- The exit of the EUR/USD price from the current range can bring us a clear direction.

- US data should move the rate tomorrow.

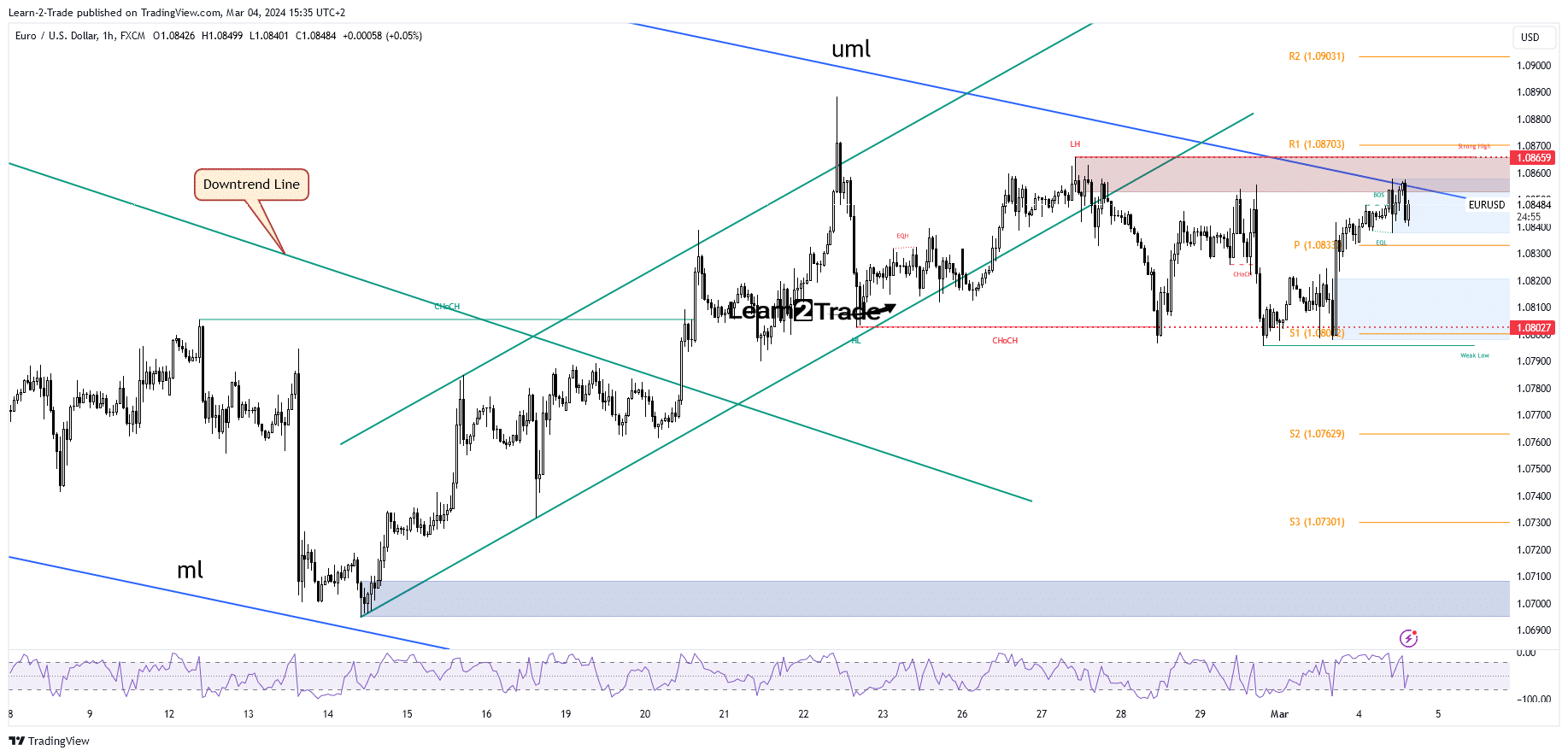

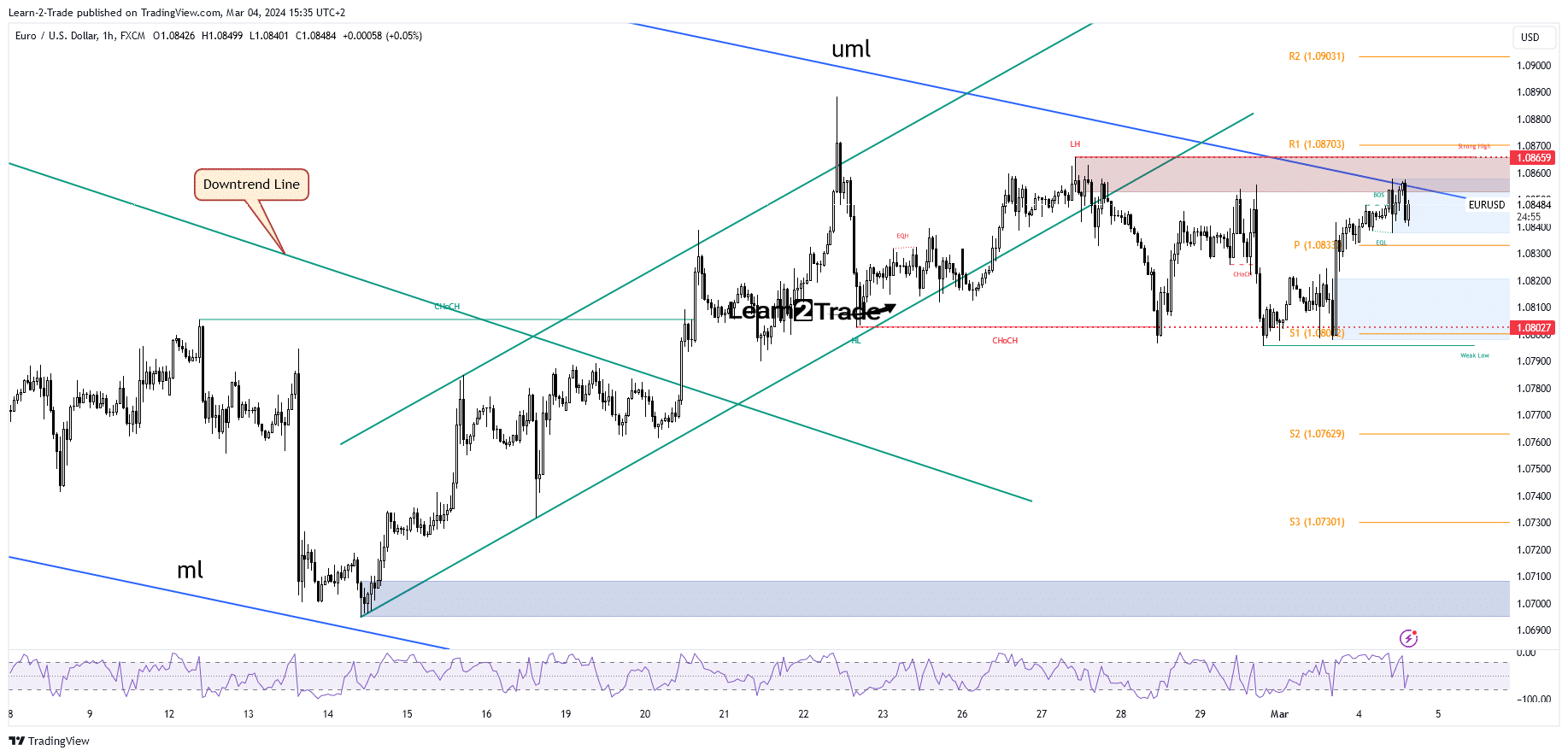

- False breakouts through the upper median line (uml) signal overbought.

EUR/USD is trading in the red at 1.0843 at the time of writing and seems overpriced. It has strengthened in the short term as the US dollar remains weak.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

On Friday, US ISM Manufacturing PMI, Revised UoM Consumer Sentiment, ISM Manufacturing Prices and Construction Spending were worse than expected.

On the other hand, the flash estimate of Eurozone CPI and flash estimate of core CPI are better than expected.

Today, the Swiss CPI rose 0.6%, beating the estimated 0.5% increase and the 0.2% increase in the previous reporting period, but the impact on the EUR/USD pair was insignificant.

The dollar took the lead and pulled the price lower again even though Spain’s change in unemployment and Sentik’s investor confidence were better than expected.

Tomorrow, the Eurozone Final Services PMI is expected to remain at 50.0, the PPI could lead to a 0.1% decline, while the German Final Services PMI could again be reported at 48.2 points.

Moreover, the US data could revive the EUR/USD pair. The ISM Services PMI may fall from 53.4 points to 52.9 points, while Factory Orders may announce a growth of 0.3% after a growth of 0.2% in the previous reporting period.

Technical analysis of EUR/USD price: False breakout

EUR/USD found support at 1.0802 and then turned higher. It has now tested the upper median line (uml) of the main descending fork, registering only false breakouts.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Technically, we have a strong supply zone right above this dynamic resistance and below 1.0865.

Price action has signaled exhausted buyers, but the new leg requires strong confirmation. The pair remains trapped between 1.0802 and 1.0865 in the short term. So it can extend the lateral movement. Only escaping from this formation brings a clear direction.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.