- An ECB survey of economists confirmed that inflation in the eurozone will fall to 2%.

- The ECB kept interest rates on hold on Thursday and hinted at the first rate cut in June.

- The Fed will remain cautious about cutting interest rates.

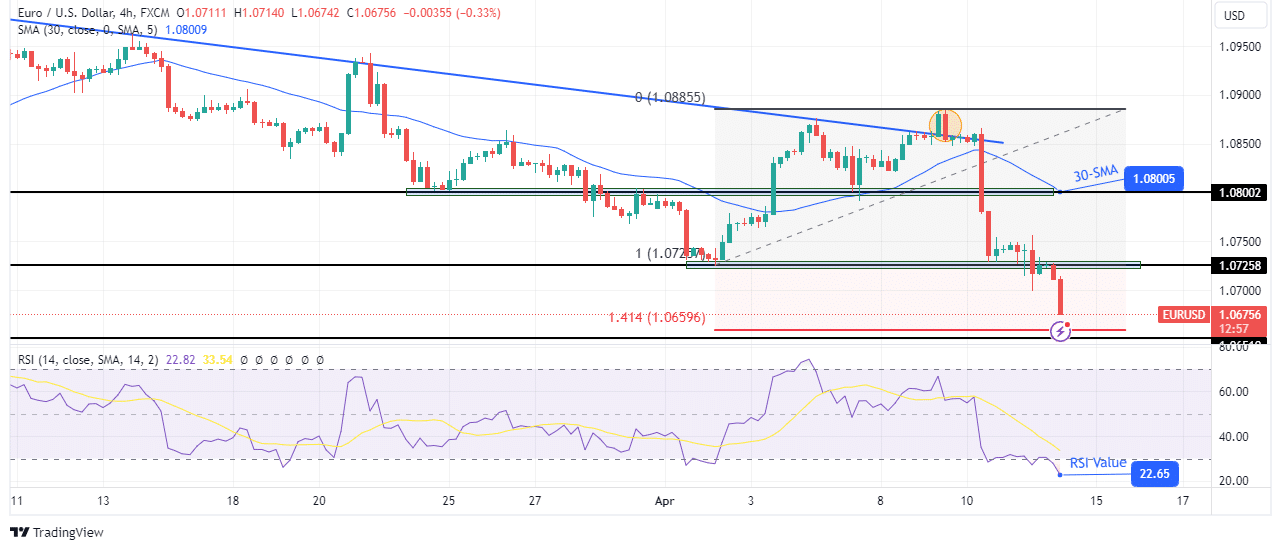

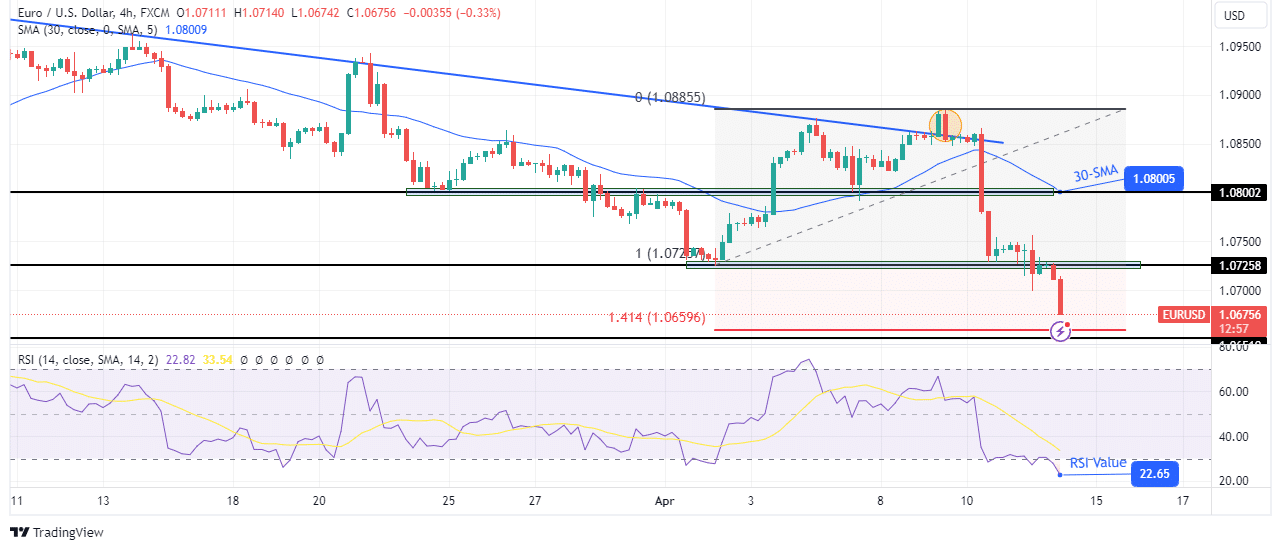

Analysis of EUR/USD prices reveals a convincing downtrend, with the euro falling on optimism that inflation in the eurozone will reach the desired 2% mark. Meanwhile, the dollar strengthened as investors cut expectations of a rate cut after the US inflation report.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

An ECB survey of economists on Friday confirmed that inflation in the eurozone will fall to 2% and stay there. Markets took this as another sign that the ECB would be ready to cut interest rates in June, well ahead of the Federal Reserve.

The ECB kept interest rates on hold on Thursday and hinted at the first rate cut in June. ECB President Christine Lagarde pointed out that inflation is on a clear downward path. That is why it will be appropriate to start reducing interest rates. Moreover, she said that the ECB is dependent on the data, not the Fed. Accordingly, they will not wait for the Fed to begin a rate-cutting cycle.

Recent US inflation data has significantly delayed the Fed’s rate-cutting cycle, with investors now expecting it to begin in September. Furthermore, the US economy is doing much better than the Eurozone economy. The Eurozone economy has been stagnant for six quarters. In addition, the labor market has slowed down. Thus, the forces driving inflation are waning.

On the other hand, the US economy has remained resilient and the labor market is hot, keeping inflation high. Accordingly, the Fed will remain cautious about cutting rates. However, there is uncertainty about the outlook for ECB policy after June, as the ECB is likely to monitor the progress of US inflation.

EUR/USD key events today

- Preliminary attitude of UoM consumers in the US

EUR/USD price technical analysis: Price continues downward spiral below 1.0725

On the charts, the EUR/USD price is in free fall. Since breaking the false trend line, the price has fallen below several major support levels. It recently broke below the 1.0725 support to make a lower low. Accordingly, the price is now well below the 30-SMA. In addition, the RSI is deep in bearish territory, supporting the bearish bias.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Bears are likely to reach the 1,414 Fib extension level soon, where the decline could be halted or reversed. A pullback would allow the price to retest the 30-SMA resistance before continuing the downtrend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.