- Consumer confidence in the eurozone fell in January.

- The ECB is likely to pause interest rate hikes at its upcoming meeting.

- Investors will be closely scrutinizing ECB chief Christine Lagarde’s press conference for clues on the future direction of rates.

On Wednesday, there was a slight bullish tilt in EUR/USD price analysis ahead of the European Central Bank’s key rate decision. In addition, investors awaited key PMI data from the Eurozone and the US.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Investors will focus on ECB chief Christine Lagarde’s press conference on Thursday, looking for key clues about the future path of interest rates.

There is consensus that the ECB is likely to pause interest rate hikes at its upcoming meeting. However, traders anticipate potential declines totaling approximately 130 basis points over the course of the year. Moreover, the probability of the first reduction in June is almost 97%.

Elsewhere, data released on Tuesday revealed a drop in eurozone consumer confidence for January compared to December.

Meanwhile, the dollar retreated slightly but remained firm due to the Fed’s cautious approach to interest rate cuts. In her last statement before the Jan. 31 policy blackout, San Francisco Fed President Mary Daley said monetary policy was in a “good place” and that it was premature to expect immediate rate cuts.

Similarly, Fed Governor Christopher Waller emphasized a “careful and slow” approach to interest rate cuts. James Knyveton, senior corporate FX dealer at Conveyor, noted that markets are no longer expecting immediate interest rate cuts, which is supporting the dollar.

This trend is consistent with broader resistance to interest rate cuts among major central banks. Nighweton added: “We’ve seen ECB officials also play down expectations of a rate cut, just like the Federal Reserve.”

EUR/USD key events today

- German flash manufacturing and services PMI

- US manufacturing and services PMI

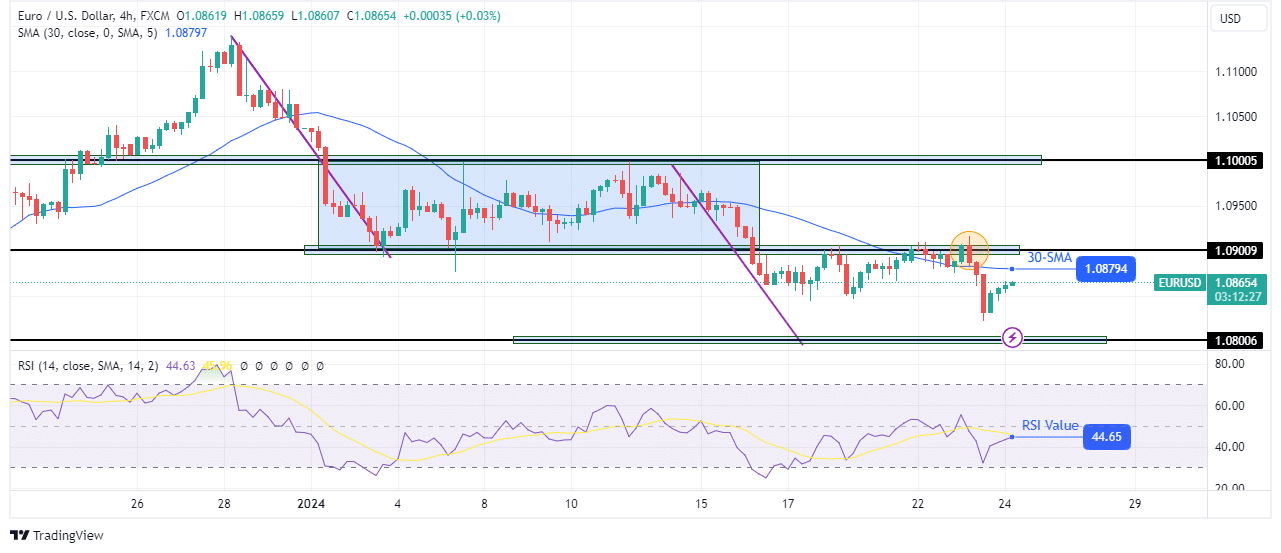

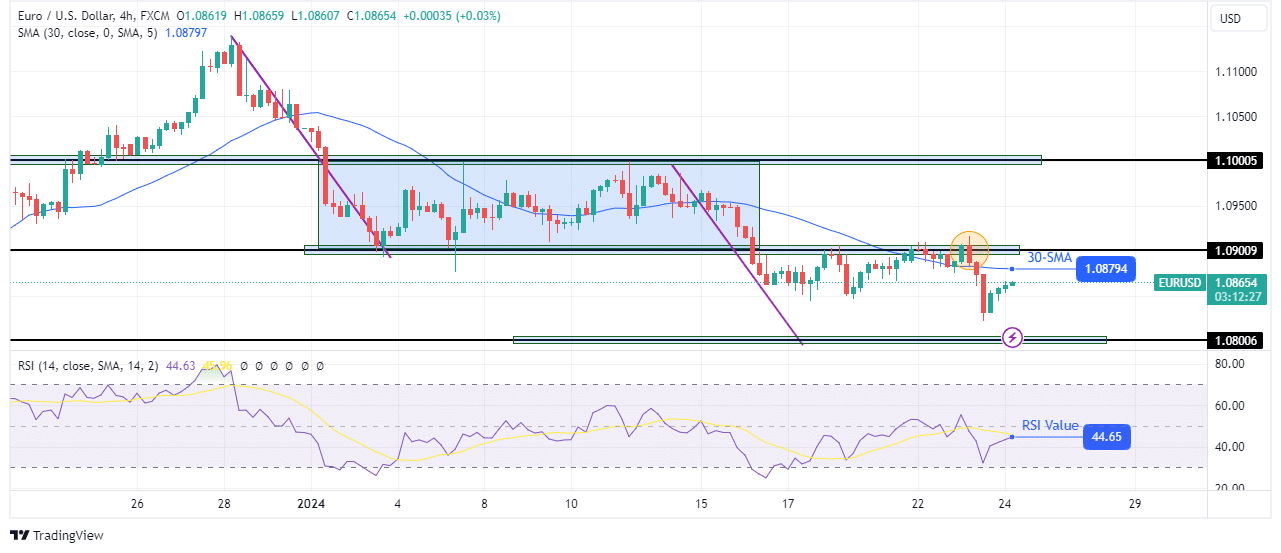

EUR/USD Price Technical Analysis: Prices are approaching key support at 1.0800

On the technical side, EUR/USD made a lower low after respecting the key resistance level at 1.0900. Consequently, the price is getting closer to retesting the 1.0800 support level. After breaking below 1.0900, the price held close to the level, retreating every time the bears tried to push it lower.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

However, a significant decline followed when the price made a bearish candle at the 1.0900 level. Currently, the price is recovering and could retest the 30-SMA as resistance. If the SMA remains firm, EUR/USD could soon touch support at 1.0800.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.