- The bias is short-term bullish.

- A new higher high activates further growth.

- US data should bring big action tomorrow.

EUR/USD pulled back a bit in the short term after reaching Friday’s high of 1.0752. Now, the pair is trading at 1.0718 at the time of writing.

The US dollar remains under strong downward pressure, which could help the euro mark a significant rally above last week’s high.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

Basically, revised UoM US consumer sentiment was worse than expected on Friday, while personal income and the core PCE price index were in line with expectations.

The U.S. dollar got a helping hand from the personal spending indicator, which reported a rise of 0.8% versus estimates of just 0.6% growth. The euro remains strong in the short term, although Germany’s Prelim CPI reported a rise of just 0.5% compared to an expected 0.6% rise.

Furthermore, Spain’s Flash CPI was also worse than expected. Tomorrow, the data file presents Eurozone Prelim Flash GDP, CPI Flash estimate, Core CPI Flash estimate and German Prelim GDP, retail sales and unemployment change data.

However, the US economic numbers could significantly affect the markets. The CB Index of consumer confidence and employment costs represent high-impact events. Meanwhile, investors are eagerly awaiting the FOMC and NFP events this week.

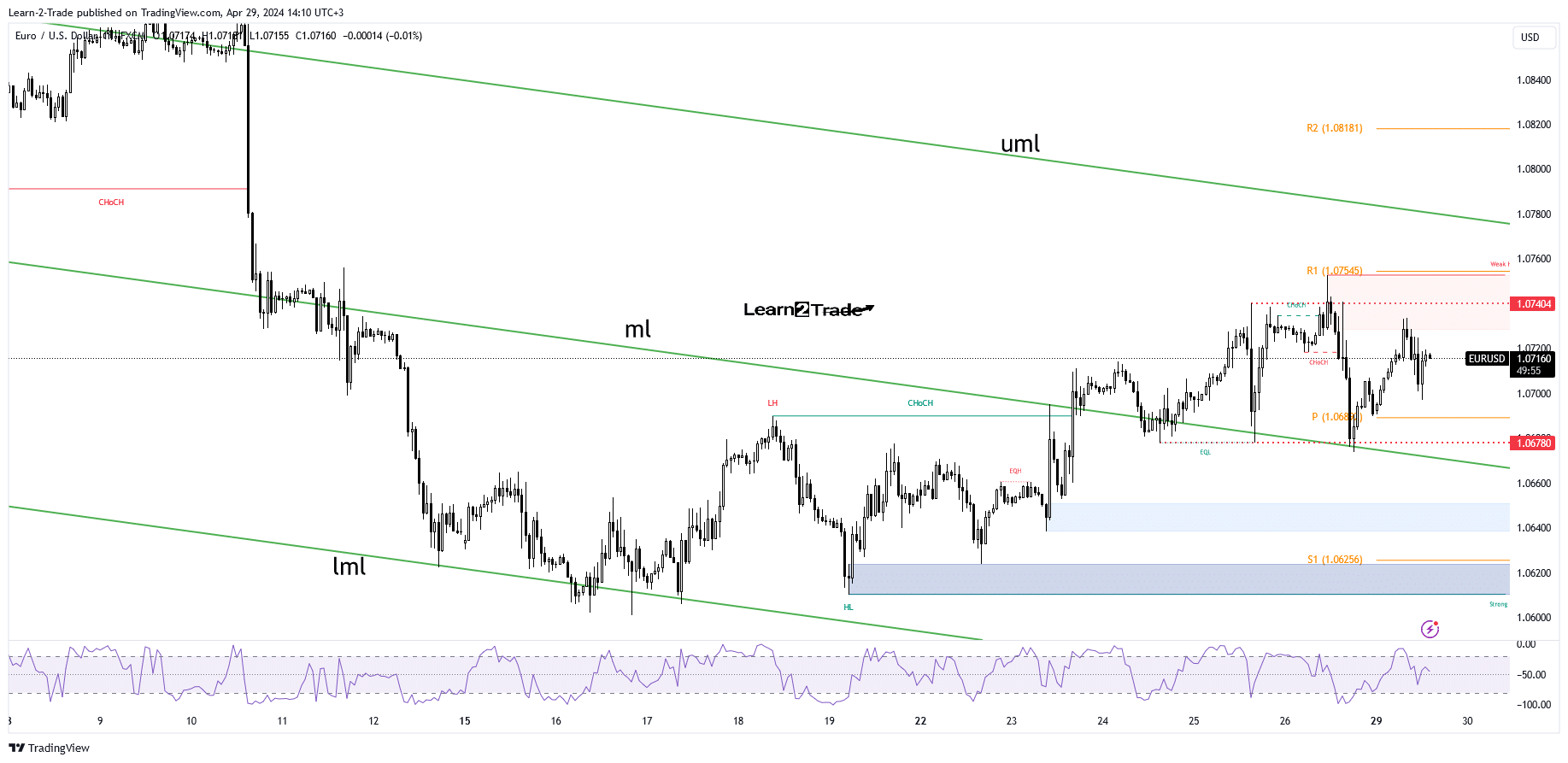

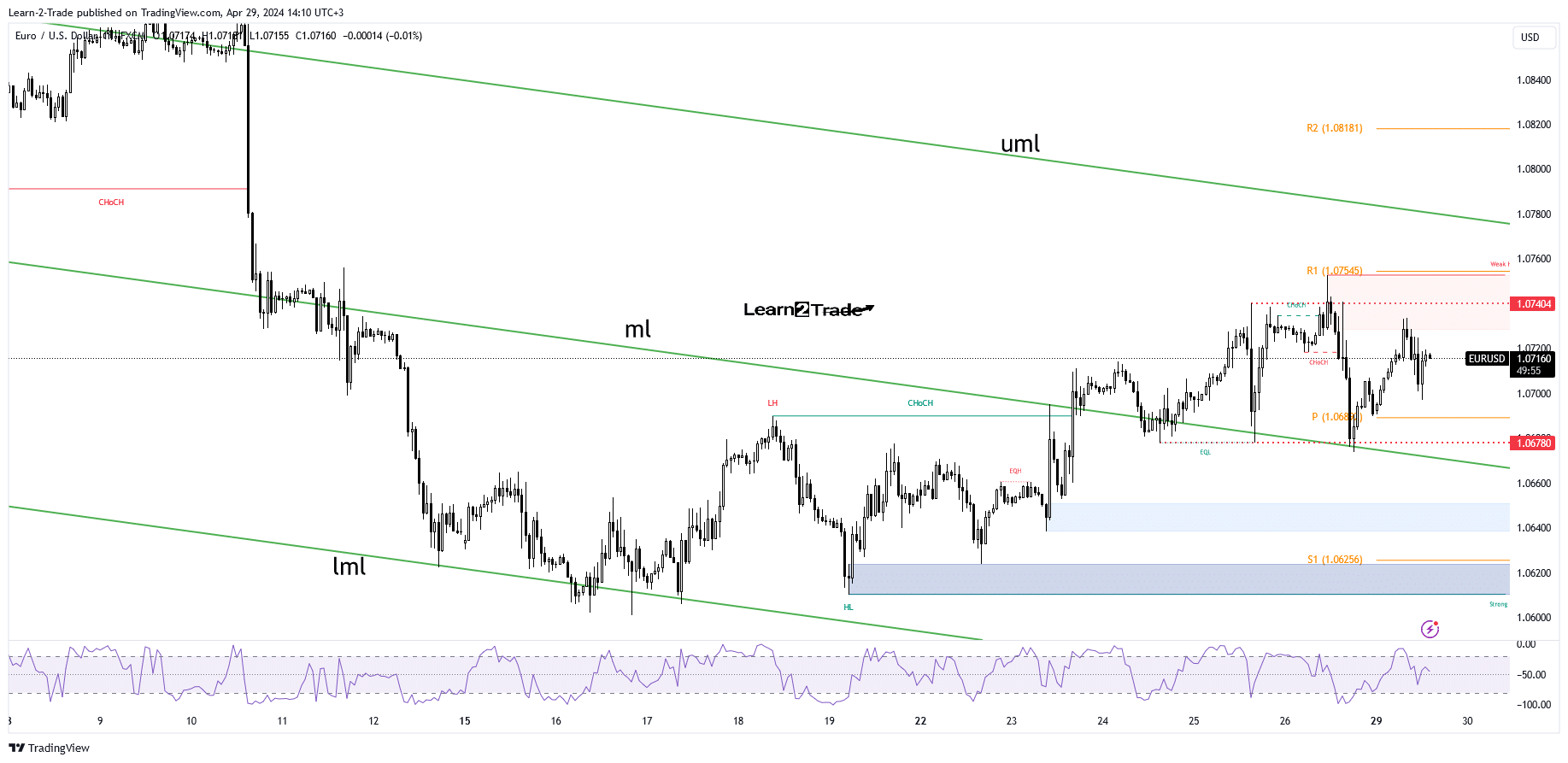

Technical analysis of EUR/USD price: Consolidation after gains

From a technical point of view, the EUR/USD price is trapped between the 1.0678 and 1.0750 levels. In the short term, the bias is bullish, so the current range is seen as a potential bullish continuation.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Price appears indecisive, which means an extended sideways move is favored. As you can see on the hourly chart, the price retested the middle line (ml), accumulating more bullish energy. However, only a new higher high and a valid break above 1.0752 can trigger a continuation to the upside.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.