- US economic data should move the rate.

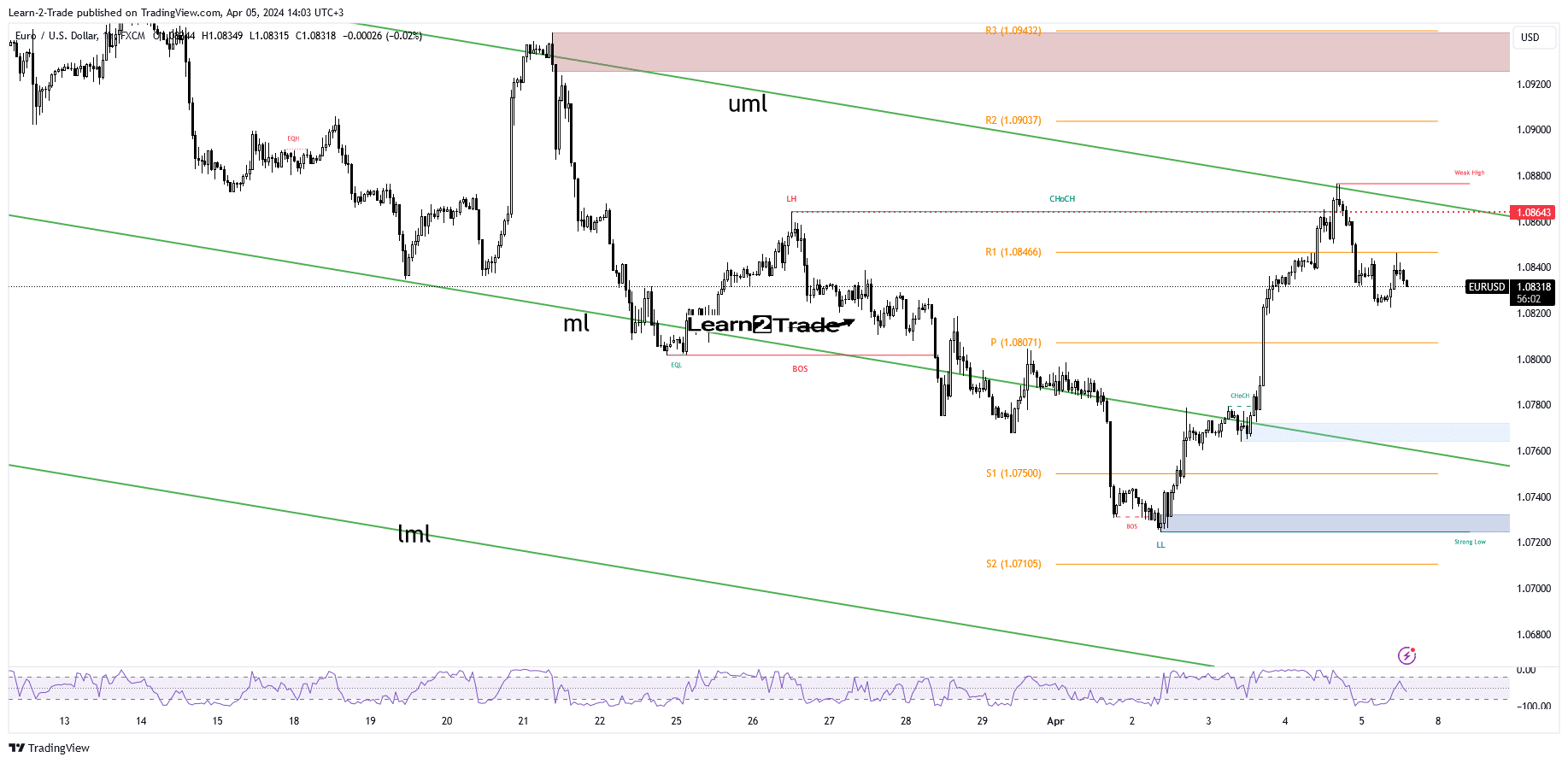

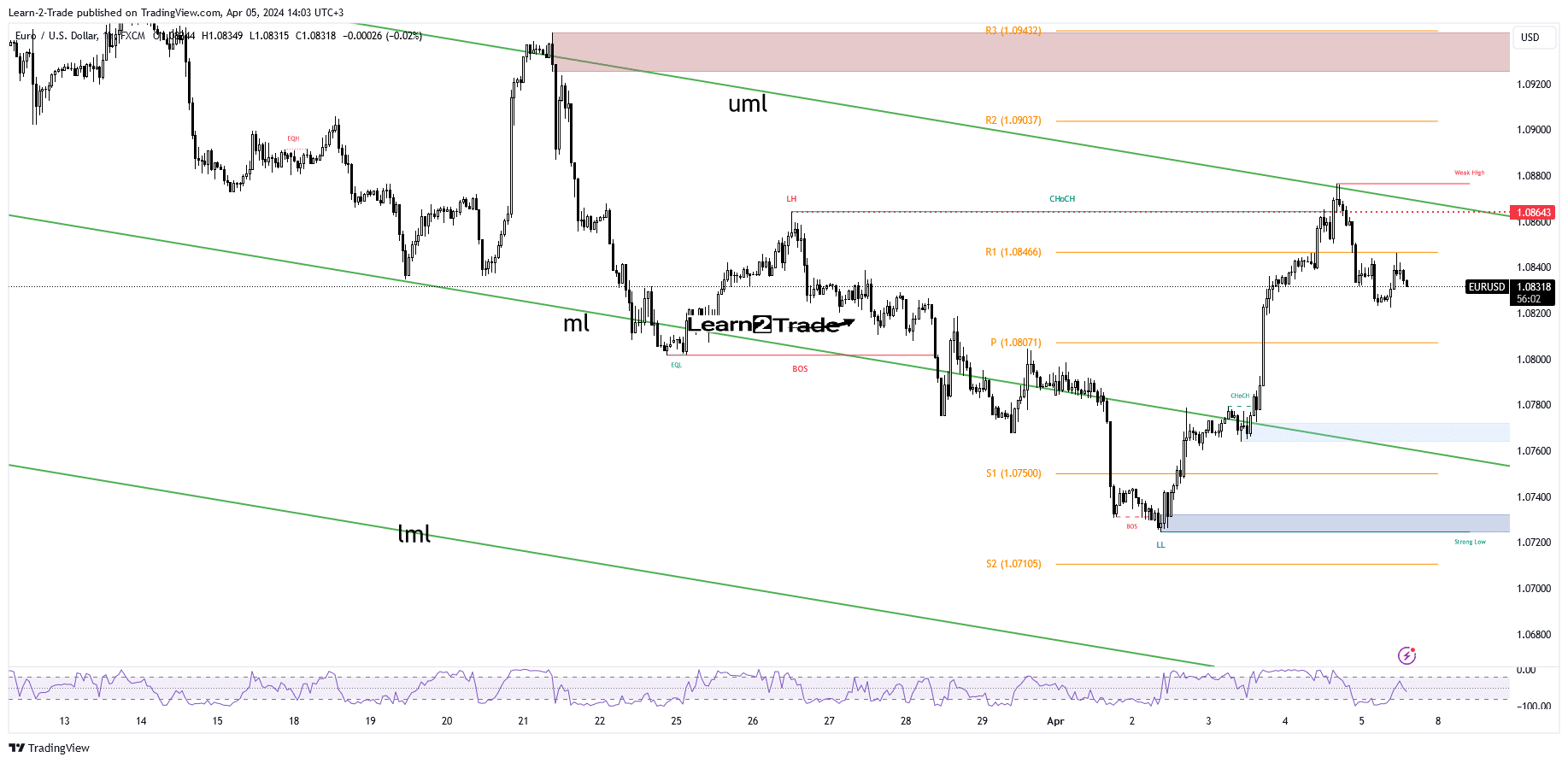

- Extraction of the upper midline activates further growth.

- Failure to hold above 1.0864 signaled exhausted buyers.

EUR/USD is trading in the red at 1.0833 at the time of writing. The pair is under selling pressure after posting a two-week high above 1.0870.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

Today, the fundamentals should be decisive. Surprisingly or not, the dollar took the lead in the short term, even though US jobless claims came in at 221K versus the expected 213K, while the trade balance fell from -67.6 billion to -68.9 billion in last trade.

On the other hand, the Eurozone Final Services PMI and German Final Services PMI were better than expected, but the Eurozone Consumer Price Index reported a 1.0% decline, beating expectations for a 0.6% decline.

Today, German factory orders, German import prices and retail sales reported poor data. However, only US economic data should have a big impact.

NFP is expected to come in at 212K vs. 275K in February. The unemployment rate is expected to remain at 3.9%, but average hourly earnings may post a 0.3% increase in March versus a 0.1% increase in the previous reporting period.

In addition, Canada’s unemployment rate and employment change should also drive action.

Technical analysis of EUR/USD price: Swing Higher Ended

Technically, the EUR/USD price ended the rally after registering only a false breakout through the upper middle line of the ascending fork (uml). It also failed to stay above the former high of 1.0864, indicating exhausted buyers.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

It fell below the week’s R1 (1.0846) but the sell-off could only be temporary. As mentioned earlier, the fundamentals should move the price, making anything possible. Staying near the upper middle line (uml) may herald an imminent breakout and continuation.

However, it is too early to talk about this scenario. New false breakouts through this dynamic could herald another massive decline.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.