- Bottom pressure remains high as DKSI is bullish.

- The lower middle line stands as a dynamic support.

- New false failures can herald overselling.

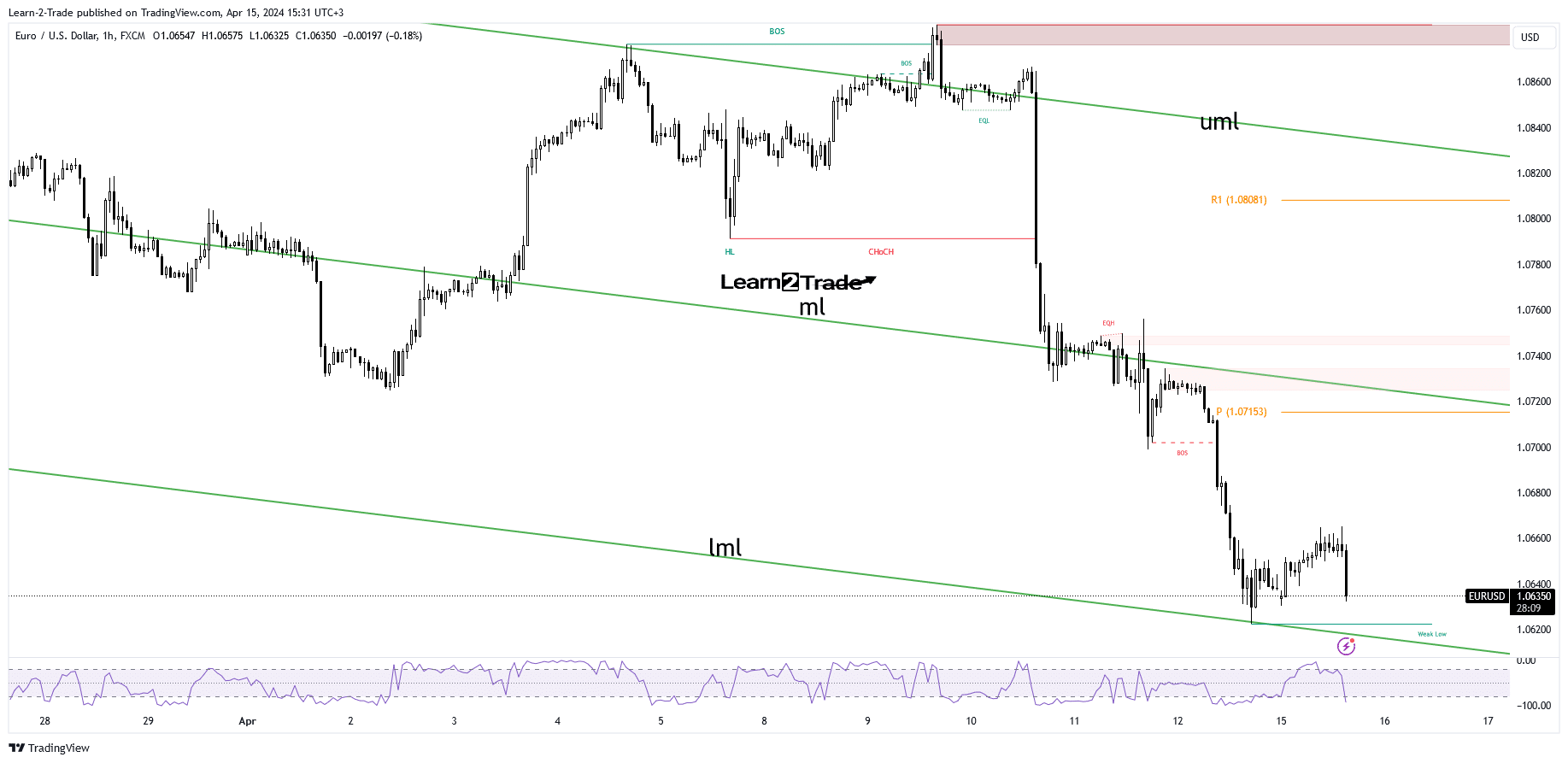

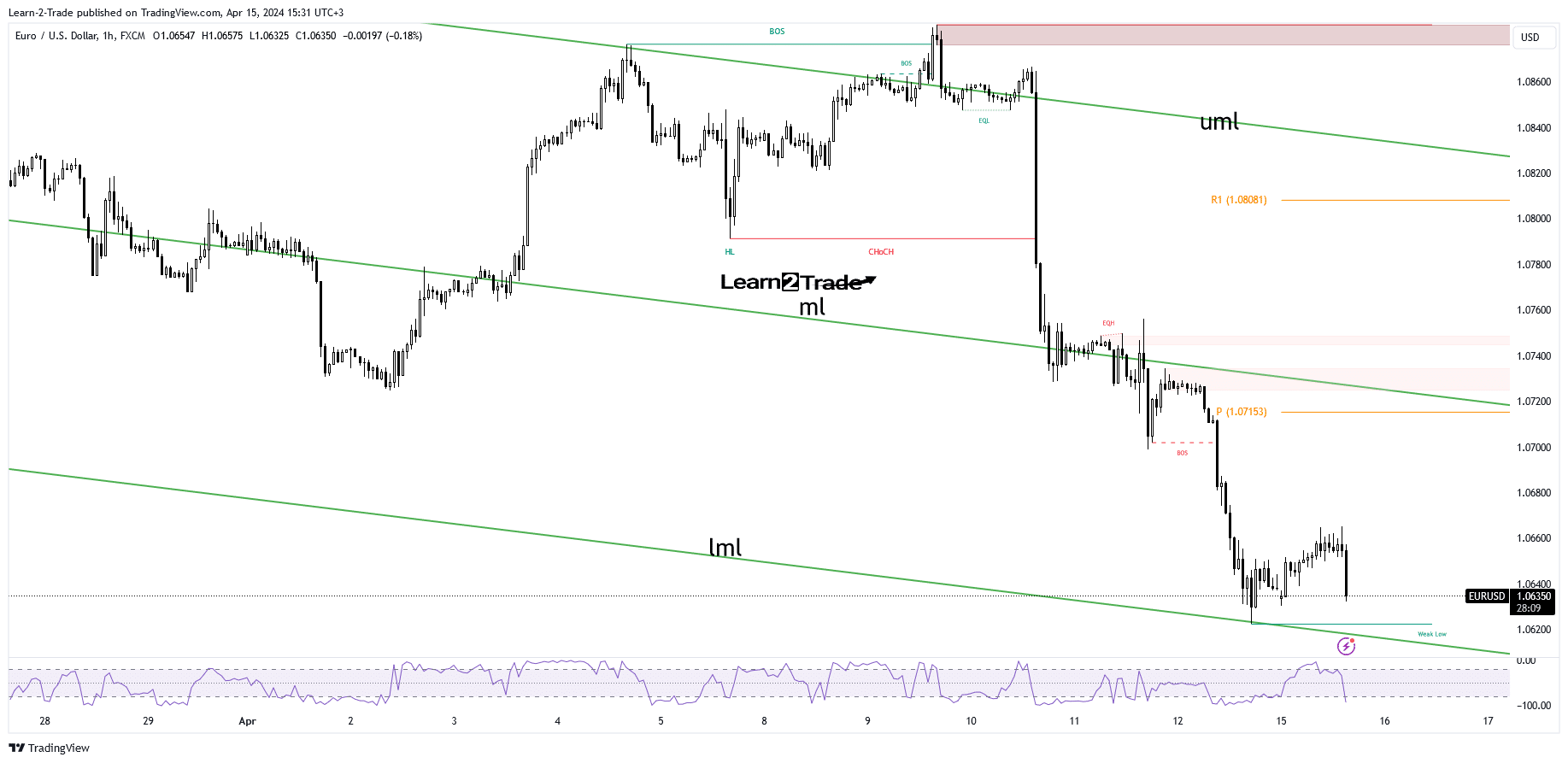

EUR/USD fell to 1.0622 on Friday, registering a new multi-week low. After such a decline, buyers took the lead and corrected higher. The pair is sitting at 1.0639 at the time of writing and is struggling to recover.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

Despite the minor pullbacks, downward pressure remains high as the US dollar remains bullish. Basically, the dollar took a hit from the US Prelim UoM Consumer Sentiment, which came in at 77.9 points below the expected 79.0 points compared to 79.4 points in the previous reporting period.

Now, EUR/USD is down again as US retail sales rose 0.7%, beating the 0.4% estimate, while core retail sales rose 1.1%, beating the 0.5% forecast.

The dollar is strongly bullish even though the US Empire State Manufacturing Index was worse than expected, at -14.3 points, against the expected -5.2 points.

Later, the US will release data on business inventories and the NAHB housing market index. On the other hand, industrial production in the Eurozone rose by 0.8%, which was in line with expectations.

Tomorrow, ZEV economic sentiment data and Canadian inflation could have a big impact.

Technical analysis of EUR/USD price: Strong bearish pressure

Technically, the EUR/USD pair found support at the lower middle line of the falling villa (lml) and tried to bounce back. This is a dynamic support, and the cost could be returned to challenge it again.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

Only the new lower low, falling and closing below 1.0622, triggers more declines, a deeper decline.

On the contrary, new false breaks below the lower median line can herald an oversold situation. However, a potential reversal is far from confirmed.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.