- Inflation in Germany, the largest economy of the Eurozone, rose by 2.7 percent more slowly on an annual basis.

- Economists believe that core inflation in the Eurozone remains stubborn.

- Bets on a Fed rate cut in June rose to 66%.

Friday’s EUR/USD price analysis revealed bearish sentiment, driven by fresh signals of easing inflation in the Eurozone. The prospect of lower inflation could prompt the European Central Bank to consider starting to cut interest rates. Meanwhile, US inflation also showed signs of easing year-on-year.

–Are you interested in learning more about automated Forex trading? Check out our detailed guide-

Inflation in Germany, the largest economy in the eurozone, rose by 2.7% in January, at a slower annual rate. This was in line with economists’ expectations and indicated that inflation in the wider bloc could show a decline. However, economists believe that core inflation remains stubborn.

It is notable that the decline in German inflation is a consequence of lower energy prices. However, figures excluding food and energy prices reveal a much slower decline in inflation. It is precisely for this reason that the ECB rejected expectations of a reduction in interest rates.

On the other hand, the dollar was steady after the US PCE price index report showed an increase in price growth in January. However, the annual figure showed a gradual easing of inflation. As a result, bets on a Fed rate cut in June rose to 66%.

Another report found that U.S. jobless claims rose last week, indicating softness in the labor market. In addition, continuous claims increased in the past month, which could indicate an increase in the unemployment rate. Traders will now await next week’s non-farm payrolls report for guidance on the timing of the Fed’s rate cut.

EUR/USD key events today

- US ISM manufacturing PMI

- US consumer sentiment

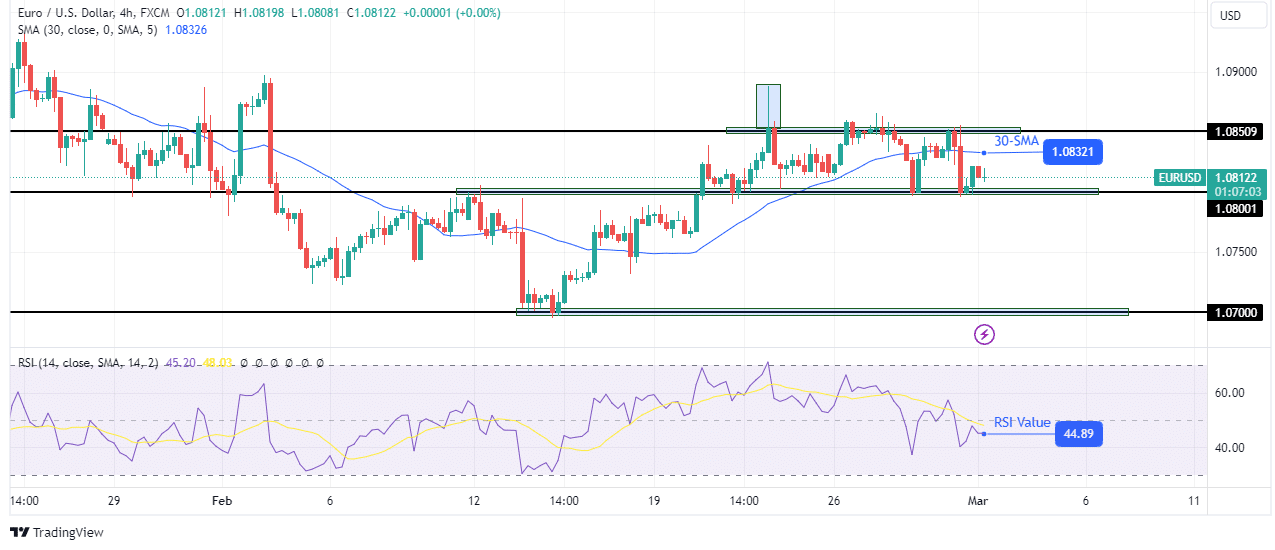

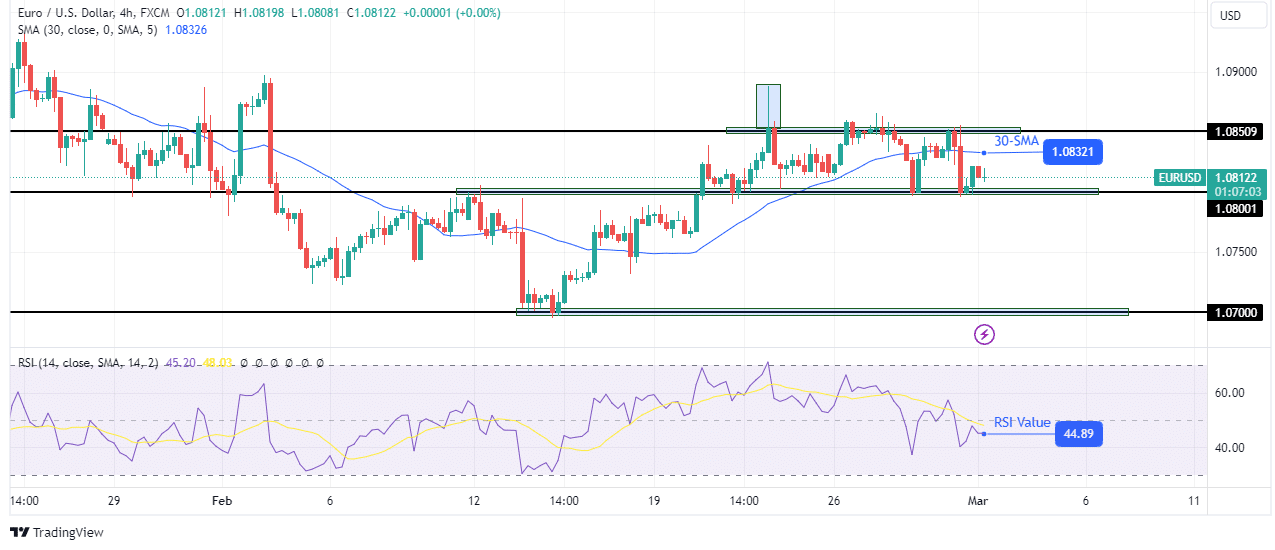

Technical analysis of EUR/USD prices: Consolidation in the range of 1.0800-1.0850

On the charts, EUR/USD is consolidating, with support at 1.0800 and resistance at 1.0850. However, in this area of the range, the bears are in control as the price is below the 30-SMA with the RSI below 50.

–Are you interested in learning more about forex signals? Check out our detailed guide-

The previous bullish move stalled at the 1.0850 resistance level, where price action indicated a reversal. The bulls tried to break above the resistance on several occasions, but failed, making big fuses. Meanwhile, the bears strengthened and broke below the 30-SMA. Therefore, the price could soon break below 1.0800 to retest the 1.0700 support level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.