- Traders raised expectations of an ECB rate cut in April.

- The dollar was flat on Friday as traders weighed the impact of unexpectedly strong economic growth data.

- The dollar is up 2% this year as expectations for a Fed rate cut ease.

On Friday, the EUR/USD outlook was bearish as traders increased their bets for an April rate cut, spurred by the ECB’s monetary policy meeting on Thursday. Despite keeping interest rates at a record high of 4%, the ECB hinted at upcoming rate cut talks.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Policymakers, speaking after the meeting, indicated openness to a change in stance at the next meeting. This paves the way for an early cut in interest rates if upcoming data confirms that inflation has moderated. At the same time, traders raised bets on a rate cut in April due to recent remarks from policymakers. The ECB’s stance fueled expectations of a rate cut. Moreover, it supports the bearish outlook for the euro.

On the other hand, the US dollar remained stable on Friday. Traders weighed the impact of unexpectedly strong economic growth data on the Fed’s rate path. In addition, they look to the key inflation gauge for further insight.

Official data on the advance estimate of GDP revealed an annual growth rate of 3.3% in the last quarter, beating the forecast of 2%. Moreover, the report pointed to further easing of inflationary pressures.

The dollar has gained 2% since the start of the year, reflecting a reduction in rate cut expectations compared to late last year. According to the CME FedWatch tool, there is a 50% chance of a rate cut in March, up from 75.6% a month ago.

EUR/USD key events today

- Core price index US PCE m/m

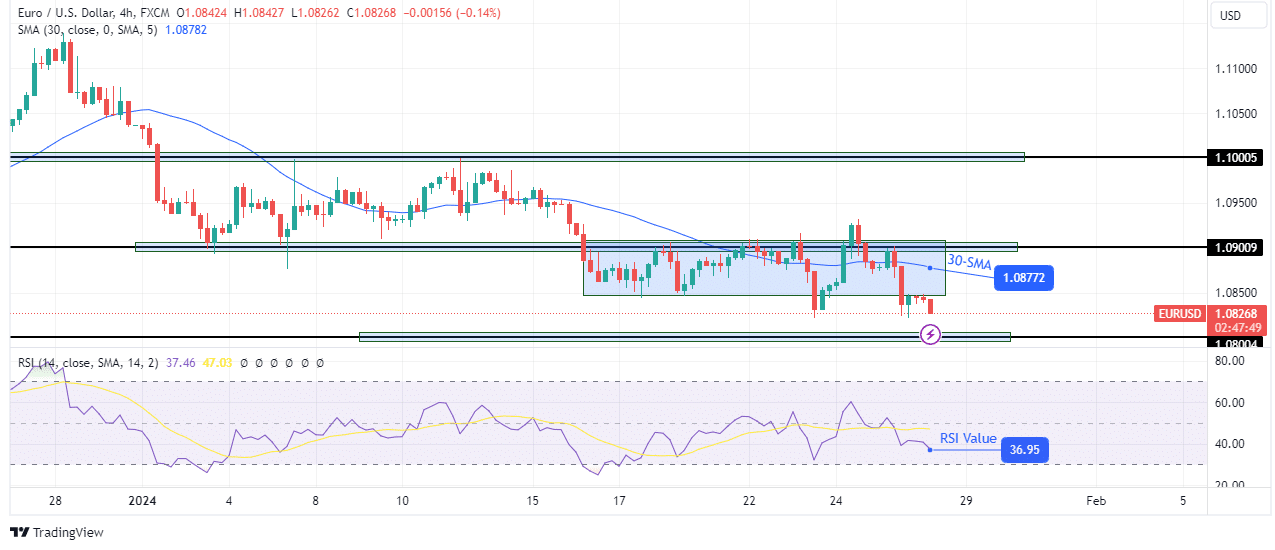

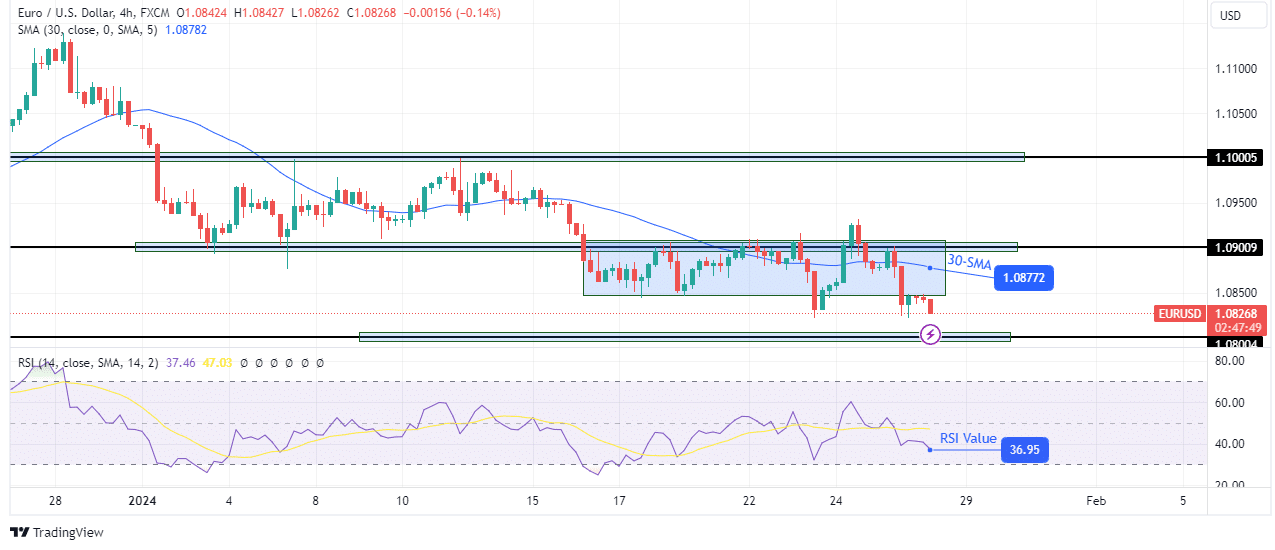

EUR/USD Technical Outlook: Bears break free from consolidation

On the technical side, EUR/USD broke out of its consolidation area, retested range support as resistance, and is now continuing its decline. The bearish bias strengthened as the price strayed well below the 30-SMA. At the same time, the RSI plunged further into bearish territory, approaching the oversold region.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Bears are currently targeting the nearest support at 1.0800. This level may trigger a pause or pullback to retest the 30-SMA before the downtrend resumes. However, the price could pass 1.0800 without a break if the bears are strong enough.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.