- The ECB’s Stournaras said on Friday that there could be only three ECB rate cuts this year.

- Eurozone economic growth exceeded forecasts in Q1.

- The dollar headed for its worst week in two months.

EUR/USD price analysis shows bullish momentum as the euro gains strength on moderately subdued ECB policy remarks. At the same time, the dollar is set for its worst week in two months, with all eyes on the upcoming US jobs report.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

On Friday, ECB policymaker Yannis Stournaras said there could be only three ECB rate cuts this year. According to him, inflation is likely to remain high given the recent upbeat economic data. Eurozone economic growth beat forecasts in Q1, which could lead to increased price pressures. However, the ECB is poised to implement its first rate cut well before the Fed in June. Therefore, the long-term outlook for the euro remains poor. Moreover, three rate cuts are far more than a single cut by the Fed is possible.

Meanwhile, the dollar was on the back foot on Friday ahead of the US non-farm payrolls report. Its recent drop comes after the Fed kept rates on hold but kept its stance on rate cuts. Investors were expecting a hawkish speech from Fed Chairman Powell. However, he maintained that the next policy move would be a rate cut.

The next big report from the US is NFP, which will shape the outlook for rate cuts. Economists expect a drop in employment compared to the previous month. However, if the numbers beat estimates as they have been recently, the EUR/USD pair could rally.

EUR/USD key events today

- Average hourly earnings in the US

- Change in non-farm employment in the US

- Unemployment rate in the US

- US ISM services PMI

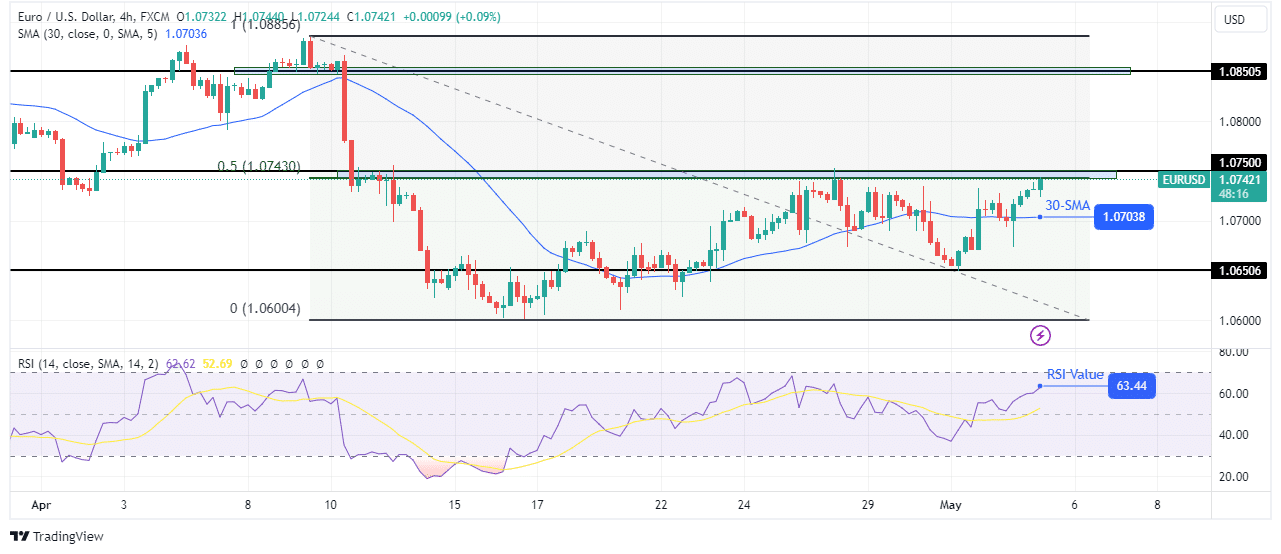

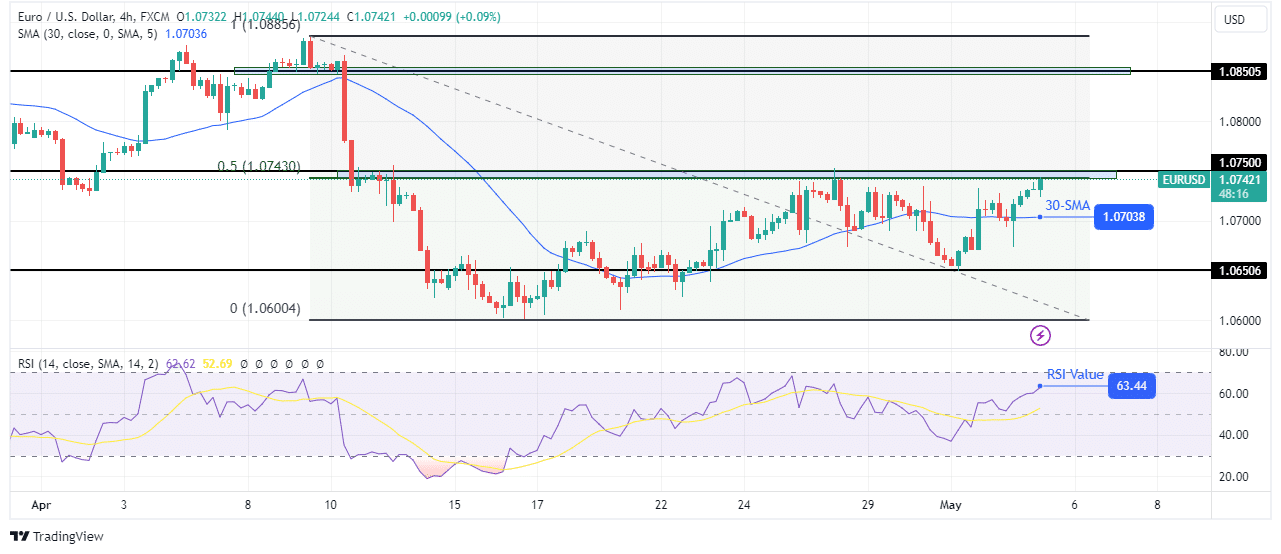

EUR/USD technical price analysis: Bulls are causing strong resistance

On the technical side, the EUR/USD price is challenging the 0.5 Fib retracement level, which is near the key level of 1.0750. Furthermore, the bias is bullish as the price recently broke above the 30-SMA after a reversal at the key support level of 1.0650. At the same time, the RSI broke above 50 to trade in bullish territory.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Consequently, the price may soon break above the 0.5 Fib and the key resistance level of 1.0750 to make a new high. Moreover, the way will be clear for the bulls to retest the key level of 1.0850.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.