- Economists expect a monthly increase in US consumer inflation of 0.3%.

- Friday’s data revealed a softer US labor market.

- Markets are expecting the ECB’s first rate cut in June.

The EUR/USD outlook is slightly bullish on Tuesday morning, setting a positive tone ahead of the much-anticipated US inflation report. Fueling the euro’s momentum, Peter Kazimir, head of Slovakia’s central bank, said the ECB should delay cutting rates until it has enough economic data.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

The US inflation report will give more clues about when the Fed might start cutting interest rates. Economists expect a monthly increase in US consumer inflation of 0.3%. However, the focus will be on whether the report beats or misses forecasts. A higher-than-expected reading could mean more delays in Fed rate cuts. Consequently, the dollar would rise, pushing EUR/USD lower.

Meanwhile, a lower-than-expected reading would increase rate cut bets, weighing on the dollar and boosting EUR/USD. Currently, traders are more confident that the Fed will cut rates in June. This confidence came after Powell’s dovish testimony. In particular, he said there had been progress on inflation, making a rate cut more likely.

In addition, Friday’s data revealed a softer labor market, with the unemployment rate higher than expected. This will allow the Fed to start lowering interest rates in the second half of the year.

Meanwhile, inflation in the eurozone is falling, and the ECB is gaining confidence in progress. As a result, markets expect the first reduction in June. Peter Casimir noted on Monday that the ECB has done a lot to reduce inflation. However, he stressed the need for patience before cutting rates.

EUR/USD key events today

- US Core CPI m/m

- US CPI m/m

- US CPI y/y

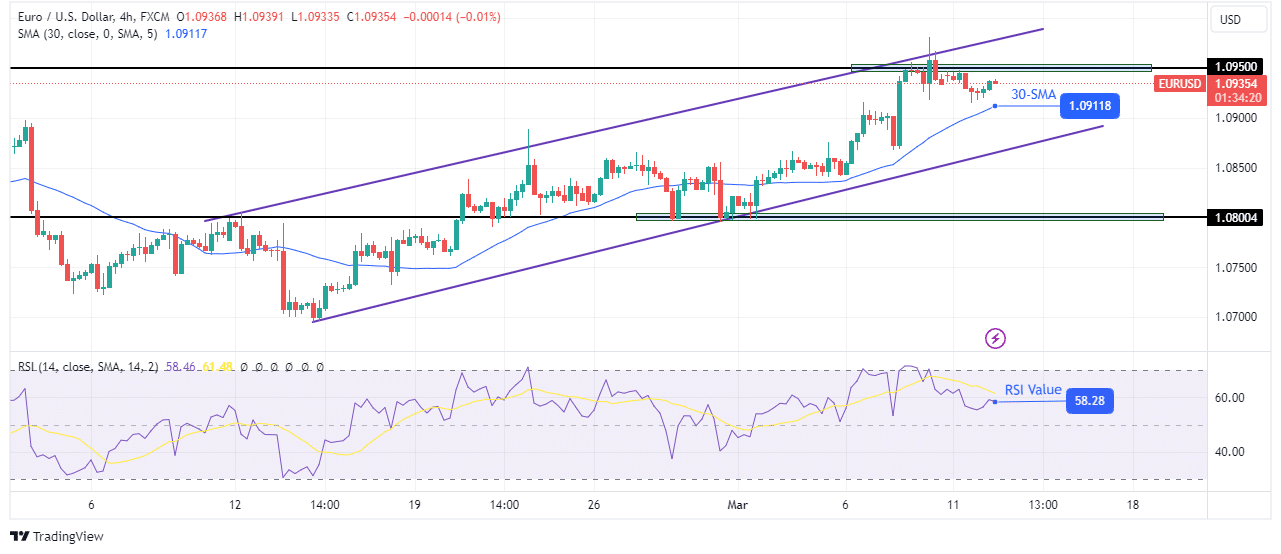

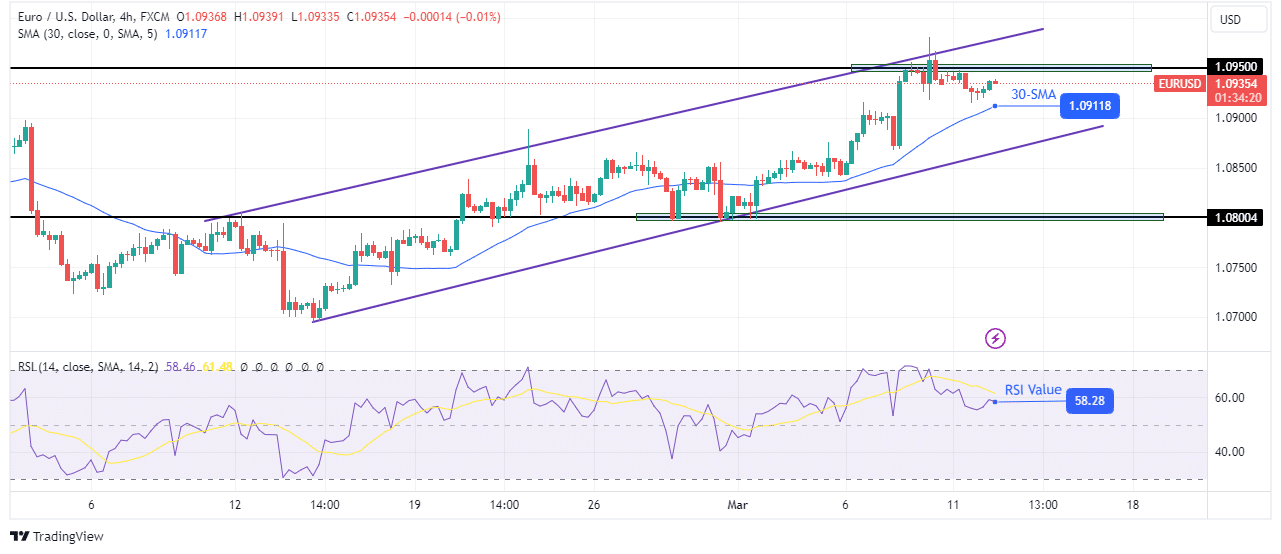

EUR/USD Technical Outlook: Bulls paused at 1.0950

On the technical side, the bias for EUR/USD is bullish as the price is trading above the 30-SMA and the RSI is above 50 in bullish territory. At the same time, the price is trading in a bullish channel. It bounces higher every time it hits channel support.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the bullish movement stalled after reaching channel resistance and the key level of 1.0950. If this resistance zone remains firm, the price is likely to decline to retest the channel support before the uptrend resumes. However, the price will continue to rise if it breaks above 1.0950.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money