be better to start early and cut back gradually than to wait too long and aggressively.

Meanwhile, ECB President Christine Lagarde sounded more hawkish on Thursday. According to her, the central bank is likely to refrain from reducing interest rates in order to avoid prolonging high inflation. It is noticeable that inflation in the Eurozone is decreasing. However, most policymakers need more confirmation that it will not start rising again.

In the US, the dollar weakened after a gloomy retail sales report. A larger-than-expected drop in retail sales in January pointed to poor consumer spending. Moreover, it showed that the economy is slowing down. However, this report had little impact on the outlook for a rate cut. Although May bets have increased, most traders now believe the Fed’s first tapering will come in June.

Notably, the initial US jobless claims report showed that the labor market is still tight. The report continued the recent trend of upbeat U.S. data, sending rate cut bets down. As a result, markets now expect a rate cut of 94bps in 2024, a significant drop from 160bps at the end of last year.

EUR/USD key events today

- USA core PPI m/m

- US PPI m/m

- Prelim UoM Consumer Sentiment

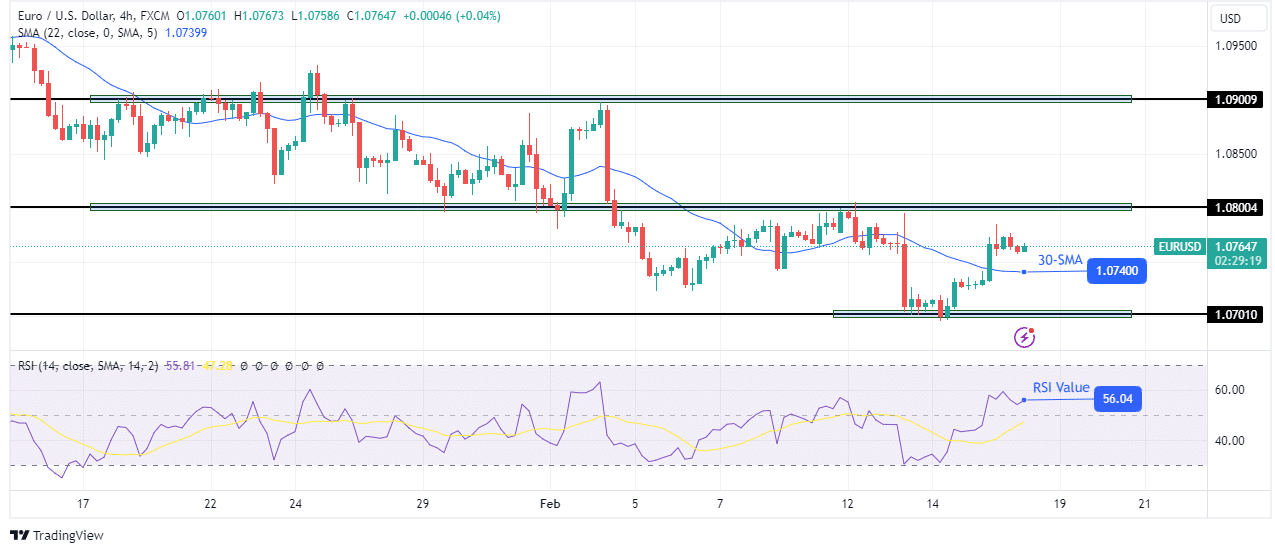

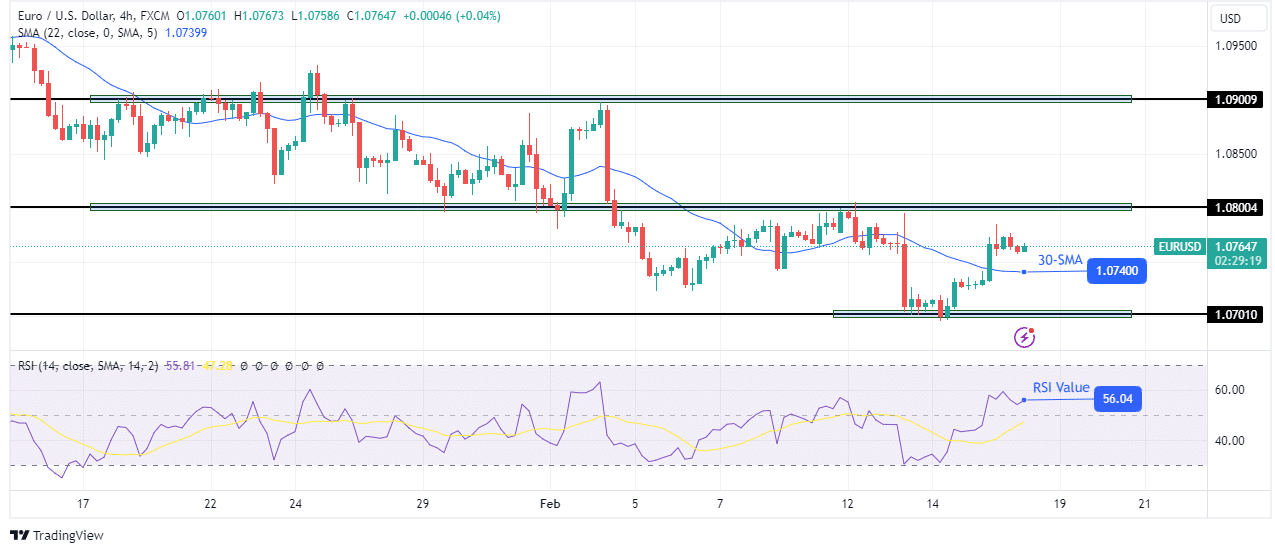

EUR/USD Technical Outlook: Bullish sentiment emerging above 30-SMA

On the charts, the sentiment changed from bearish to bullish as the price broke above the 30-SMA resistance. The bullish move came after the price paused at the 1.0701 support level. In addition, the price started making large-bodied bullish candles that broke above the SMA.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Looking at the RSI, it is clear that the bullish momentum is stronger now than it was the first time the price rose to retest the 1.0800 resistance level. Accordingly, there is a higher chance that the bulls will break above 1.0800 to retest the critical resistance level of 1.0900.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.