- Despite the temporary spikes, the EUR/USD pair maintains a bearish bias in the short term.

- A new lower low triggers more dips.

- US NFP, unemployment rate and average hourly earnings should move the rate.

EUR/USD fell lower after reaching yesterday’s high of 1.0817. The pair is trading at 1.0785 at the time of writing.

The short-term bias remains bearish. So, it still falls in the plan. The US dollar fell significantly, opening up space for European buyers.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Yesterday, the US and the Eurozone released mixed data. US jobless claims came in at 220,000 last week versus the 221,000 expected, but above the 219,000 in the previous reporting period. At the same time, revised eurozone GDP reported a 0.1% drop as expected, but German industrial production fell 0.4% even as traders expected a 0.1% rise. Today, German final CPI reported a 0.4% decline, in line with expectations.

Later, US economic figures should move the markets. Nonfarm payrolls are expected to come in at 184,000 in the latest month, up from 150,000 in the previous reporting period. Average hourly earnings could post a 0.3% rise, following a 0.2% increase in October, while the unemployment rate could hold steady at 3.9%. Moreover, the Prelim UoM Consumer Sentiment could jump from 61.3 points to 62.0 points.

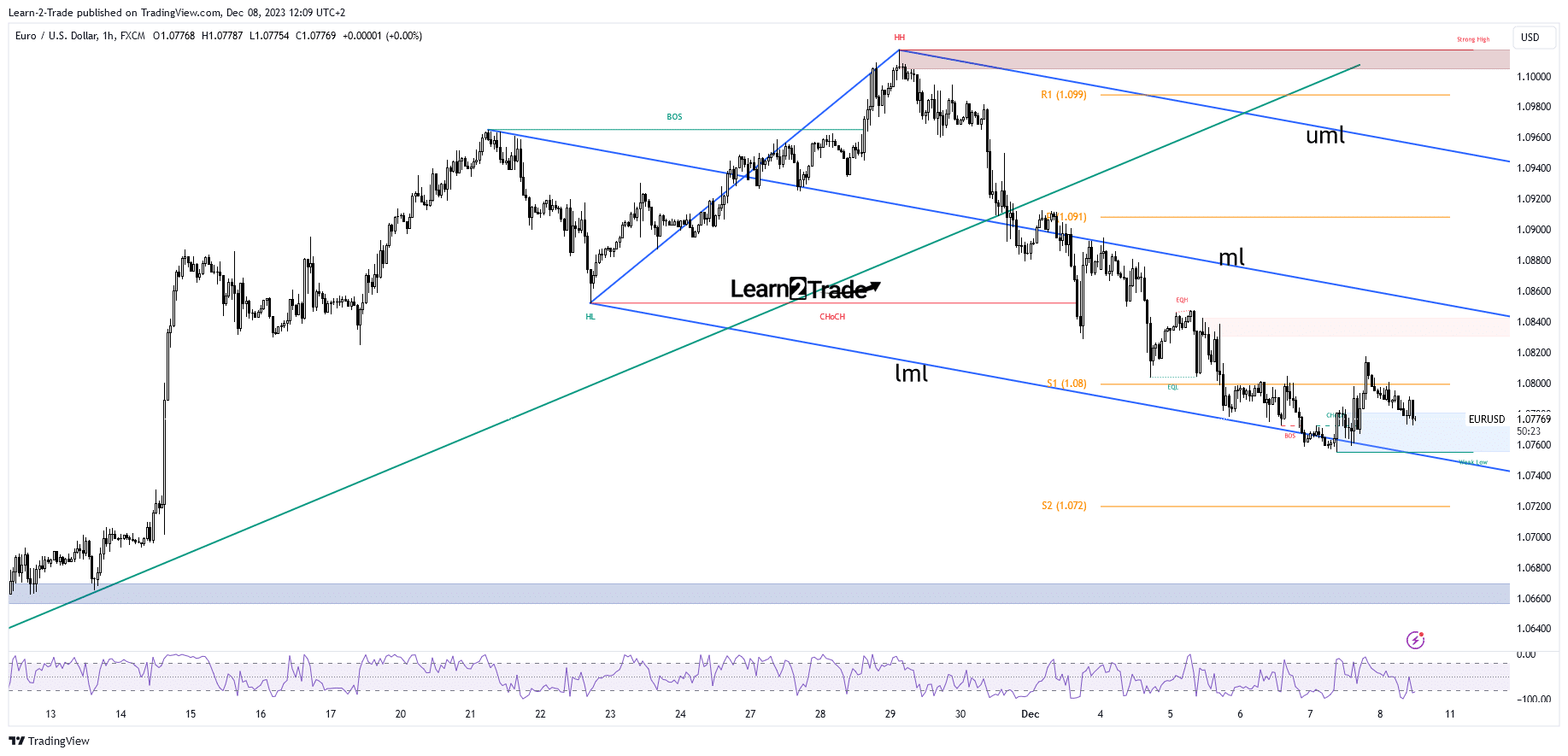

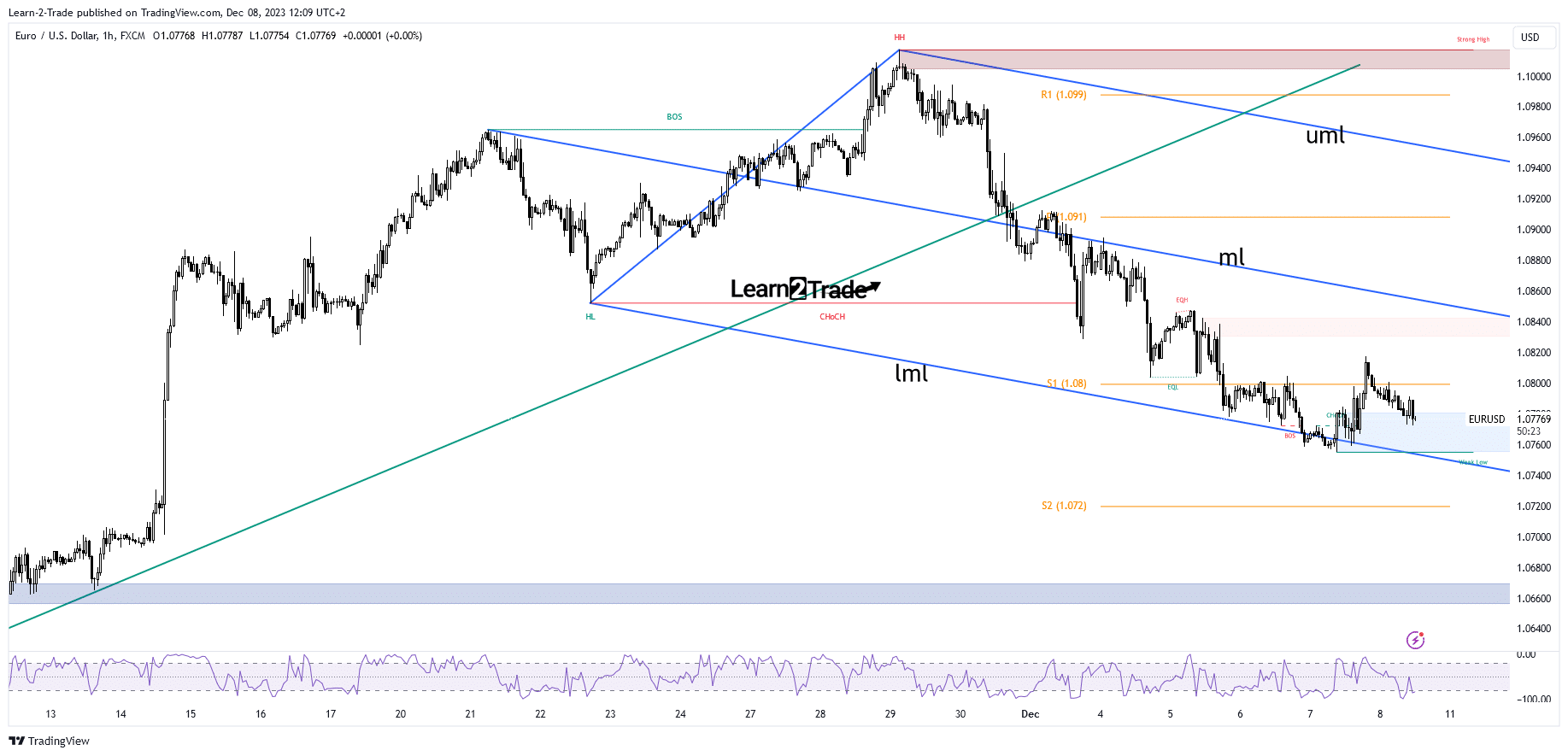

Technical analysis of EUR/USD price: Bearish bias intact

From a technical point of view, the EUR/USD price has found support at the lower middle line of the descending villa (lml). The pair bounced back but failed to stay above the weekly S1 of the 1.0800 psychological level.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

It is now triggering a demand zone above the previous low of 1.0755. Downward pressure remains high despite temporary bounces. Staying close to the former low and right above the lower middle line (lml), price action may signal an imminent breakdown and continuation to the downside. Only a hold above 1.0760 and a return above 1.08 could herald a bigger bounce.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.